Question: please answer all or none 1 pts Question 12 Suppose a State of New York bond will pay $1,000 ten years from now. If the

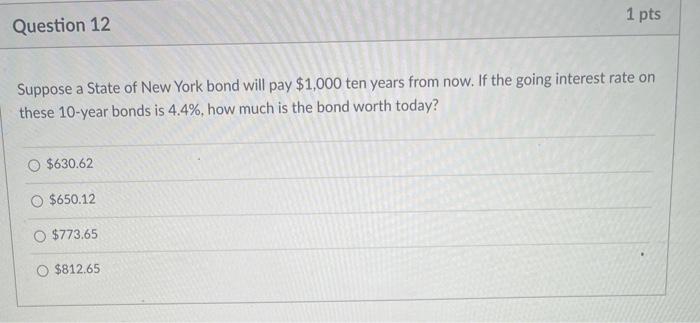

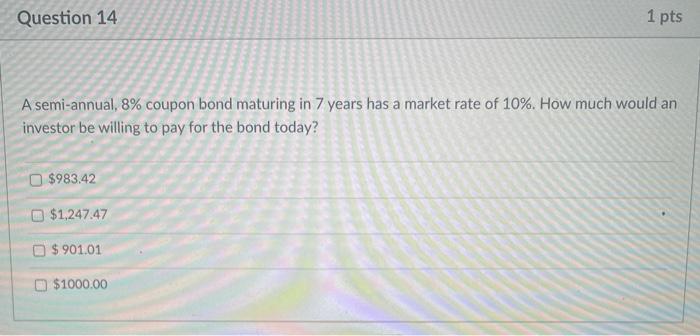

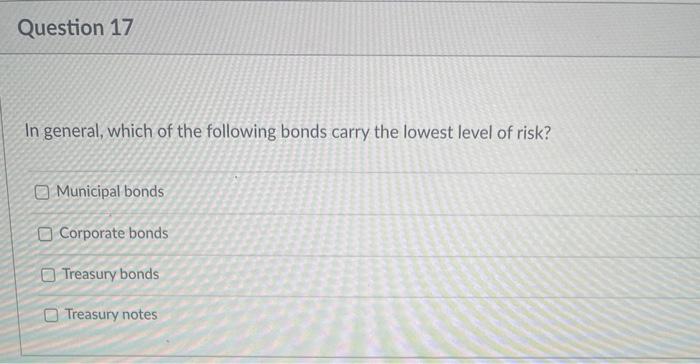

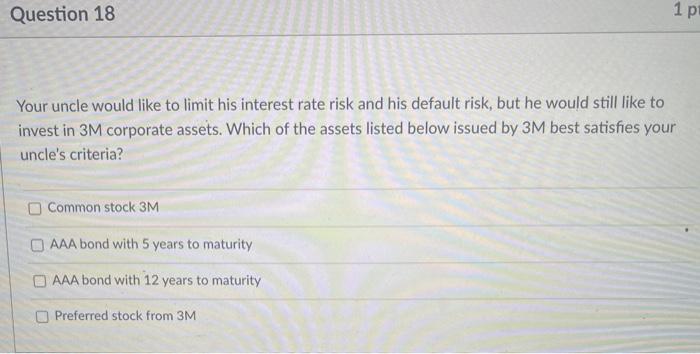

1 pts Question 12 Suppose a State of New York bond will pay $1,000 ten years from now. If the going interest rate on these 10-year bonds is 4.4%, how much is the bond worth today? $630.62 $650.12 $773.65 O $812.65 Question 14 1 pts A semi-annual, 8% coupon bond maturing in 7 years has a market rate of 10%. How much would an investor be willing to pay for the bond today? $983.42 $1,247.47 $901.01 $1000.00 Question 17 In general, which of the following bonds carry the lowest level of risk? Municipal bonds Corporate bonds Treasury bonds Treasury notes Question 18 1 p Your uncle would like to limit his interest rate risk and his default risk, but he would still like to invest in 3M corporate assets. Which of the assets listed below issued by 3M best satisfies your uncle's criteria? Common stock 3M AAA bond with 5 years to maturity AAA bond with 12 years to maturity Preferred stock from 3M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts