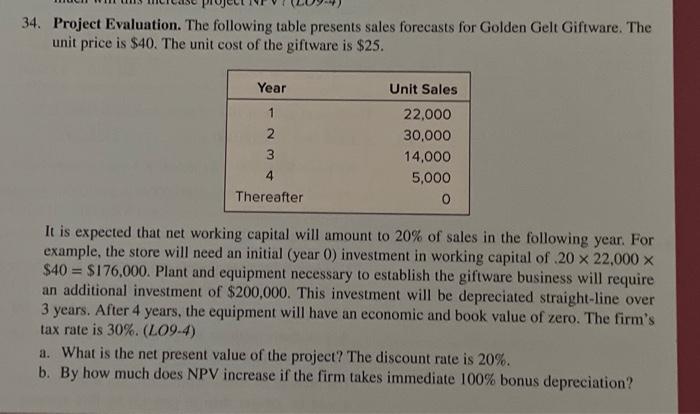

Question: Please answer all parts 34. Project Evaluation. The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The unit cost

34. Project Evaluation. The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The unit cost of the giftware is $25. Year Unit Sales 1 WN 22.000 30,000 14,000 5,000 0 4 Thereafter It is expected that net working capital will amount to 20% of sales in the following year. For example, the store will need an initial (year 0) investment in working capital of 20 x 22,000 X $40 = $176,000. Plant and equipment necessary to establish the giftware business will require an additional investment of $200,000. This investment will be depreciated straight-line over 3 years. After 4 years, the equipment will have an economic and book value of zero. The firm's tax rate is 30%. (L09-4) a. What is the net present value of the project? The discount rate is 20%. b. By how much does NPV increase if the firm takes immediate 100% bonus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts