Question: PLEASE ANSWER ALL FIVE QUESTIONS & THE ANSWERS MUST BE ANSWERED AS A FORMULA, YOU DON'T NEED TO WORKOUT THE QUESTION, I JUST NEED THE

PLEASE ANSWER ALL FIVE QUESTIONS & THE ANSWERS MUST BE ANSWERED AS A FORMULA, YOU DON'T NEED TO WORKOUT THE QUESTION, I JUST NEED THE FORMULA, THE FORMULA IS WHERE THE YELLOW HIGHLIGHTS ARE:

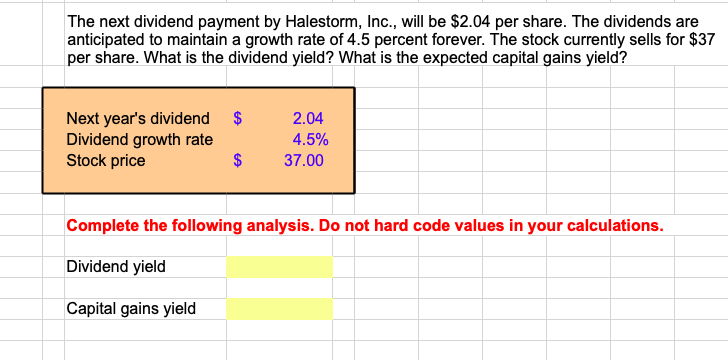

#1)

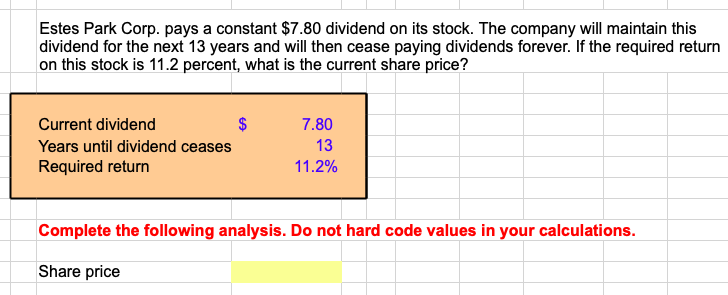

#2):

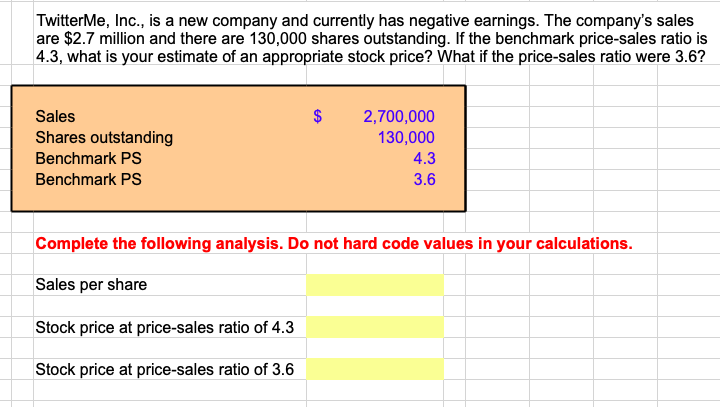

#3);

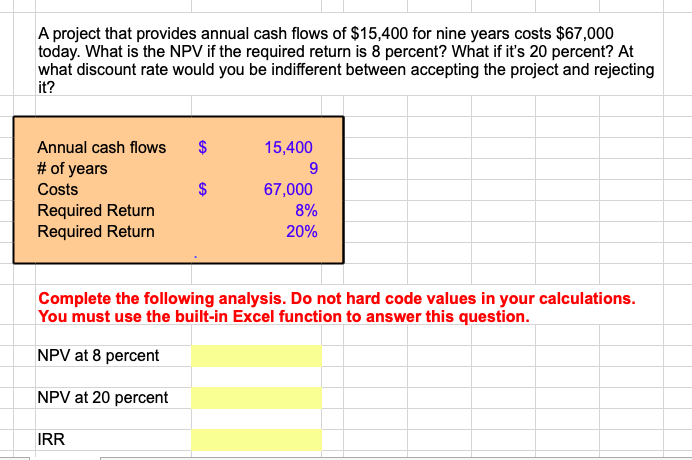

#4):

#5):

THANK YOU!

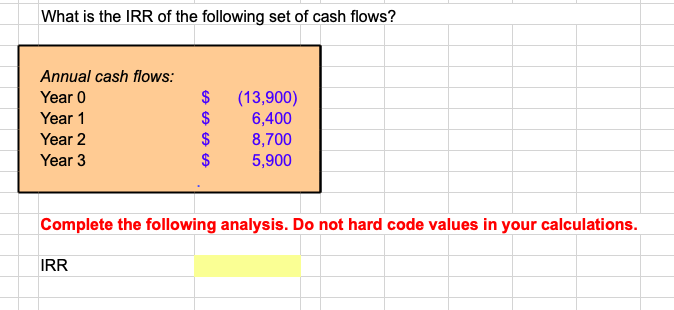

The next dividend payment by Halestorm, Inc., will be $2.04 per share. The dividends are anticipated to maintain a growth rate of 4.5 percent forever. The stock currently sells for $37 per share. What is the dividend yield? What is the expected capital gains yield? Estes Park Corp. pays a constant $7.80 dividend on its stock. The company will maintain this dividend for the next 13 years and will then cease paying dividends forever. If the required return on this stock is 11.2 percent, what is the current share price? TwitterMe, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 130,000 shares outstanding. If the benchmark price-sales ratio is 4.3, what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6? A project that provides annual cash flows of $15,400 for nine years costs $67,000 today. What is the NPV if the required return is 8 percent? What if it's 20 percent? At what discount rate would you be indifferent between accepting the project and rejecting it? Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel function to answer this question. What is the IRR of the following set of cash flows? Complete the following analysis. Do not hard code values in your calculations. IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts