Question: Please answer all! Exercise 25-12 Product pricing using variable costs LO P6 Rios Co. makes drones and uses the variable cost approach in setting product

Please answer all!

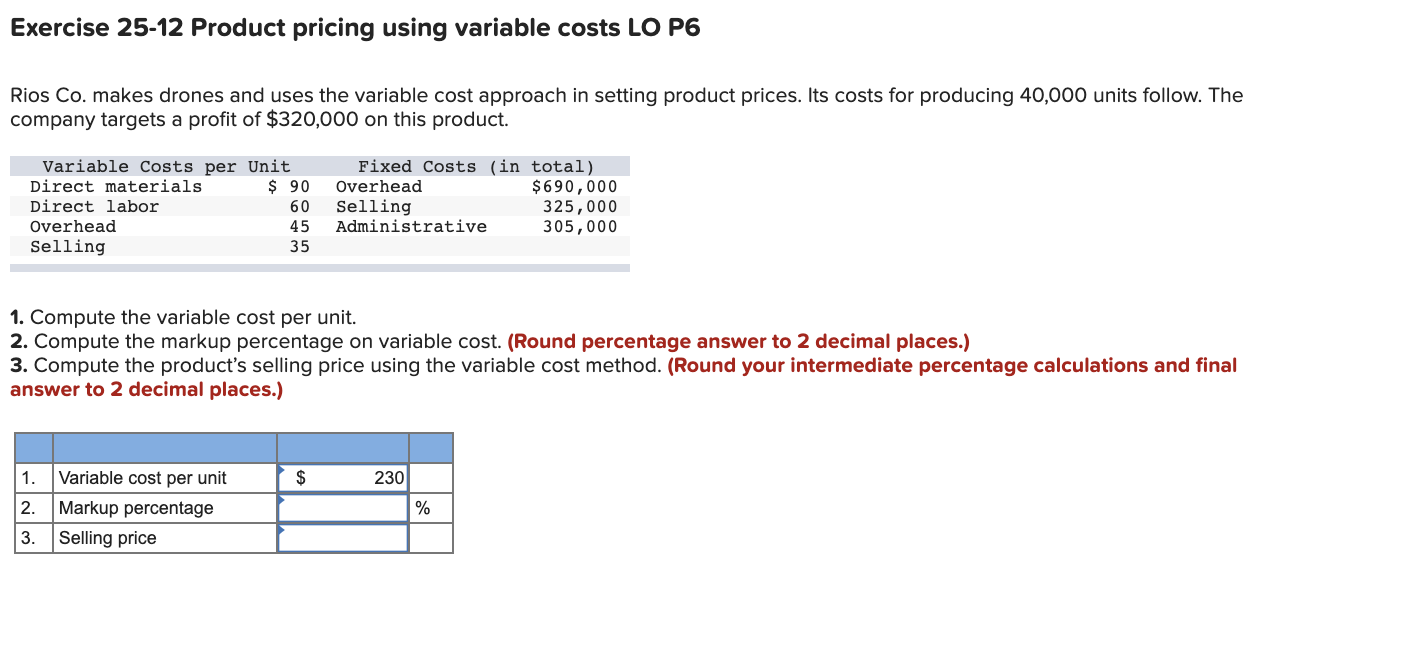

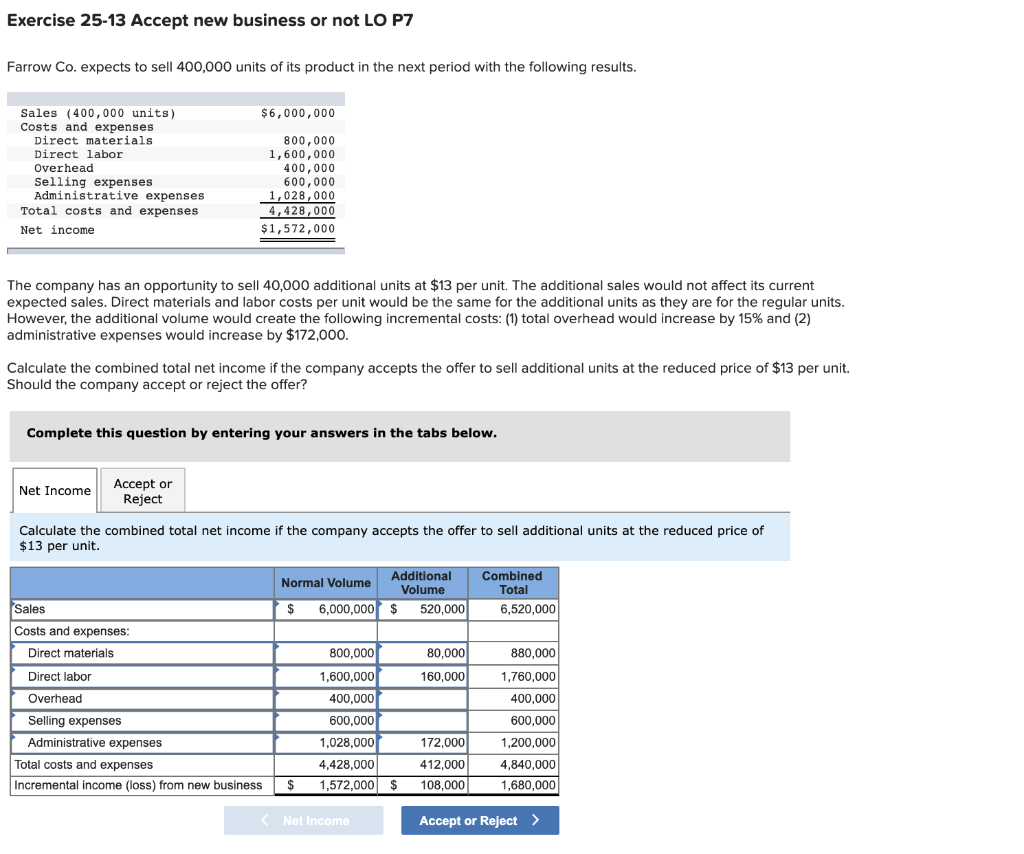

Exercise 25-12 Product pricing using variable costs LO P6 Rios Co. makes drones and uses the variable cost approach in setting product prices. Its costs for producing 40,000 units follow. The company targets a profit of $320,000 on this product. Variable Costs per Unit Direct materials $ 90 Direct labor 60 Overhead 45 Selling 35 Fixed Costs (in total) Overhead $ 690,000 Selling 325,000 Administrative 305,000 1. Compute the variable cost per unit. 2. Compute the markup percentage on variable cost. (Round percentage answer to 2 decimal places.) 3. Compute the product's selling price using the variable cost method. (Round your intermediate percentage calculations and final answer to 2 decimal places.) 1. $ 230 2. Variable cost per unit Markup percentage Selling price % 3. Exercise 25-13 Accept new business or not LO P7 Farrow Co. expects to sell 400,000 units of its product in the next period with the following results. $6,000,000 Sales (400,000 units) Costs and expenses Direct materials Direct labor Overhead Selling expenses Administrative expenses Total costs and expenses Net income 800,000 1,600,000 400,000 600,000 1,028,000 4,428,000 $1,572,000 The company has an opportunity to sell 40,000 additional units at $13 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 15% and (2) administrative expenses would increase by $172,000. Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit. Should the company accept or reject the offer? Complete this question by entering your answers in the tabs below. Net Income Accept or Reject Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit. Additional Combined Normal Volume Volume Total Sales $ 6,000,000 $ 520,000 6,520,000 Costs and expenses: Direct materials 800,000 80,000 880,000 Direct labor 1,600,000 160,000 1,760,000 Overhead 400,000 400,000 Selling expenses 600,000 600,000 Administrative expenses 1,028,000 172,000 1,200,000 Total costs and expenses 4,428,000 412,000 4,840,000 Incremental income (loss) from new business $ 1,572,000 $ 108,000 1,680,000 Net Income Accept or Reject>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts