Question: Please answer all, I have 0 questions left on Chegg and will leave a thumbs up. 3. Ying import has several bond issues outstanding, each

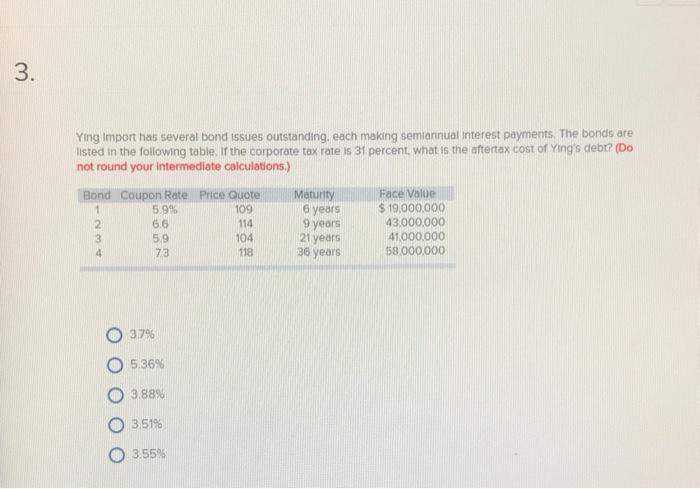

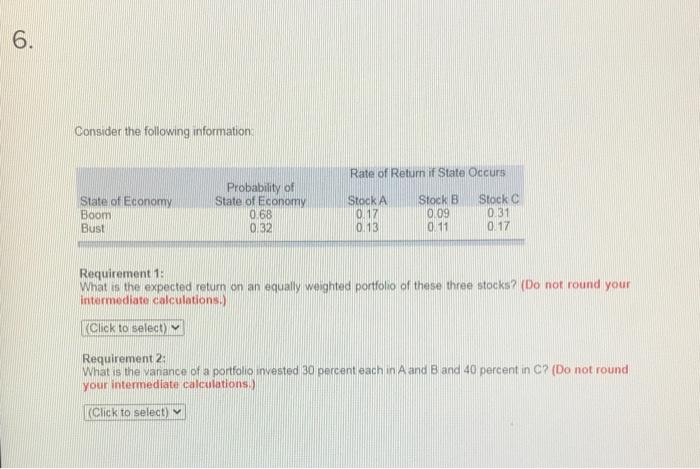

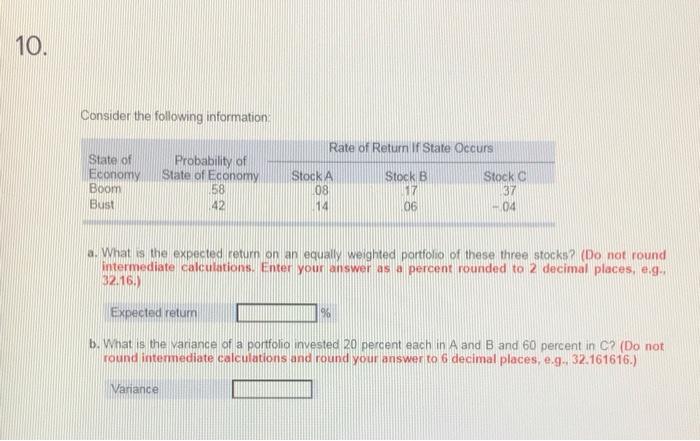

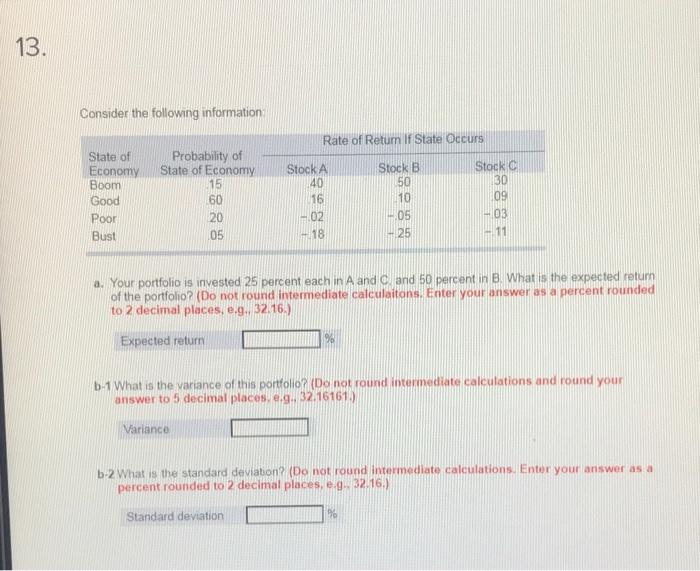

3. Ying import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table, if the corporate tax rate is 31 percent, what is the aftertax cost of Ying's debt? (DO not round your intermediate calculations.) Maturity Bond Coupon Rate Price Quote 1 5.9% 109 2 114 3 5.9 104 4 73 118 6.6 6 years 9 years 21 years 36 years Face Value $ 19,000,000 43,000,000 41,000,000 58,000,000 3.79 5.36% 3,88% 3.51% 3.55% 6. Consider the following information Rate of Return if State Occurs State of Economy Boom Bust Probability of State of Economy 0.68 0.32 Stock A 0.17 0.13 Stock B 009 0 11 Stock 0.31 0.17 Requirement 1: What is the expected retum on an equally weighted portfolio of these three stocks (Do not round your intermediate calculations.) Click to select Requirement 2: What is the vanance of a portfolio invested 30 percent each in A and B and 40 percent in C? (Do not round your intermediate calculations) Click to select) M 10. Consider the following information Rate of Retum If State Occurs State of Economy Boom Bust Probability of State of Economy 58 42 Stock 08 14 Stock B 17 06 Stock 37 04 a. What is the expected return on an equally weighted portfolio of these three stocks ? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Expected retum 96 b. What is the variance of a portfolio invested 20 percent each in A and B and 60 percent in C? (Do not round intermediate calculations and round your answer to 6 decimal places, e.g. 32.161616.) Varance 13. Consider the following information Rate of Return If State Occurs State of Economy Boom Good Poor Bust Probability of State of Economy 15 60 20 105 Stock A 40 16 Stock 30 09 Stock B 50 110 05 25 -02 18 03 11 a. Your portfolio is invested 25 percent each in A and Cand 50 percent in B. What is the expected retum of the portfolio? (Do not round intermediate calculaitons. Enter your answer as a percent rounded to 2 decimal places, e.g. 32. 16.) Expected return 26 b-1 What is the variance of this portfolio (Danou round intermediate calculations and round your answer to 5 decimal places.g. 3215161.) Variance b-2 What is the standard deviation? (Do not round Intermediate calculations Enter your answer as a percent rounded to 2 decimal places, eg 32.16.) Standard deviation 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts