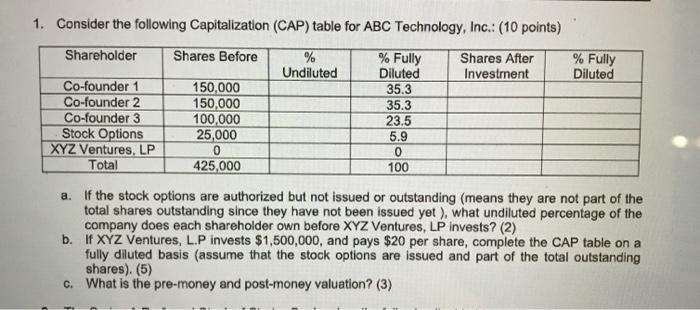

Question: Please answer all. I will rate, thanks 1. Consider the following Capitalization (CAP) table for ABC Technology, Inc.: (10 points) Shareholder Shares Before % Undiluted

1. Consider the following Capitalization (CAP) table for ABC Technology, Inc.: (10 points) Shareholder Shares Before % Undiluted Shares After Investment % Fully Diluted Co-founder 1 Co-founder 2 Co-founder 3 Stock Options XYZ Ventures, LP Total 150,000 150,000 100,000 25,000 0 425,000 % Fully Diluted 35.3 35.3 23.5 5.9 0 100 If the stock options are authorized but not issued or outstanding (means they are not part of the total shares outstanding since they have not been issued yet), what undiluted percentage of the company does each shareholder own before XYZ Ventures, LP invests? (2) b. If XYZ Ventures, L.P invests $1,500,000, and pays $20 per share, complete the CAP table on a fully diluted basis (assume that the stock options are issued and part of the total outstanding shares). (5) C. What is the pre-money and post-money valuation? (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts