Question: Please answer all If sales go up by 40%, which of the following will go up by 40%? A) fixed costs B) indirect costs. C)

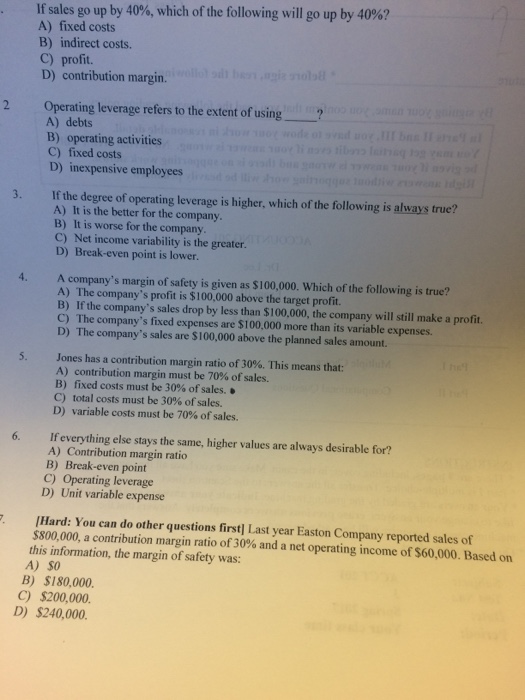

If sales go up by 40%, which of the following will go up by 40%? A) fixed costs B) indirect costs. C) profit. D) contribution margin. 2 Operating leverage refers to the extent of using A) debts B) operating activities C) fixed costs D) inexpensive employees 3. If the degree of operating leverage is higher, which of the following is always true? A) It is the better for the company B) It is worse for the company C) Net income variability is the greater. D) Break-even point is lower. 4. A company's margin of safety is given as $100,000. Which of the following is true? A) The company's profit is $100,000 above the target profit. B) If the company's sales drop by less than $100,000, the company will still make a profit. C) The company's fixed expenses are $100,000 more than its variable expenses. D) The company's sales are $100,000 above the planned sales amount. Jones has a contribution margin ratio of 30%. This means that: A) contribution margin must be 70% of sales. B) fixed costs must be 30% of sales. . C) total costs must be 30% of sales. D) variable costs rnust be 70% of sales. 5, 6. If everything else stays the same, higher values are always desirable for? A) Contribution margin ratio B) Break-even point C) Operating leverage D) Unit variable expense . Hard: You can do other questions first] Last year Easton Company reported sales of $800,000, a contribution margin ratio of 30% and a net operating income of$60,000. Based on this information, the margin of safety was: A) $0 B) $180,000. C) $200,000. D) $240,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts