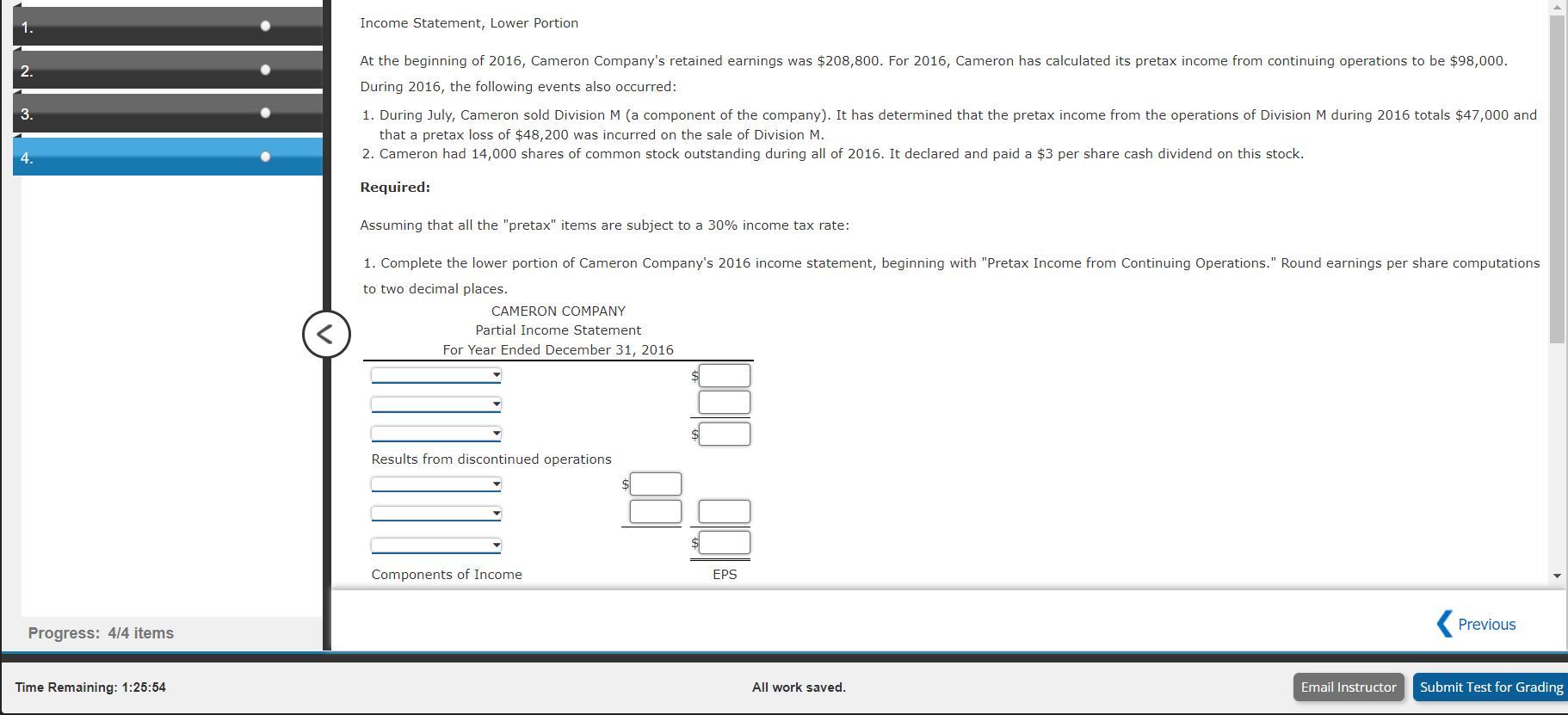

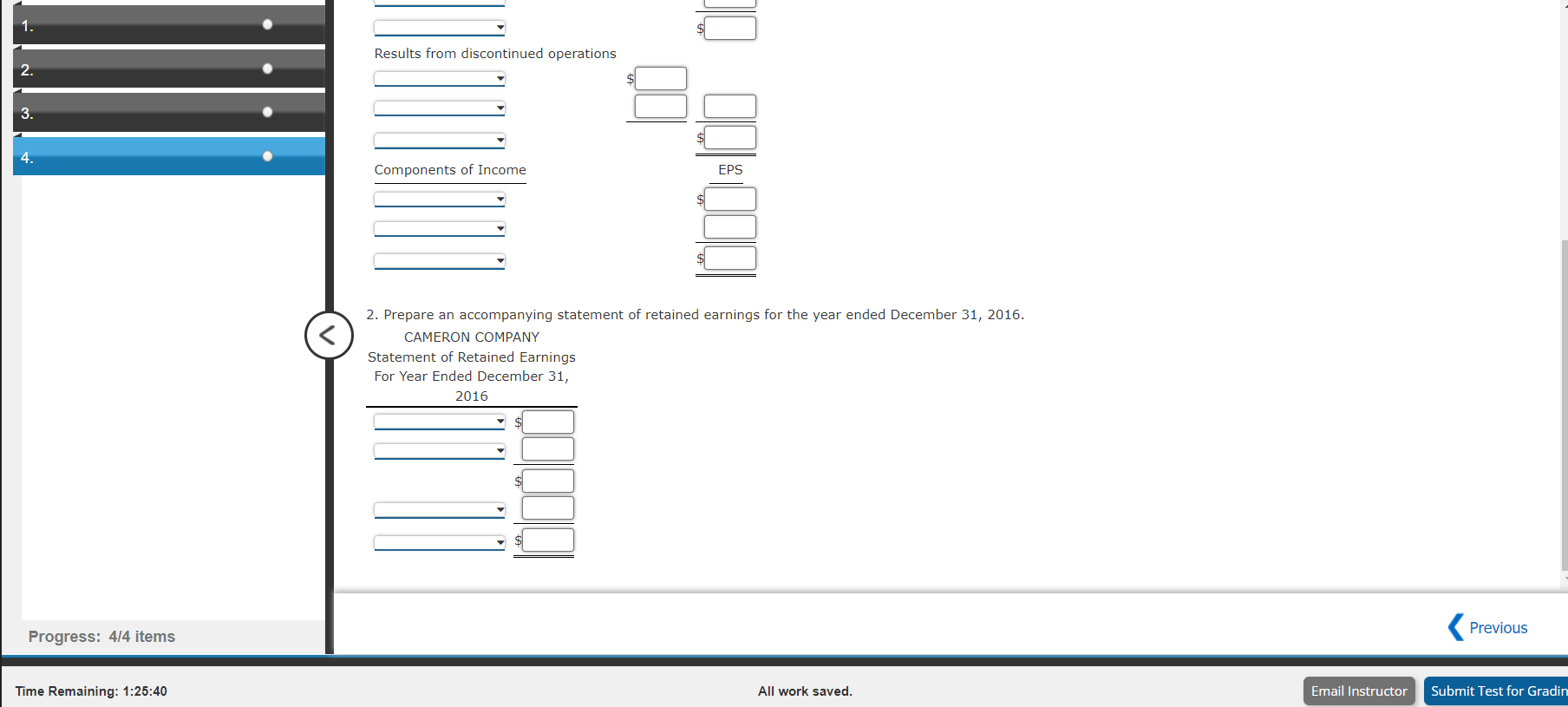

Question: PLEASE ANSWER ALL ...NEED IT ASAP Income Statement, Lower Portion During 2016 , the following events also occurred: that a pretax loss of $48,200 was

PLEASE ANSWER ALL ...NEED IT ASAP

PLEASE ANSWER ALL ...NEED IT ASAP

Income Statement, Lower Portion During 2016 , the following events also occurred: that a pretax loss of $48,200 was incurred on the sale of Division M. 2. Cameron had 14,000 shares of common stock outstanding during all of 2016 . It declared and paid a $3 per share cash dividend on the Required: Assuming that all the "pretax" items are subject to a 30% income tax rate: to two decimal places. Progress: 4/4 items Time Remaining: 1:25:54 All work saved. 2. Prepare an accompanying statement of retained earnings for the year ended December 31 , 2016. CAMERON COMPANY Statement of Retained Earnings For Year Ended December 31, Income Statement, Lower Portion During 2016 , the following events also occurred: that a pretax loss of $48,200 was incurred on the sale of Division M. 2. Cameron had 14,000 shares of common stock outstanding during all of 2016 . It declared and paid a $3 per share cash dividend on the Required: Assuming that all the "pretax" items are subject to a 30% income tax rate: to two decimal places. Progress: 4/4 items Time Remaining: 1:25:54 All work saved. 2. Prepare an accompanying statement of retained earnings for the year ended December 31 , 2016. CAMERON COMPANY Statement of Retained Earnings For Year Ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts