Question: Please answer all parts and explain (preferably using excel) :) thank you!!! 17 768 62 954 90 Project #10 778 85 957 18 762-65 968

Please answer all parts and explain (preferably using excel) :) thank you!!!

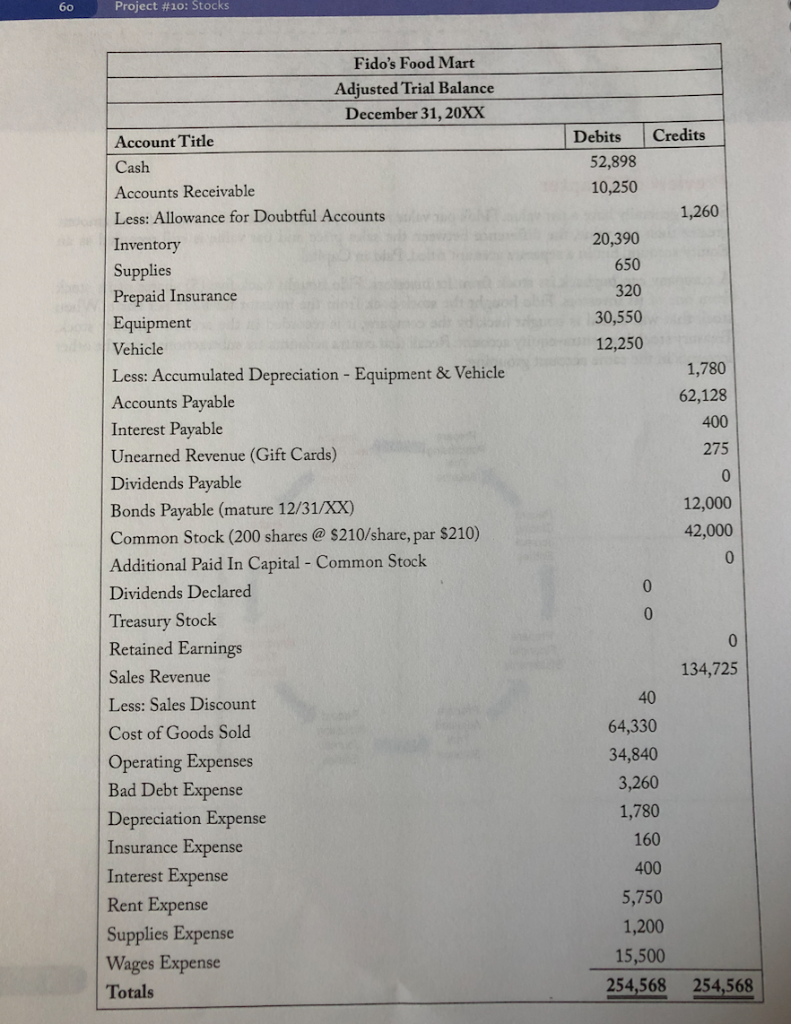

17 768 62 954 90 Project #10 778 85 957 18 762-65 968 75 Stocks 76 99 43 057 0 09 Preview of Chapter Stocks generally have a par value. Fido's par value is $210 per share. If stock is issued for an amount greater than par value, the difference between the sales price and par value is still recorded as an Equity account, but in a separate account titled, Paid in Capital. A company can buyback its stock from its investors. Fido bought back five (5) shares of its stock from one of its investors. Fido bought the stock back from the investor for $225 per share. When stock that was issued is bought back by the company, it is recorded in the account treasury stock Treasury stock is a contra-equity account. Recall that contra accounts are subtractions from the other accounts in the same account grouping. Analyze and Record Journal Entries Prepare Postclosing Trial Balance Record Closing Journal Entries Post to Ledger Accounts Prepare Unadjusted Trial Prepare Financial Statements Balance Prepare Adjusted Trial Balance Record Adjusting Journal Entries 1 Courtesy of Laura K. Bantz and Ann Esarco Project #10: $tocks 60 Fido's Food Mart Adjusted Trial Balance December 31,20XX Credits Debits Account Title 52,898 Cash 10,250 Accounts Receivab le 1,260 Less: Allowance for Doubtful Accounts 20,390 Inventory 650 Supplies Prepaid Insurance Equipment Vehicle 320 30,550 12,250 1,780 Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable Interest Payable 62,128 400 275 Unearned Revenue (Gift Cards) 0 Dividends Payable 12,000 Bonds Payable (mature 12/31/XX) 42,000 Common Stock (200 shares@ $210/share, par $210) 10 Additional Paid In Capital - Common Stock 10 Dividends Declared 0 Treasury Stock Retained Earnings 134,725 Sales Revenue 40 Less: Sales Discount 64,330 Cost of Goods Sold 34,840 Operating Expenses Bad Debt Expense 3,260 1,780 Depreciation Expense Insurance Expense Interest Expense Rent Expense Supplies Expense Wages Expense 160 400 5,750 1,200 15,500 254,568 254,568 Totals Project #10: Stocks 61 Business has been better than Fido's Food Mart even imagined! It is quickly realized that they need to raise additional capital to continue to grow. The accountant arranges for the following transactions to occur: Required: 1. Record the journal entry to account for a December 31, 20XX issuance of 20 shares at $225 per share, par $210 a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions & end balances. 2. Record the journal entry to declare a $2,200 dividend on December 31, 20XX to be paid March 15 of the following year. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions & end balances. on 3. Record the journal entry to repurchase 5 share of Treasury Stock@$225.00 per share on December 31, 20XX to liquidate a partner who adopted a cat and didn't want to be part of a pet store only selling dog food a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions & end balances. 4. Prepare Adjusted Trial Balance and highlight the accounts and amounts changed a new ade in stock023u arkets meat e trander orniey of a or se buye O dominic8 /Shutterstock.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts