Question: Please answer all E-F (see second photo). Thank you. (Common stock valuation) Assume the following: the investor's required rate of return is 12.5 percent, the

Please answer all E-F (see second photo).

Thank you.

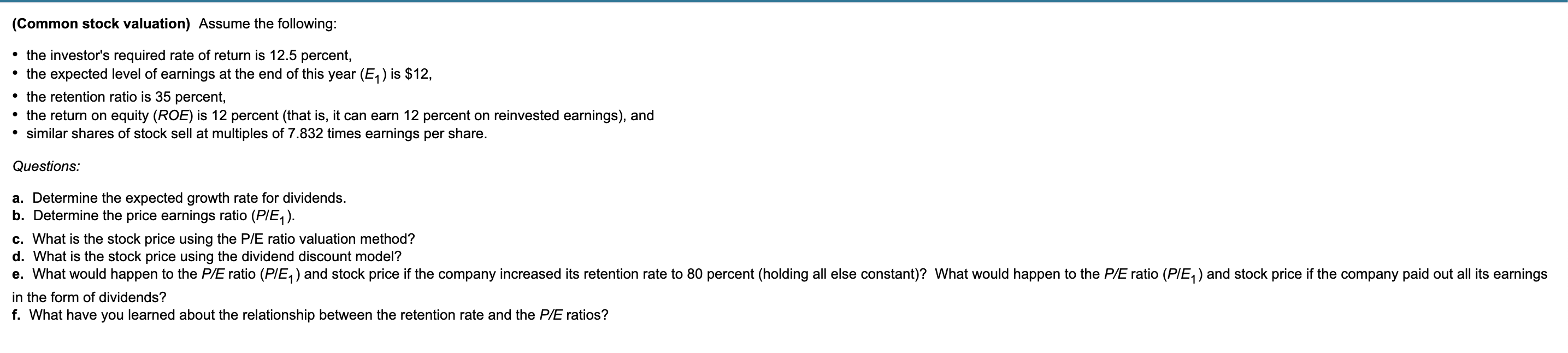

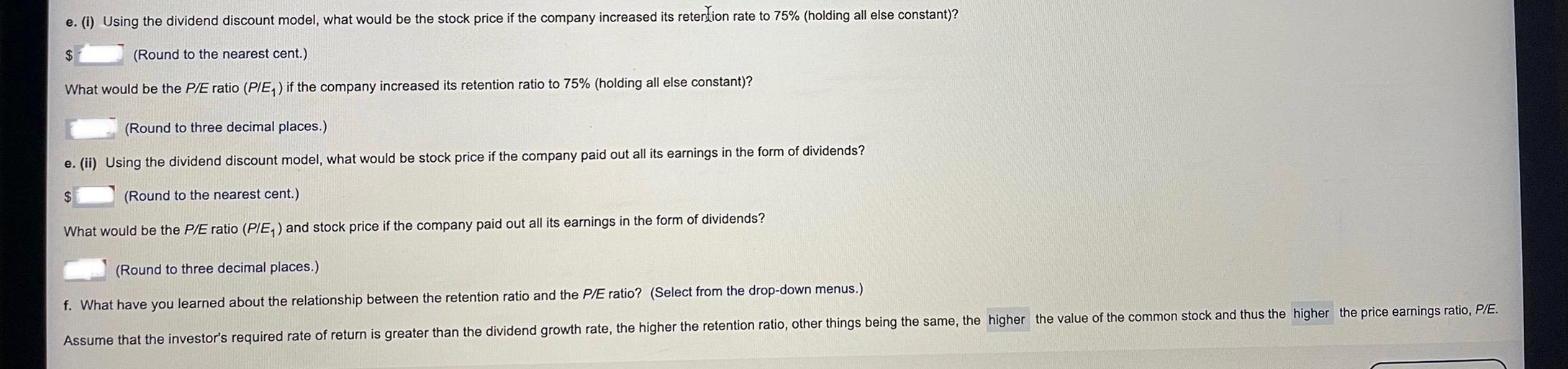

(Common stock valuation) Assume the following: the investor's required rate of return is 12.5 percent, the expected level of earnings at the end of this year (E1) is $12, the retention ratio is 35 percent, the return on equity (ROE) is 12 percent (that is, it can earn 12 percent on reinvested earnings), and similar shares of stock sell at multiples of 7.832 times earnings per share. Questions: a. Determine the expected growth rate for dividends. b. Determine the price earnings ratio (PIE1). c. What is the stock price using the P/E ratio valuation method? d. What is the stock price using the dividend discount model? e. What would happen to the P/E ratio (P/E1) and stock price if the company increased its retention rate to 80 percent (holding all else constant)? What would happen to the P/E ratio (PIE1) and stock price if the company paid out all its earnings in the form of dividends? f. What have you learned about the relationship between the retention rate and the P/E ratios? e. (1) Using the dividend discount model, what would be the stock price if the company increased its retention rate to 75% (holding all else constant)? $ (Round to the nearest cent.) What would be the P/E ratio (PE) if the company increased its retention ratio to 75% (holding all else constant)? (Round to three decimal places.) e. (ii) Using the dividend discount model, what would be stock price if the company paid out all its earnings in the form of dividends? $ (Round to the nearest cent.) What would be the P/E ratio (PE) and stock price if the company paid out all its earnings in the form of dividends? (Round to three decimal places.) f. What have you learned about the relationship between the retention ratio and the P/E ratio? (Select from the drop-down menus.) Assume that the investor's required rate of return is greater than the dividend growth rate, the higher the retention ratio, other things being the same, the higher the value of the common stock and thus the higher the price earnings ratio, P/E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts