Question: please answer all, much appriciated ! TeleNyckel, Inc, has a beta of 0.26 and is trying to calculate its cost of equity capital. If the

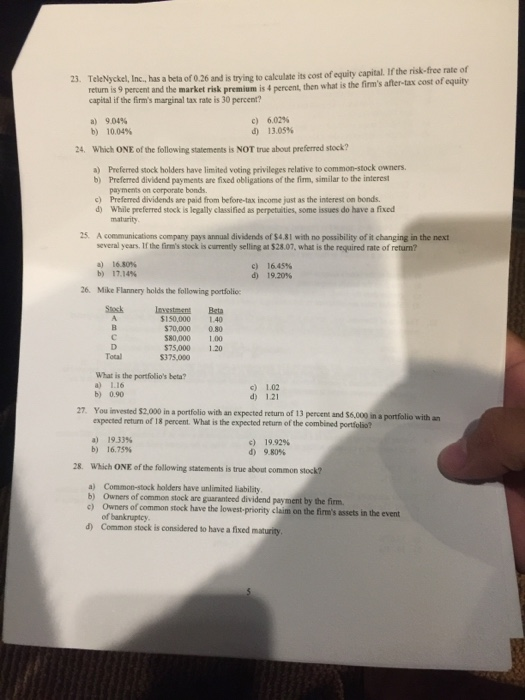

TeleNyckel, Inc, has a beta of 0.26 and is trying to calculate its cost of equity capital. If the risk-free rate of return is 9 percent and the market risk premium is 4 percent, then what is the firm's after-tax cost of equity 23. capital if the firm's marginal tax rate is 30 percent 6.02% 13.05% a) 904% c) d) b) 10.04% 24. Which ONE of the following statements is NOT true about preferred stock? a) Preferred stock holders have limited voting privileges relative to common-stock owners b) Preferred dividend payments are fixed obligations of the firm, similar to the interest payments on corporate bonds. Preferred dividends are paid from before-tax income just as the interest on bonds. While preferred stock is legally classified as perpetuities, some issues do have a fixed maturity c) d) 25. A communications company pays annual dividends of $4.81 with no possibility of it changing in the next several years. If the firm's stock is curently selling at $28.07, what is the required rate of return? s) b) 10.50% 17.14% c) d) 16.45% 19.20% 6 Mike Flannery holds the following portiolio Stock Investment Beta 150,000 1.40 $70,000 080 $80,000 1.00 $75,000 1.20 Total $375,000 What is the portfolio's beta? a) 116 b) 0.90 c) 1.02 d) 121 27. You invested $2.000 in a portfolio with an expected return of 13 percent and $6,000 in a portfolio with an portfolio? a) 1933% c) d) 19.92% 9,80% b) Which ONE of the following statements is true about common stock? a) Common-stock holders have unlimited liability 16.75% 28. b) Owners of common stock are guaranteed dividend payment by the firm c) Owners of common stock have the lowest-priority claim on the firm's assets in the event of bankaptcy Common stock is considered to have a fixed maturity d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts