Question: PLEASE ANSWER ALL. I AM SUPER STUCK! (: You have a loan outstanding. It requires making six annual payments of $2,000 each at the end

PLEASE ANSWER ALL. I AM SUPER STUCK! (:

PLEASE ANSWER ALL. I AM SUPER STUCK! (:

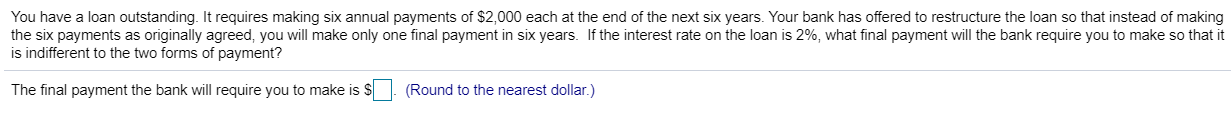

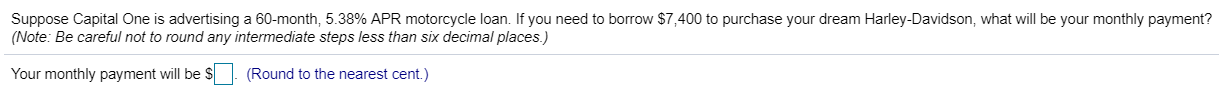

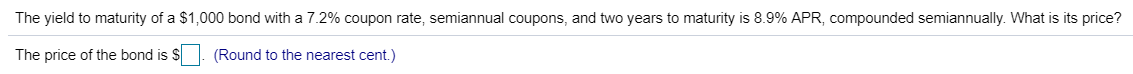

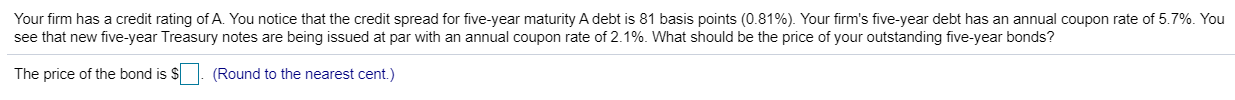

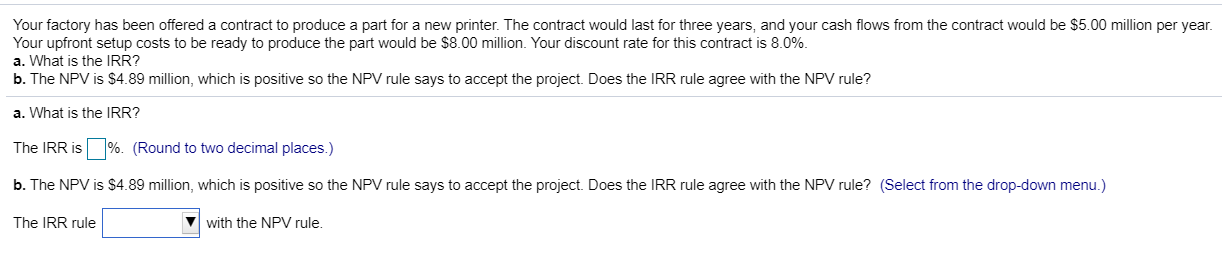

You have a loan outstanding. It requires making six annual payments of $2,000 each at the end of the next six years. Your bank has offered to restructure the loan so that instead of making the six payments as originally agreed, you will make only one final payment in six years. If the interest rate on the loan is 2%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment? The final payment the bank will require you to make is $ . (Round to the nearest dollar.) Suppose Capital One is advertising a 60-month, 5.38% APR motorcycle loan. If you need to borrow $7,400 to purchase your dream Harley-Davidson, what will be your monthly payment? (Note: Be careful not to round any intermediate steps less than six decimal places.) Your monthly payment will be $7. (Round to the nearest cent.) The yield to maturity of a $1,000 bond with a 7.2% coupon rate, semiannual coupons, and two years to maturity is 8.9% APR, compounded semiannually. What is its price? The price of the bond is $ . (Round to the nearest cent.) Your firm has a credit rating of A. You notice that the credit spread for five-year maturity A debt is 81 basis points (0.81%). Your firm's five-year debt has an annual coupon rate of 5.7%. You see that new five-year Treasury notes are being issued at par with an annual coupon rate of 2.1%. What should be the price of your outstanding five-year bonds? The price of the bond is $ . (Round to the nearest cent.) Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.00 million per year. Your upfront setup costs to be ready to produce the part would be $8.00 million. Your discount rate for this contract is 8.0%. a. What is the IRR? b. The NPV is $4.99 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.) b. The NPV is $4.89 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? (Select from the drop-down menu.) The IRR rule with the NPV rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts