Question: Please answer all parts. A,B, C, D, E. Thank you! Stock splits Personal Finance Problem Nathan Detroit owns 400 shares of the drink company Monster

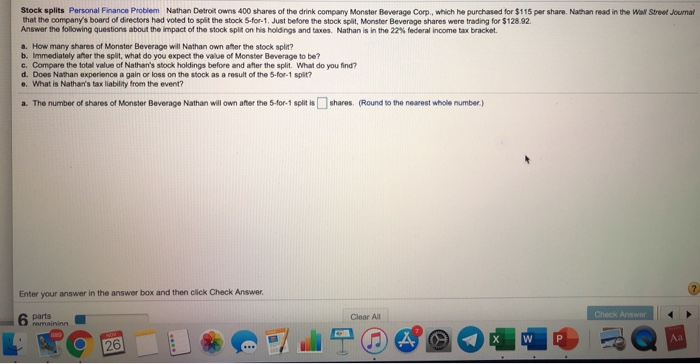

Stock splits Personal Finance Problem Nathan Detroit owns 400 shares of the drink company Monster Beverage Corp., which he purchased for $115 per share. Nathan read in the Wall Street Journal that the company's board of directors had voted to split the stock 5-for-1. Just before the stock scat, Monster Beverage shares were trading for $128.92. Answer the following questions about the impact of the stock split on his holdings and taxes. Nathan is in the 22% federal income tax bracket. a. How many shares of Monster Beverage will Nathan own after the stock split? b. Immediately after the split, what do you expect the value of Monster Beverage to be? C. Compare the total value of Nathan's stock holdings before and after the split. What do you find? d. Does Nathan experience again or loss on the stock as a result of the 5-for-1 split? e. What is Nathan's tax liability from the event? a. The number of shares of Monster Beverage Nathan will own after the 5-for-1 split is shares (Round to the nearest whole number) Enter your answer in the answer box and then click Check Answer. LCD 1*720*2011. EQN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts