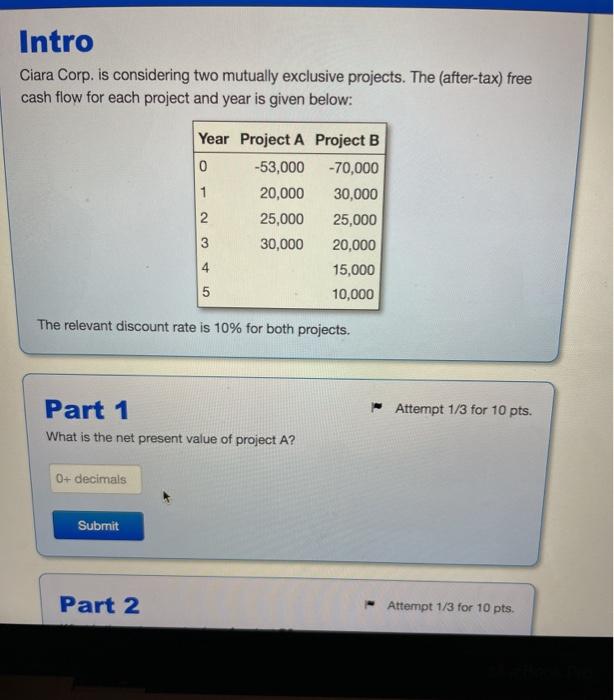

Question: please answer all Intro Ciara Corp. is considering two mutually exclusive projects. The (after-tax) free cash flow for each project and year is given below:

please answer all

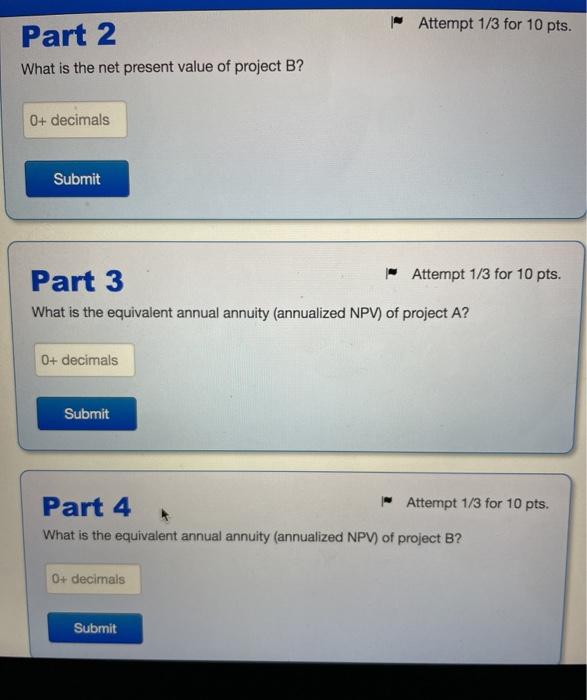

please answer allIntro Ciara Corp. is considering two mutually exclusive projects. The (after-tax) free cash flow for each project and year is given below: Year Project A Project B 0 -53,000 -70,000 20,000 30,000 2 25,000 25,000 30,000 20,000 4 15,000 5 10,000 3 5 The relevant discount rate is 10% for both projects. Attempt 1/3 for 10 pts. Part 1 What is the net present value of project A? 0+ decimals Submit Part 2 Attempt 1/3 for 10 pts. Attempt 1/3 for 10 pts. Part 2 What is the net present value of project B? 0+ decimals Submit Part 3 Attempt 1/3 for 10 pts. What is the equivalent annual annuity (annualized NPV) of project A? 0+ decimals Submit Part 4 Attempt 1/3 for 10 pts. What is the equivalent annual annuity (annualized NPV) of project B? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts