Question: please answer all g Objective 4 E26-25 Using IRR to make capital investment decisions Refer to the data regarding Juda Products in Exercise E26-24. Compute

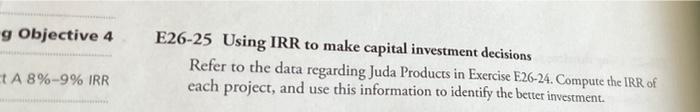

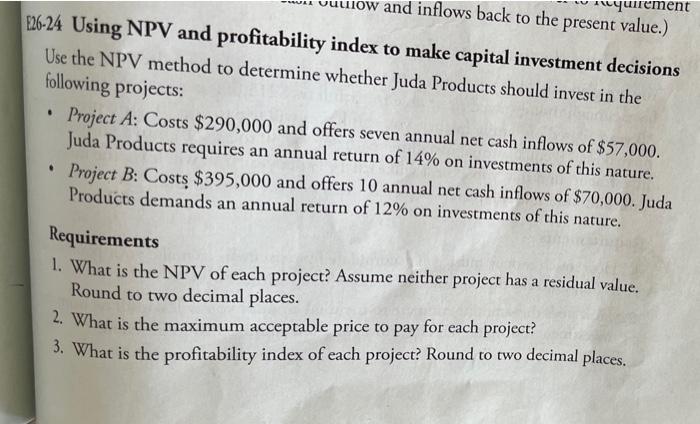

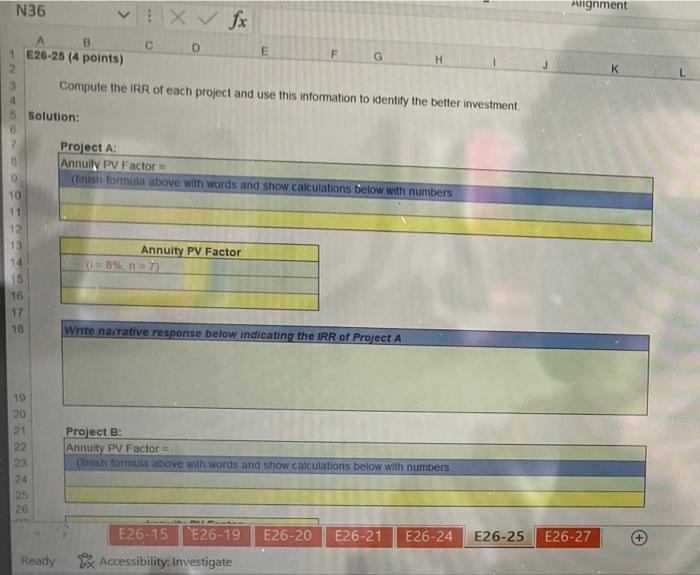

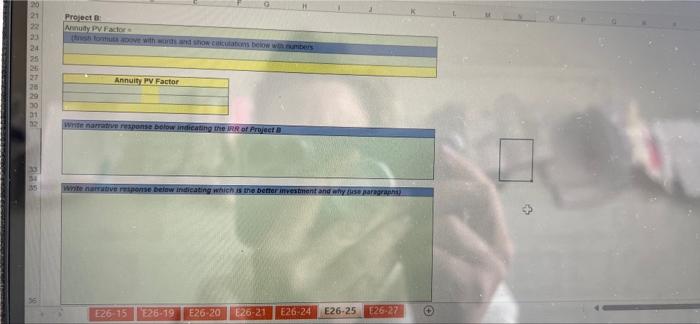

g Objective 4 E26-25 Using IRR to make capital investment decisions Refer to the data regarding Juda Products in Exercise E26-24. Compute the IRR of each project, and use this information to identify the better investment TA 8%-9% IRR now and inflows back to the present value.) 226-24 Using NPV and profitability index to make capital investment decisions Use the NPV method to determine whether Juda Products should invest in the following projects: Project A: Costs $290,000 and offers seven annual net cash inflows of $57,000. Juda Products requires an annual return of 14% on investments of this nature. Project B: Costs $395,000 and offers 10 annual net cash inflows of $70,000. Juda Products demands an annual return of 12% on investments of this nature. . . Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. N36 Alignment IX fx 1 E26-25 (4 points) D E F G H K Compute the IRR of each project and use this information to identify the better investment Solution: Project A: Annuity PV Factor (Tinish formula above with words and show calculations below with numbers 10 12 13 Annuity PV Factor B%) 15 16 17 18 Write narrative response below indicating the IRR of Project A 19 20 21 22 23 24 25 Project B: Annuity PV Factor (inish formula above with words and show calculations below with numbers 26 E26-20 E26-21 E26-24 E26-25 E26-27 E26-15 E26-19 Accessibility: Investigate Ready Project Armudy PV Factor & ENRNARRA Annuity PV Factor Write narrative response Delow indicating their or Project 3 white nam se below indicating which is the better investment and we graphi E26-15 "E26-19 E26-20 E26-21 E26-24 E26-25 E26-27 g Objective 4 E26-25 Using IRR to make capital investment decisions Refer to the data regarding Juda Products in Exercise E26-24. Compute the IRR of each project, and use this information to identify the better investment TA 8%-9% IRR now and inflows back to the present value.) 226-24 Using NPV and profitability index to make capital investment decisions Use the NPV method to determine whether Juda Products should invest in the following projects: Project A: Costs $290,000 and offers seven annual net cash inflows of $57,000. Juda Products requires an annual return of 14% on investments of this nature. Project B: Costs $395,000 and offers 10 annual net cash inflows of $70,000. Juda Products demands an annual return of 12% on investments of this nature. . . Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. N36 Alignment IX fx 1 E26-25 (4 points) D E F G H K Compute the IRR of each project and use this information to identify the better investment Solution: Project A: Annuity PV Factor (Tinish formula above with words and show calculations below with numbers 10 12 13 Annuity PV Factor B%) 15 16 17 18 Write narrative response below indicating the IRR of Project A 19 20 21 22 23 24 25 Project B: Annuity PV Factor (inish formula above with words and show calculations below with numbers 26 E26-20 E26-21 E26-24 E26-25 E26-27 E26-15 E26-19 Accessibility: Investigate Ready Project Armudy PV Factor & ENRNARRA Annuity PV Factor Write narrative response Delow indicating their or Project 3 white nam se below indicating which is the better investment and we graphi E26-15 "E26-19 E26-20 E26-21 E26-24 E26-25 E26-27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts