Question: Please answer all five questions WITHOUT explanation You are assigned to the audit of Orion Limited, a large proprietary company with offices in all major

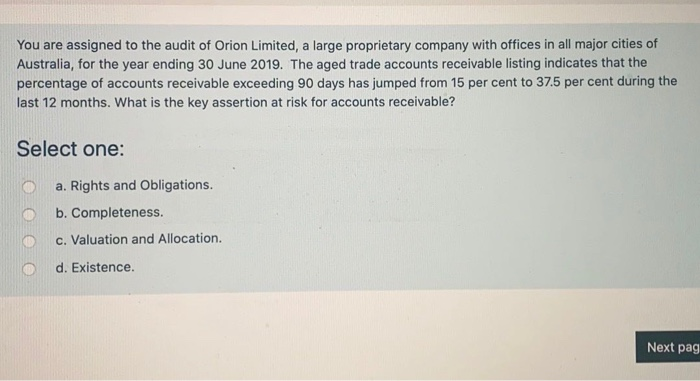

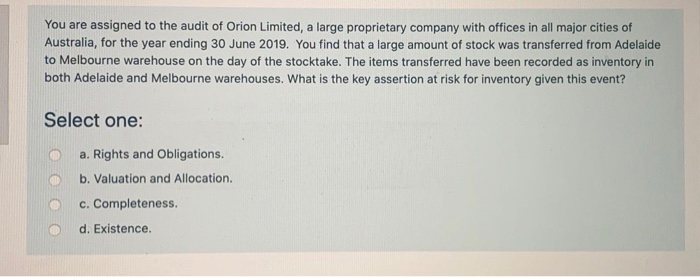

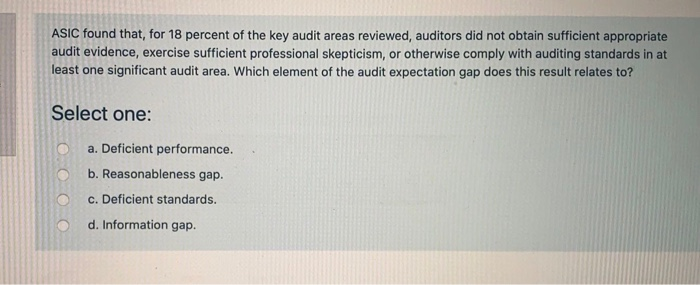

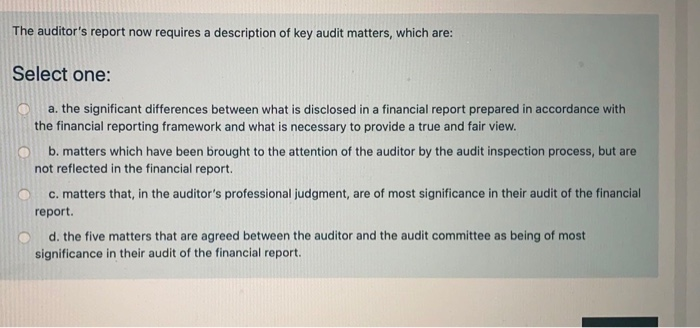

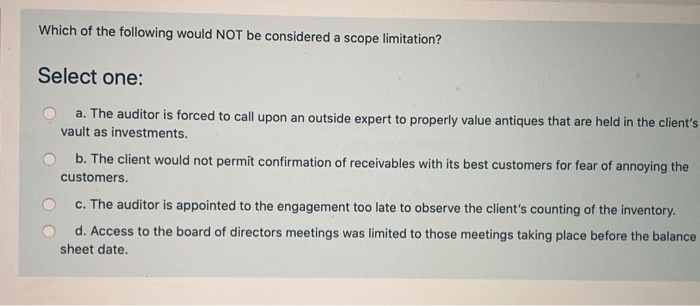

You are assigned to the audit of Orion Limited, a large proprietary company with offices in all major cities of Australia, for the year ending 30 June 2019. The aged trade accounts receivable listing indicates that the percentage of accounts receivable exceeding 90 days has jumped from 15 per cent to 37.5 per cent during the last 12 months. What is the key assertion at risk for accounts receivable? Select one: a. Rights and Obligations. b. Completeness. c. Valuation and Allocation. d. Existence. Next pag You are assigned to the audit of Orion Limited, a large proprietary company with offices in all major cities of Australia, for the year ending 30 June 2019. You find that a large amount of stock was transferred from Adelaide to Melbourne warehouse on the day of the stocktake. The items transferred have been recorded as inventory in both Adelaide and Melbourne warehouses. What is the key assertion at risk for inventory given this event? Select one: a. Rights and Obligations. b. Valuation and Allocation. c. Completeness d. Existence. ASIC found that, for 18 percent of the key audit areas reviewed, auditors did not obtain sufficient appropriate audit evidence, exercise sufficient professional skepticism, or otherwise comply with auditing standards in at least one significant audit area. Which element of the audit expectation gap does this result relates to? Select one: a. Deficient performance. b. Reasonableness gap. c. Deficient standards. d. Information gap. The auditor's report now requires a description of key audit matters, which are: Select one: a. the significant differences between what is disclosed in a financial report prepared in accordance with the financial reporting framework and what is necessary to provide a true and fair view. b. matters which have been brought to the attention of the auditor by the audit inspection process, but are not reflected in the financial report. c. matters that, in the auditor's professional judgment, are of most significance in their audit of the financial report d. the five matters that are agreed between the auditor and the audit committee as being of most significance in their audit of the financial report. Which of the following would NOT be considered a scope limitation? Select one: a. The auditor is forced to call upon an outside expert to properly value antiques that are held in the client's vault as investments. b. The client would not permit confirmation of receivables with its best customers for fear of annoying the customers. C. The auditor is appointed to the engagement too late to observe the client's counting of the inventory. d. Access to the board of directors meetings was limited to those meetings taking place before the balance sheet date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts