Question: PLEASE ANSWER ALL KINDLY ASAP WOULD BE REALLY HELPFUL THANK YOU Answer each of the following questions in the space provided below the questions. Mark

PLEASE ANSWER ALL KINDLY ASAP WOULD BE REALLY HELPFUL THANK YOU

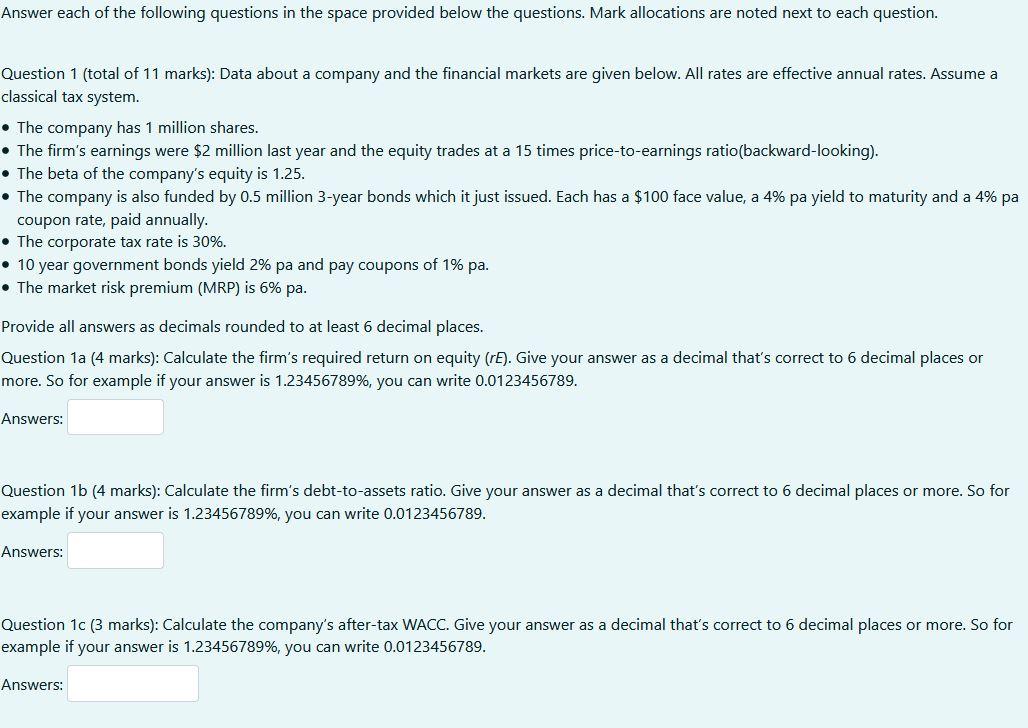

Answer each of the following questions in the space provided below the questions. Mark allocations are noted next to each question. Question 1 (total of 11 marks): Data about a company and the financial markets are given below. All rates are effective annual rates. Assume a classical tax system. The company has 1 million shares. The firm's earnings were $2 million last year and the equity trades at a 15 times price-to-earnings ratio(backward-looking). The beta of the company's equity is 1.25. The company is also funded by 0.5 million 3-year bonds which it just issued. Each has a $100 face value, a 4% pa yield to maturity and a 4% pa coupon rate, paid annually. The corporate tax rate is 30%. 10 year government bonds yield 2% pa and pay coupons of 1% pa. The market risk premium (MRP) is 6% pa. Provide all answers as decimals rounded to at least 6 decimal places. Question 1a (4 marks): Calculate the firm's required return on equity (rE). Give your answer as a decimal that's correct to 6 decimal places or more. So for example if your answer is 1.23456789%, you can write 0.0123456789. Answers: Question 1b (4 marks): Calculate the firm's debt-to-assets ratio. Give your answer as a decimal that's correct to 6 decimal places or more. So for example if your answer is 1.23456789%, you can write 0.0123456789. Answers: Question 1c (3 marks): Calculate the company's after-tax WACC. Give your answer as a decimal that's correct to 6 decimal places or more. So for example if your answer is 1.23456789%, you can write 0.0123456789. Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts