Question: Please answer all mc questions! Thank you Question 1 (1 point) In the last 10 years many employers have shifted from group RRSPs to pension

Please answer all mc questions! Thank you

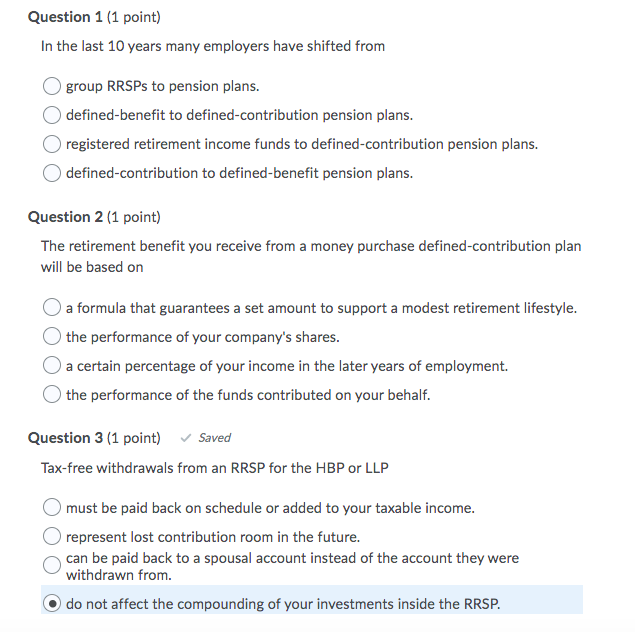

Question 1 (1 point) In the last 10 years many employers have shifted from group RRSPs to pension plans. defined-benefit to defined-contribution pension plans. registered retirement income funds to defined-contribution pension plans. defined-contribution to defined-benefit pension plans. Question 2 (1 point) The retirement benefit you receive from a money purchase defined contribution plan will be based on a formula that guarantees a set amount to support a modest retirement lifestyle. the performance of your company's shares. a certain percentage of your income in the later years of employment. the performance of the funds contributed on your behalf. Question 3 (1 point) Saved Tax-free withdrawals from an RRSP for the HBP or LLP must be paid back on schedule or added to your taxable income. represent lost contribution room in the future. can be paid back to a spousal account instead of the account they were withdrawn from. do not affect the compounding of your investments inside the RRSP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts