Question: Please answer all multiple choice questions. The machine that was used to produce notebooks cost $750,000 when it was purchased new one year ago It

Please answer all multiple choice questions.

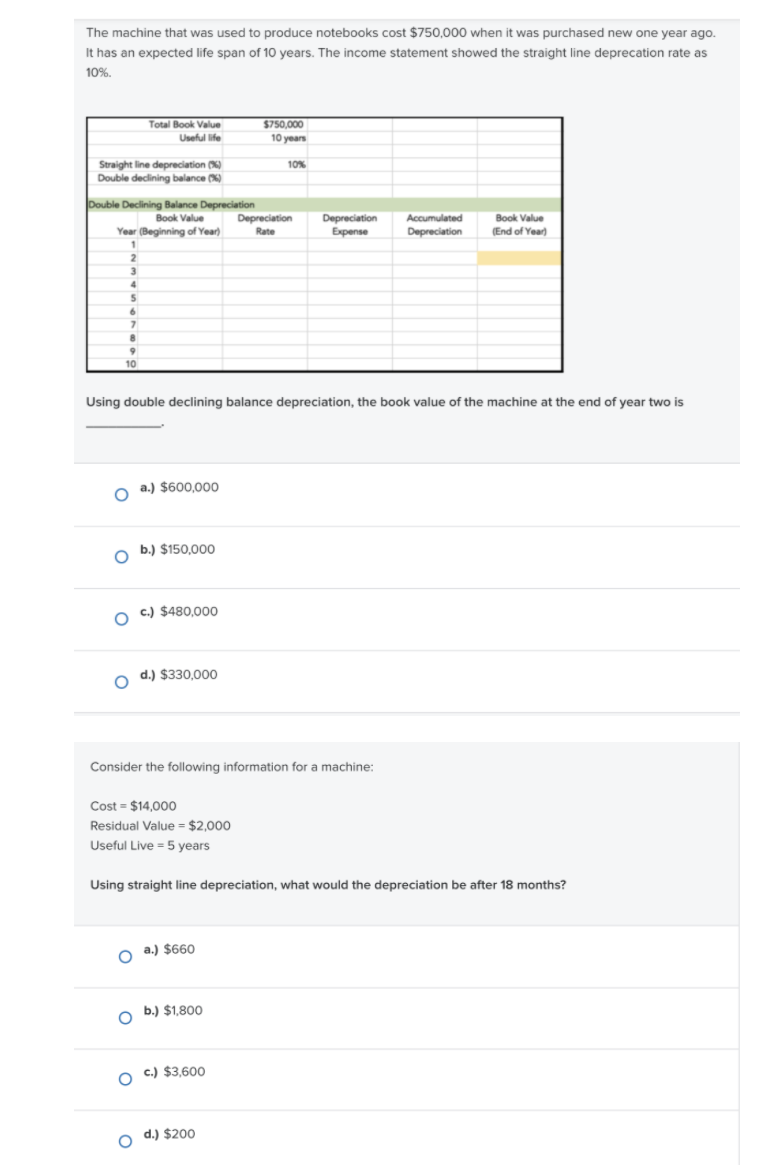

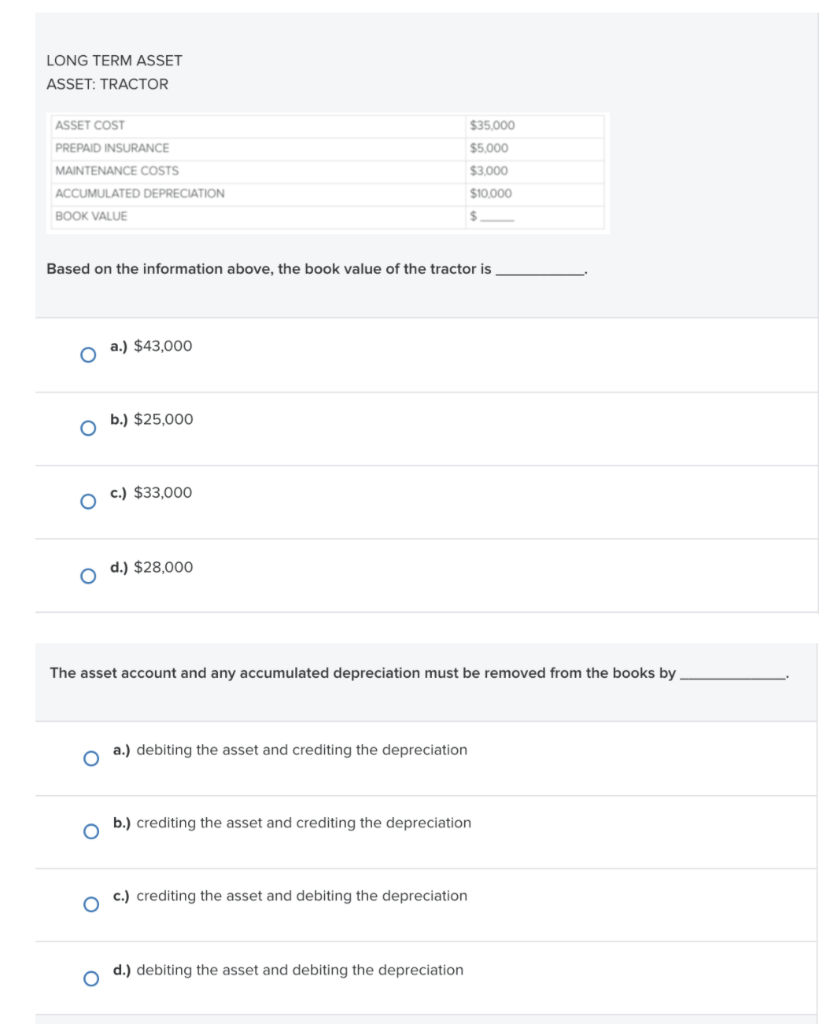

The machine that was used to produce notebooks cost $750,000 when it was purchased new one year ago It has an expected life span of 10 years. The income statement showed the straight line deprecation rate as 10% Total Book Value Useful life $750,000 10 years 10% Straight line depreciation (%) Double declining balance %) Double Declining Balance Depreciation Book Value Depreciation Year (Beginning of Year) Rate 1 2 3 Depreciation Expense Accumulated Depreciation Book Value (End of Year) 4 5 6 2 9 10 Using double declining balance depreciation, the book value of the machine at the end of year two is a.) $600,000 b.) $150,000 c.) $480,000 O d.) $330,000 Consider the following information for a machine: Cost = $14,000 Residual Value = $2,000 Useful Live = 5 years Using straight line depreciation, what would the depreciation be after 18 months? o a.) $660 b.) $1,800 O O c.) $3,600 O d.) $200 LONG TERM ASSET ASSET: TRACTOR ASSET COST $35.000 $5.000 PREPAID INSURANCE MAINTENANCE COSTS ACCUMULATED DEPRECIATION BOOK VALUE $3.000 $10,000 $ Based on the information above, the book value of the tractor is a.) $43,000 b.) $25,000 c.) $33,000 d.) $28,000 The asset account and any accumulated depreciation must be removed from the books by a.) debiting the asset and crediting the depreciation O o b.) crediting the asset and crediting the depreciation c.) crediting the asset and debiting the depreciation O d.) debiting the asset and debiting the depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts