Question: Please answer All HELP Please!! Help Sau 8 Exercise 10-24 (Algo) Interest capitalization (LO10-7) On January 1, 2021, the Highlands Company began construction on a

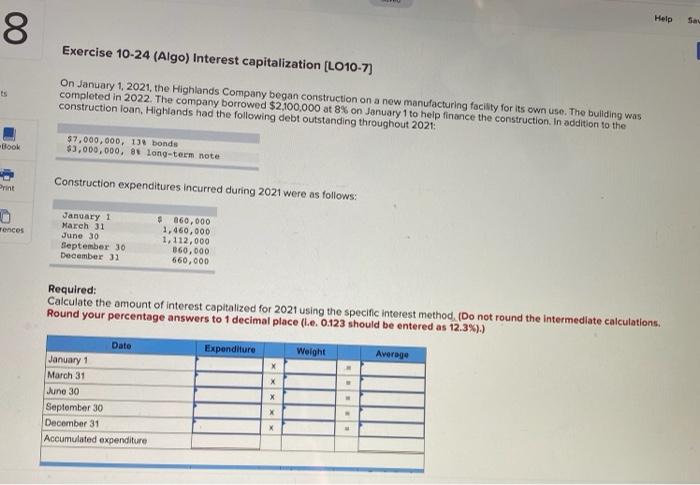

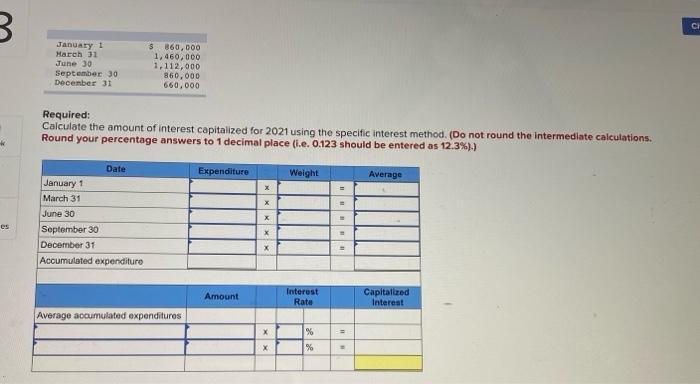

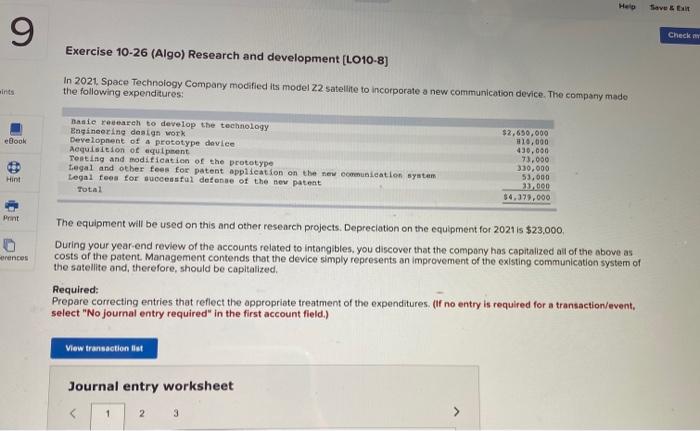

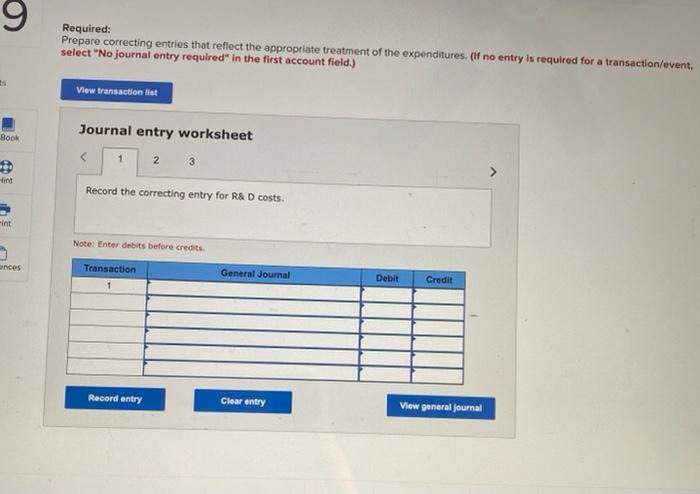

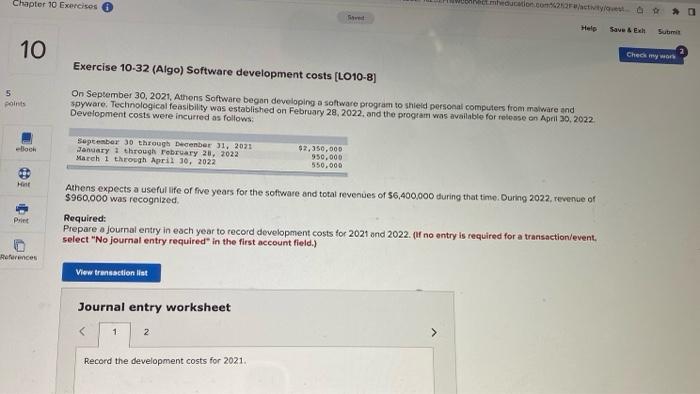

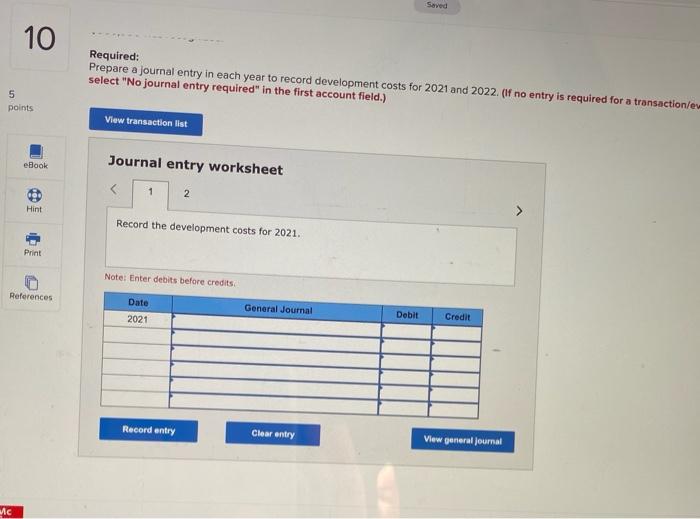

Help Sau 8 Exercise 10-24 (Algo) Interest capitalization (LO10-7) On January 1, 2021, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2022. The company borrowed $2,100,000 at 8% on January 1 to help finance the construction. In addition to the construction loan, Highlands had the following debt outstanding throughout 2021 -Book $7,000,000, 138 bonds $3,000,000, 8: long-term note Construction expenditures incurred during 2021 were as follows: Print Tences January 1 March 31 June 30 September 30 December 31 $ 860,000 1,460,000 1,112,000 060,000 660,000 Required: Calculate the amount of interest capitalized for 2021 using the specific interest method. (Do not round the intermediate calculations Round your percentage answers to 1 decimal place (ie. 0.123 should be entered as 12.3%).) Dato Expenditure Weight Average January 1 March 31 June 30 September 30 December 31 Accumulated expenditure X X X 3 CH January 1 Harch 31 June 30 September 30 December 31 S860,000 1,460.000 1.112,000 860,000 660,000 Required: Calculate the amount of interest capitalized for 2021 using the specific interest method. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%).) Date Expenditure Weight Average X = x x es January 1 March 31 June 30 September 30 December 31 Accumulated expenditure Amount Interest Rate Capitalized Interest Average accumulated expenditures X % X % Help Save 9 Check Exercise 10-26 (Algo) Research and development (LO10-8] In 2021. Space Technology Company modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: eBook Basie research to develop the technology Bagineering design work Development of a prototype device Acquisition of equipment Testing and modification of the prototype Legal and other fees for patent application on the new communication system Legal fees for successful defense of the new patent Total $2,650,000 10,000 430.000 73.000 330.000 53,000 33.000 $4,379.000 Hint Print rences The equipment will be used on this and other research projects. Depreciation on the equipment for 20211s $23,000, During your year-end review of the accounts related to intongibles, you discover that the company has capitalized all of the above as costs of the patent Management contends that the device simply represents an improvement of the existing communication system of the satellite and, therefore, should be capitalized, Required: Prepare correcting entries that reflect the appropriate treatment of the expenditures. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction et Journal entry worksheet 2 3 Required: Prepare correcting entries that reflect the appropriate treatment of the expenditures. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction that Journal entry worksheet Book 1 3 Hint Record the correcting entry for R&D costs. int Note: Enter debits before credits ances Transaction General Journal Debit Credit Record entry Clear entry View general journal Chapter 10 Exercises meducation contacto Help Save & Ech Suome 10 Checimo Exercise 10-32 (Algo) Software development costs (LO10-8] 5 points On September 30, 2021, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2022, and the program was available for release on April 30, 2022 Development costs were incurred as follows: eBook September 30 through December 31, 2023 January 1 through rebruary 21, 2022 March 1 through April 30, 2022 62,350,000 950.000 550.000 HE Athens expects a useful life of five years for the software and total revenues of 56,400,000 during that time. During 2022. revenue of $960,000 was recognized Required: Prepare a journal entry in each year to record development costs for 2021 and 2022. (of no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Pret Rences View transaction list Journal entry worksheet Record the development costs for 2021. Saved 10 Required: Prepare a journal entry in each year to record development costs for 2021 and 2022. (If no entry is required for a transactione select "No journal entry required" in the first account field.) 5 points View transaction list eBook Journal entry worksheet 1 2 Hint Record the development costs for 2021, Print Note: Enter debits before credits References Date 2021 General Journal Debit Credit Record entry Clear entry View general journal Mc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts