Question: Please answer all parts A-C. Please also show all work and Excel functions/calculations used to get results. Thanks. 3. A developer wants to purchase a

Please answer all parts A-C. Please also show all work and Excel functions/calculations used to get results. Thanks.

Please answer all parts A-C. Please also show all work and Excel functions/calculations used to get results. Thanks.

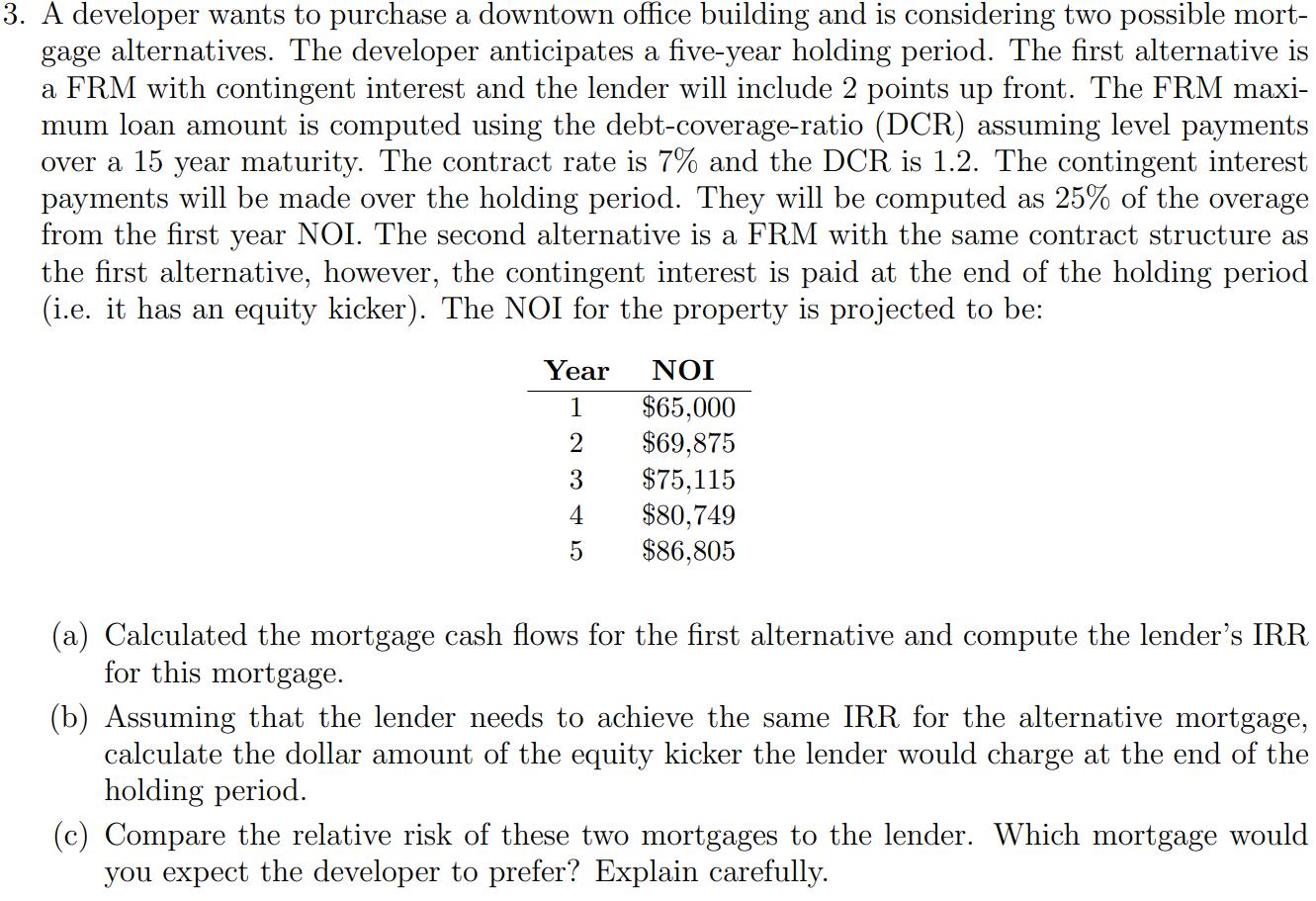

3. A developer wants to purchase a downtown office building and is considering two possible mort- gage alternatives. The developer anticipates a five-year holding period. The first alternative is a FRM with contingent interest and the lender will include 2 points up front. The FRM maxi- mum loan amount is computed using the debt-coverage-ratio (DCR) assuming level payments over a 15 year maturity. The contract rate is 7% and the DCR is 1.2. The contingent interest payments will be made over the holding period. They will be computed as 25% of the overage from the first year NOI. The second alternative is a FRM with the same contract structure as the first alternative, however, the contingent interest is paid at the end of the holding period (i.e. it has an equity kicker). The NOI for the property is projected to be: Year NOI $65,000 $69,875 3 $75,115 4 $80,749 $86,805 (a) Calculated the mortgage cash flows for the first alternative and compute the lender's IRR for this mortgage. (b) Assuming that the lender needs to achieve the same IRR for the alternative mortgage, calculate the dollar amount of the equity kicker the lender would charge at the end of the holding period. (c) Compare the relative risk of these two mortgages to the lender. Which mortgage would you expect the developer to prefer? Explain carefully. 3. A developer wants to purchase a downtown office building and is considering two possible mort- gage alternatives. The developer anticipates a five-year holding period. The first alternative is a FRM with contingent interest and the lender will include 2 points up front. The FRM maxi- mum loan amount is computed using the debt-coverage-ratio (DCR) assuming level payments over a 15 year maturity. The contract rate is 7% and the DCR is 1.2. The contingent interest payments will be made over the holding period. They will be computed as 25% of the overage from the first year NOI. The second alternative is a FRM with the same contract structure as the first alternative, however, the contingent interest is paid at the end of the holding period (i.e. it has an equity kicker). The NOI for the property is projected to be: Year NOI $65,000 $69,875 3 $75,115 4 $80,749 $86,805 (a) Calculated the mortgage cash flows for the first alternative and compute the lender's IRR for this mortgage. (b) Assuming that the lender needs to achieve the same IRR for the alternative mortgage, calculate the dollar amount of the equity kicker the lender would charge at the end of the holding period. (c) Compare the relative risk of these two mortgages to the lender. Which mortgage would you expect the developer to prefer? Explain carefully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts