Question: Please answer all five with explaintion. thanks Suppose a stock had an initial price of $72 per share, paid a dividend of $3.40 per share

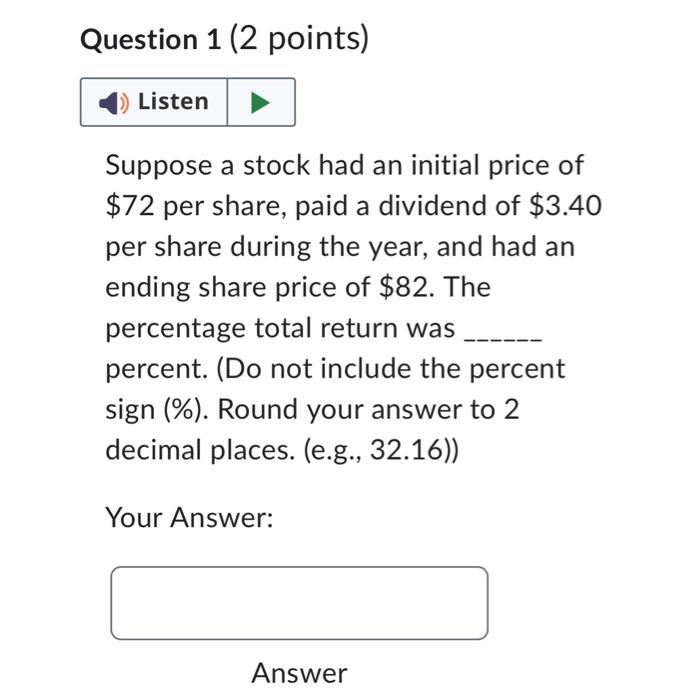

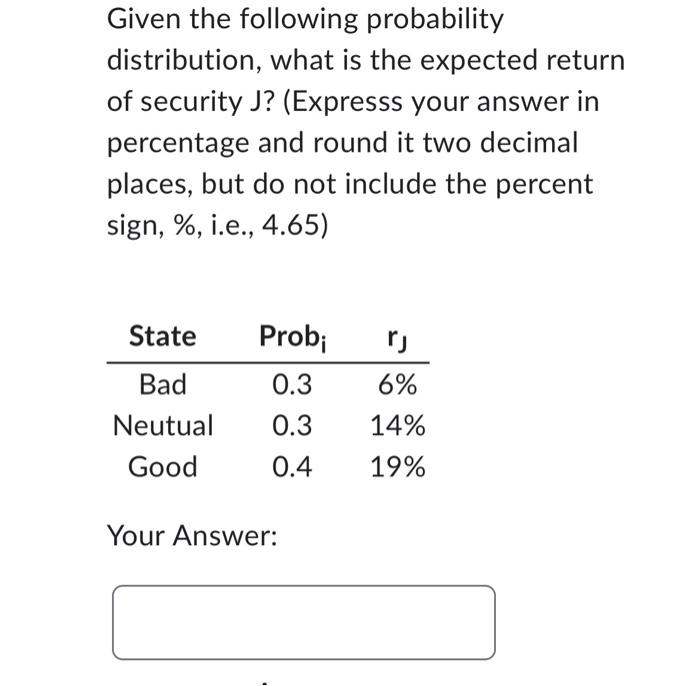

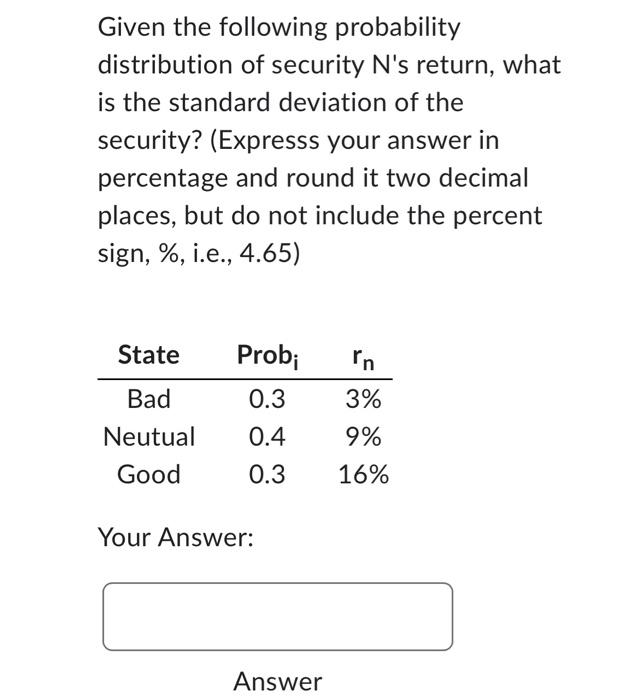

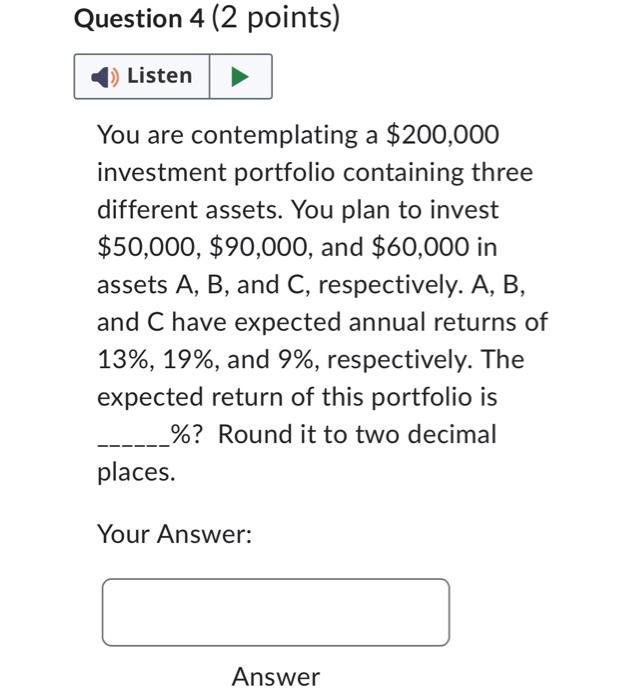

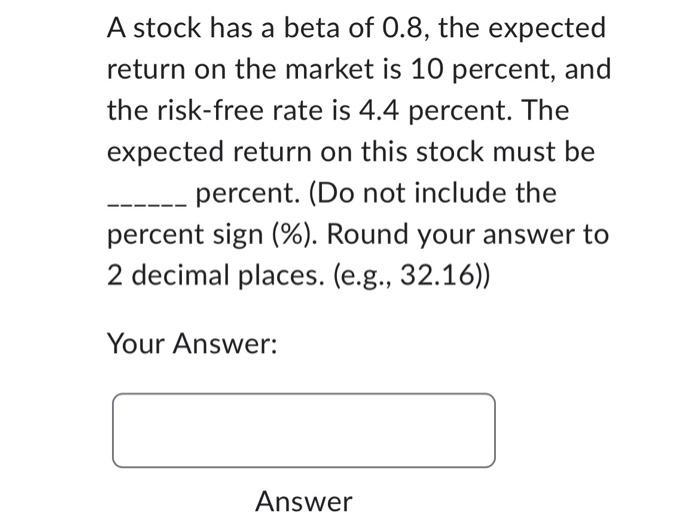

Suppose a stock had an initial price of $72 per share, paid a dividend of $3.40 per share during the year, and had an ending share price of $82. The percentage total return was percent. (Do not include the percent sign (\%). Round your answer to 2 decimal places. (e.g., 32.16)) Your Answer: Given the following probability distribution, what is the expected return of security J? (Expresss your answer in percentage and round it two decimal places, but do not include the percent sign, \%, i.e., 4.65) Your Answer: Given the following probability distribution of security N's return, what is the standard deviation of the security? (Expresss your answer in percentage and round it two decimal places, but do not include the percent sign, \%, i.e., 4.65) Your Answer: You are contemplating a $200,000 investment portfolio containing three different assets. You plan to invest $50,000,$90,000, and $60,000 in assets A,B, and C, respectively. A,B, and C have expected annual returns of 13%,19%, and 9%, respectively. The expected return of this portfolio is % ? Round it to two decimal places. Your Answer: Answer A stock has a beta of 0.8 , the expected return on the market is 10 percent, and the risk-free rate is 4.4 percent. The expected return on this stock must be percent. (Do not include the percent sign (\%). Round your answer to 2 decimal places. (e.g., 32.16)) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts