Question: PLEASE ANSWER ALL PARTS. 3. Consider the following simple linear regression model designed to examine the relationship between earnings and educational attainment: Wage: = 3

PLEASE ANSWER ALL PARTS.

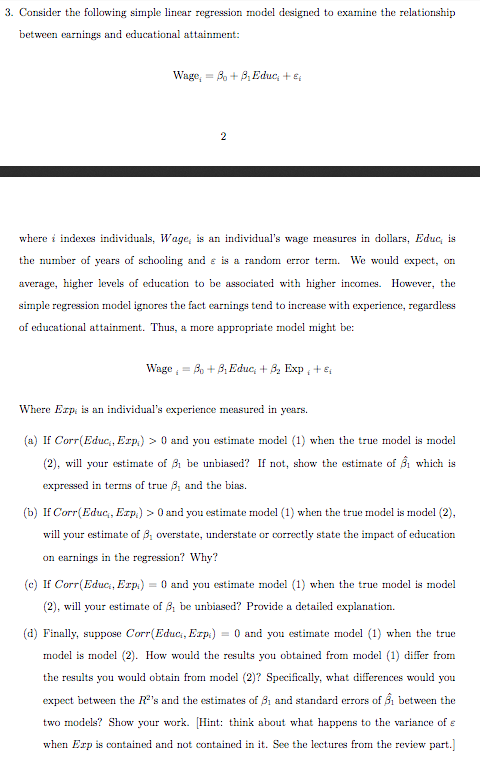

3. Consider the following simple linear regression model designed to examine the relationship between earnings and educational attainment: Wage: = 3 + 3. Educ: + 2 where i indexes individuals, Wage is an individual's wage measures in dollars, Educ is the number of years of schooling and e is a random error term. We would expect, on average, higher levels of education to be associated with higher incomes. However, the simple regression model ignore the fact earnings tend to increase with experience, regardless of educational attainment. Thus, a more appropriate model might be: Wage : = Be + B. Educ: +3. Exp+e Where Erp is an individual's experience measured in years. (a) If Corr(Educ, Exp.) > 0 and you estimate model (1) when the true model is model (2), will your estimate of Bi be unbiased? If not, show the estimate of Bi which is expressed in terms of true S, and the bias. (b) If Corr(Educ, Exp.) >0 and you estimate model (1) when the true model is model (2), will your estimate of B, overstate, understate or correctly state the impact of education on earnings in the regression? Why? (c) If Corr(Educ, Erp) = 0 and you estimate model (1) when the true model is model (2), will your estimate of B, be unbiased? Provide a detailed explanation. (a) Finally, suppose Corr(Educ, Erpi) = 0 and you estimate model (1) when the true model is model (2). How would the results you obtained from model (1) differ from the results you would obtain from model (2)? Specifically, what differences would you expect between the R''s and the estimates of 81 and standard errors of between the two models? Show your work. (Hint: think about what happens to the variance of e when Erp is contained and not contained in it. See the lectures from the review part.) 3. Consider the following simple linear regression model designed to examine the relationship between earnings and educational attainment: Wage: = 3 + 3. Educ: + 2 where i indexes individuals, Wage is an individual's wage measures in dollars, Educ is the number of years of schooling and e is a random error term. We would expect, on average, higher levels of education to be associated with higher incomes. However, the simple regression model ignore the fact earnings tend to increase with experience, regardless of educational attainment. Thus, a more appropriate model might be: Wage : = Be + B. Educ: +3. Exp+e Where Erp is an individual's experience measured in years. (a) If Corr(Educ, Exp.) > 0 and you estimate model (1) when the true model is model (2), will your estimate of Bi be unbiased? If not, show the estimate of Bi which is expressed in terms of true S, and the bias. (b) If Corr(Educ, Exp.) >0 and you estimate model (1) when the true model is model (2), will your estimate of B, overstate, understate or correctly state the impact of education on earnings in the regression? Why? (c) If Corr(Educ, Erp) = 0 and you estimate model (1) when the true model is model (2), will your estimate of B, be unbiased? Provide a detailed explanation. (a) Finally, suppose Corr(Educ, Erpi) = 0 and you estimate model (1) when the true model is model (2). How would the results you obtained from model (1) differ from the results you would obtain from model (2)? Specifically, what differences would you expect between the R''s and the estimates of 81 and standard errors of between the two models? Show your work. (Hint: think about what happens to the variance of e when Erp is contained and not contained in it. See the lectures from the review part.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts