Question: please answer all correctly for thumbs up thanks Project A has a 10 percent cost of capital and a payback period of 2 years with

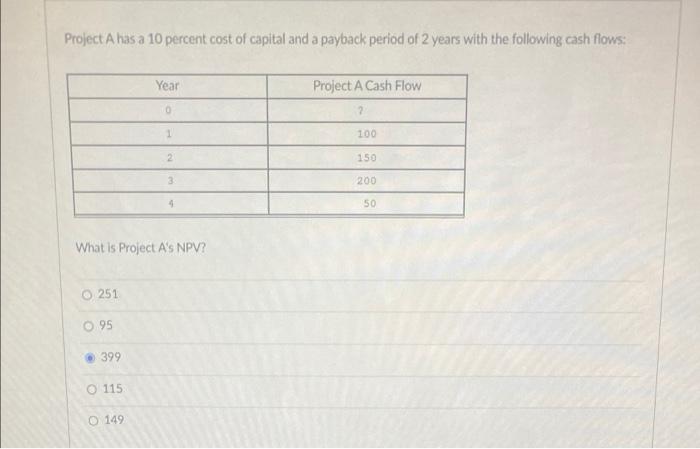

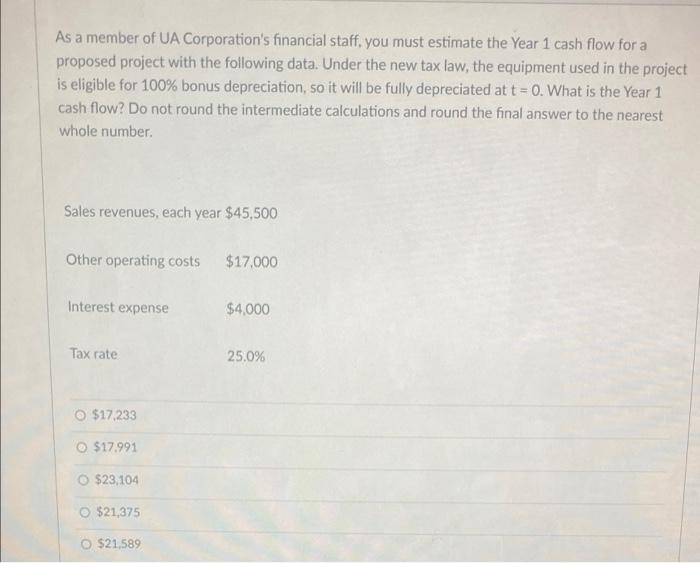

Project A has a 10 percent cost of capital and a payback period of 2 years with the following cash flows: Year Project A Cash Flow 0 2 1 100 2 150 3 200 4 50 What is Project A's NPV? 251 095 399 115 0 149 As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a proposed project with the following data. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t=0. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number Sales revenues, each year $45,500 Other operating costs $17.000 Interest expense $4,000 Tax rate 25.0% O $17.233 $17.991 O $23,104 $21,375 0 $21,589

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts