Question: Please answer all parts A, B, and C. Please show all work! If you use Excel to solve this problem please make clear the calculations

Please answer all parts A, B, and C. Please show all work! If you use Excel to solve this problem please make clear the calculations you made.

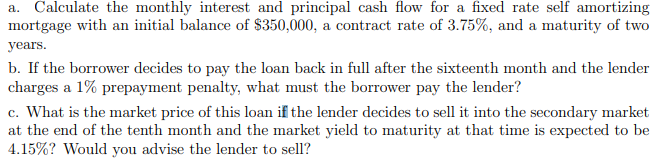

a. Calculate the monthly interest and principal cash flow for a fixed rate self amortizing mortgage with an initial balance of $350,000, a contract rate of 3.75%, and a maturity of two years. b. If the borrower decides to pay the loan back in full after the sixteenth month and the lender charges a 1% prepayment penalty, what must the borrower pay the lender? c. What is the market price of this loan if the lender decides to sell it into the secondary market at the end of the tenth month and the market yield to maturity at that time is expected to be 4.15%? Would you advise the lender to sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts