Question: please answer all or none Question 28 12 What does the Discounted Cash Flow (or Gordon) model suggest to be the most likely variable available

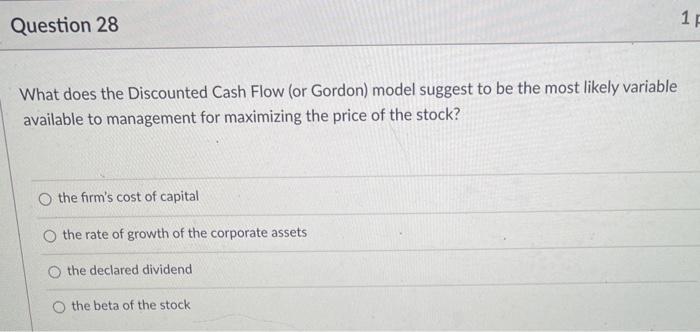

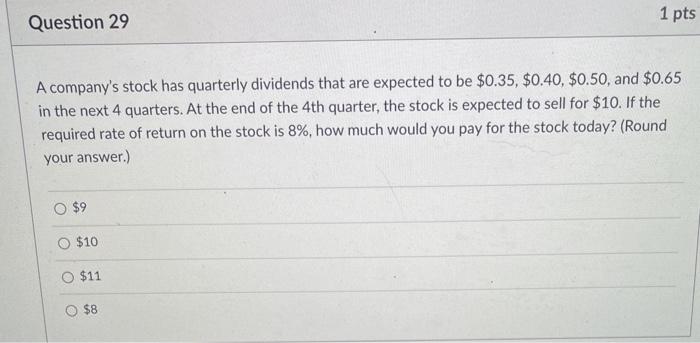

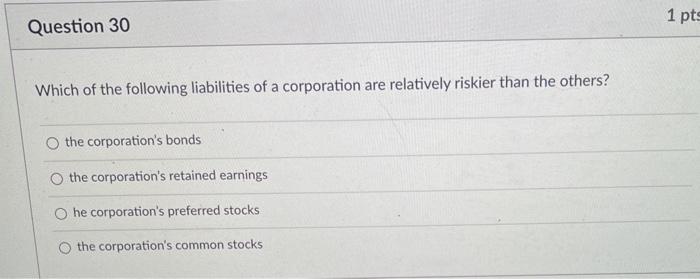

Question 28 12 What does the Discounted Cash Flow (or Gordon) model suggest to be the most likely variable available to management for maximizing the price of the stock? O the firm's cost of capital the rate of growth of the corporate assets the declared dividend O the beta of the stock Question 29 1 pts A company's stock has quarterly dividends that are expected to be $0.35, $0.40, $0.50 and $0.65 in the next 4 quarters. At the end of the 4th quarter, the stock is expected to sell for $10. If the required rate of return on the stock is 8%, how much would you pay for the stock today? (Round your answer.) $9 O $10 O $11 $8 1 pts Question 30 Which of the following liabilities of a corporation are relatively riskier than the others? O the corporation's bonds the corporation's retained earnings he corporation's preferred stocks the corporation's common stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts