Question: please answer all or none Question 43 Jamana Inc. has an ROA of 10% and an ROE of 15%. Its total asset turnover is 1.2x.

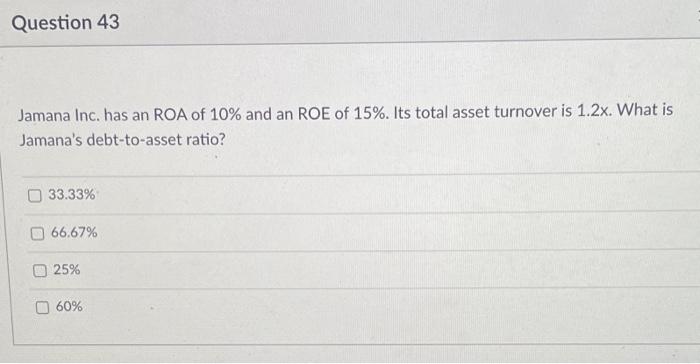

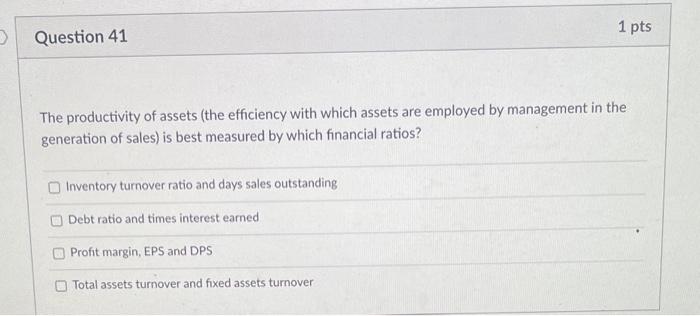

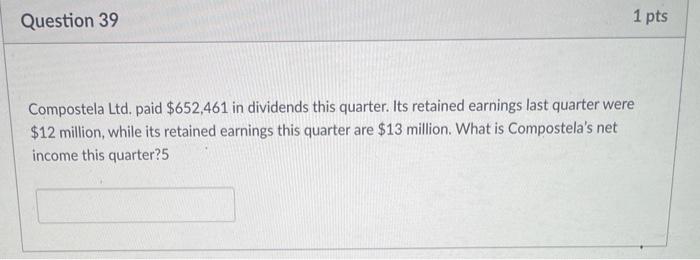

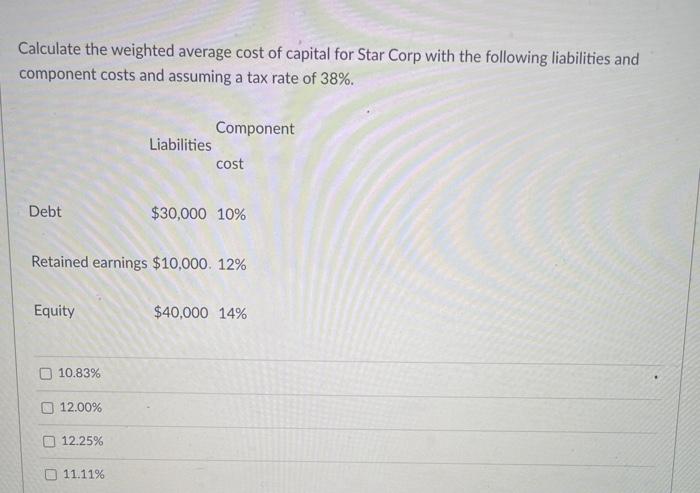

Question 43 Jamana Inc. has an ROA of 10% and an ROE of 15%. Its total asset turnover is 1.2x. What is Jamana's debt-to-asset ratio? 33.33% 66.67% 25% 60% 1 pts > Question 41 The productivity of assets (the efficiency with which assets are employed by management in the generation of sales) is best measured by which financial ratios? Inventory turnover ratio and days sales outstanding Debt ratio and times interest eamed Profit margin, EPS and DPS Total assets turnover and fixed assets turnover Question 39 1 pts Compostela Ltd. paid $652,461 in dividends this quarter. Its retained earnings last quarter were $12 million, while its retained earnings this quarter are $13 million. What is Compostela's net income this quarter?5 Calculate the weighted average cost of capital for Star Corp with the following liabilities and component costs and assuming a tax rate of 38%. Component Liabilities cost Debt $30,000 10% Retained earnings $10,000. 12% Equity $40,000 14% 10.83% 12.00% 12.25% O 11.11% Question 43 Jamana Inc. has an ROA of 10% and an ROE of 15%. Its total asset turnover is 1.2x. What is Jamana's debt-to-asset ratio? 33.33% 66.67% 25% 60% 1 pts > Question 41 The productivity of assets (the efficiency with which assets are employed by management in the generation of sales) is best measured by which financial ratios? Inventory turnover ratio and days sales outstanding Debt ratio and times interest eamed Profit margin, EPS and DPS Total assets turnover and fixed assets turnover Question 39 1 pts Compostela Ltd. paid $652,461 in dividends this quarter. Its retained earnings last quarter were $12 million, while its retained earnings this quarter are $13 million. What is Compostela's net income this quarter?5 Calculate the weighted average cost of capital for Star Corp with the following liabilities and component costs and assuming a tax rate of 38%. Component Liabilities cost Debt $30,000 10% Retained earnings $10,000. 12% Equity $40,000 14% 10.83% 12.00% 12.25% O 11.11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts