Question: please answer all or none Chapter 17 1. If a bank is falling short of meeting its capital requirements by $1 million, what three things

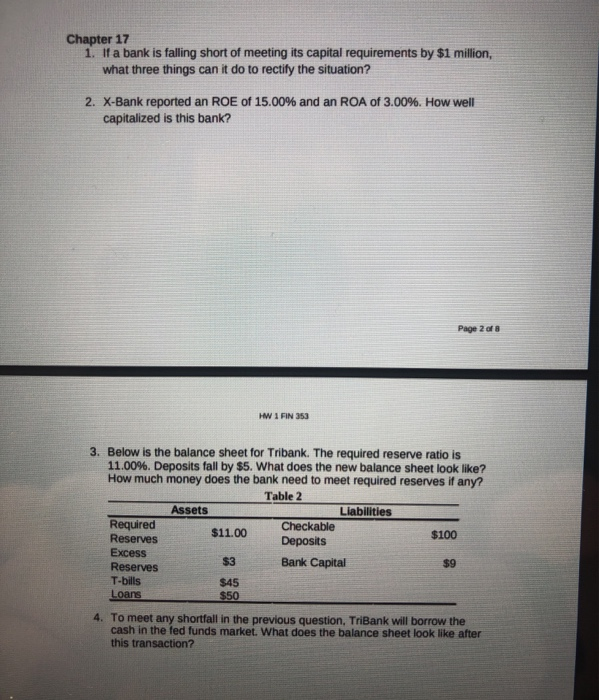

Chapter 17 1. If a bank is falling short of meeting its capital requirements by $1 million, what three things can it do to rectify the situation? 2. X-Bank reported an ROE of 15.00% and an ROA of 3.00%. How well capitalized is this bank? Page 2 of 8 HW 1 FIN 353 3. Below is the balance sheet for Tribank. The required reserve ratio is 11.00%. Deposits fall by $5. What does the new balance sheet look like? How much money does the bank need to meet required reserves if any? Table 2 Assets Liabilities Required Reserves Checkable $11.00 $100 Deposits Excess Bank Capital $3 $9 Reserves T-bills Loans $45 $50 4. To meet any shortfall in the previous question, TriBank will borrow the cash in the fed funds market. What does the balance sheet look like after this ansaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts