Question: Please answer all parts A, B, C, and D to question #1. If there are any questions please leave a comment. Thanks so much! A)

Please answer all parts A, B, C, and D to question #1. If there are any questions please leave a comment. Thanks so much!

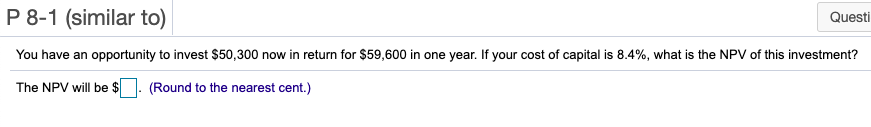

A)

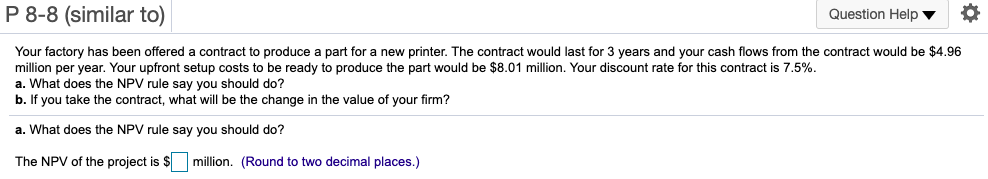

B)

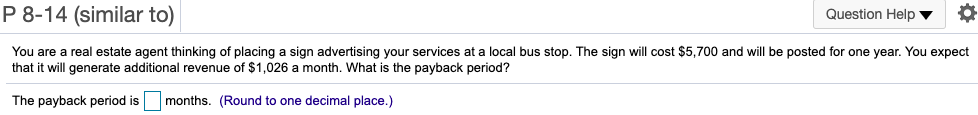

C)

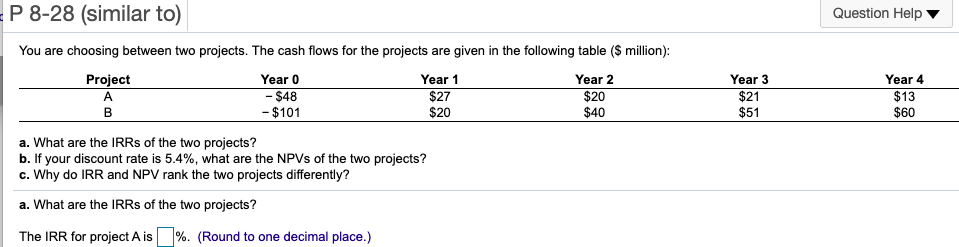

D)

P 8-1 (similar to) Questi You have an opportunity to invest $50,300 now in return for $59,600 in one year. If your cost of capital is 8.4%, what is the NPV of this investment? The NPV will be $ (Round to the nearest cent.) P 8-8 (similar to) Question Help Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.96 million per year. Your upfront setup costs to be ready to produce the part would be $8.01 million. Your discount rate for this contract is 7.5%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.) P 8-14 (similar to) Question Help o You are a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $5,700 and will be posted for one year. You expect that it will generate additional revenue of $1,026 a month. What is the payback period? The payback period is months. (Round to one decimal place.) P 8-28 (similar to) Question Help You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 A - $48 $27 $20 B - $101 $20 $40 Year 3 $21 $51 Year 4 $13 $60 a. What are the IRRs of the two projects? b. If your discount rate is 5.4%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project Ais %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts