Question: PLEASE ANSWER ALL PARTS AND FOLLOW THE SAME FORMAT Exercise 12-11 (Algo) Admission of new partner LO P3 The Struter Partnership has total partners' equity

PLEASE ANSWER ALL PARTS AND FOLLOW THE SAME FORMAT

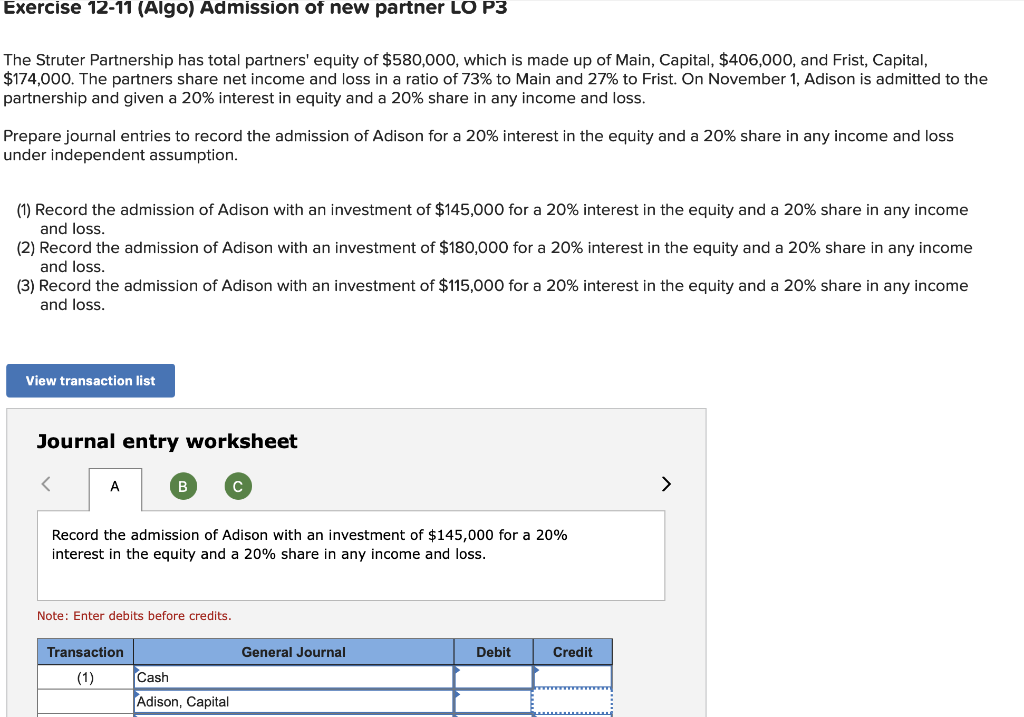

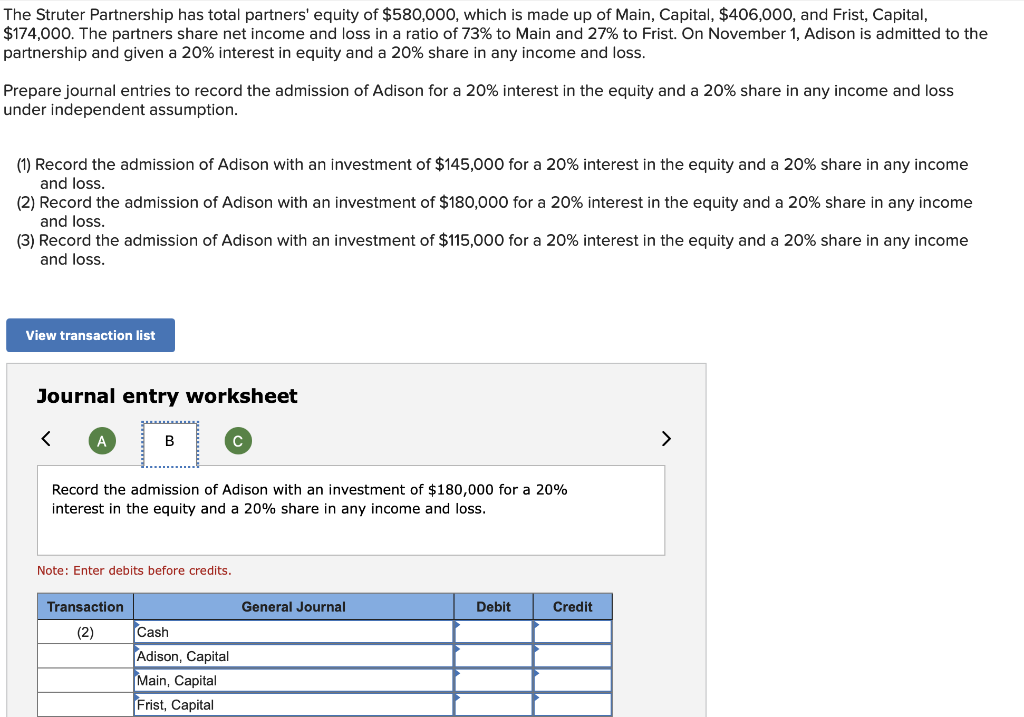

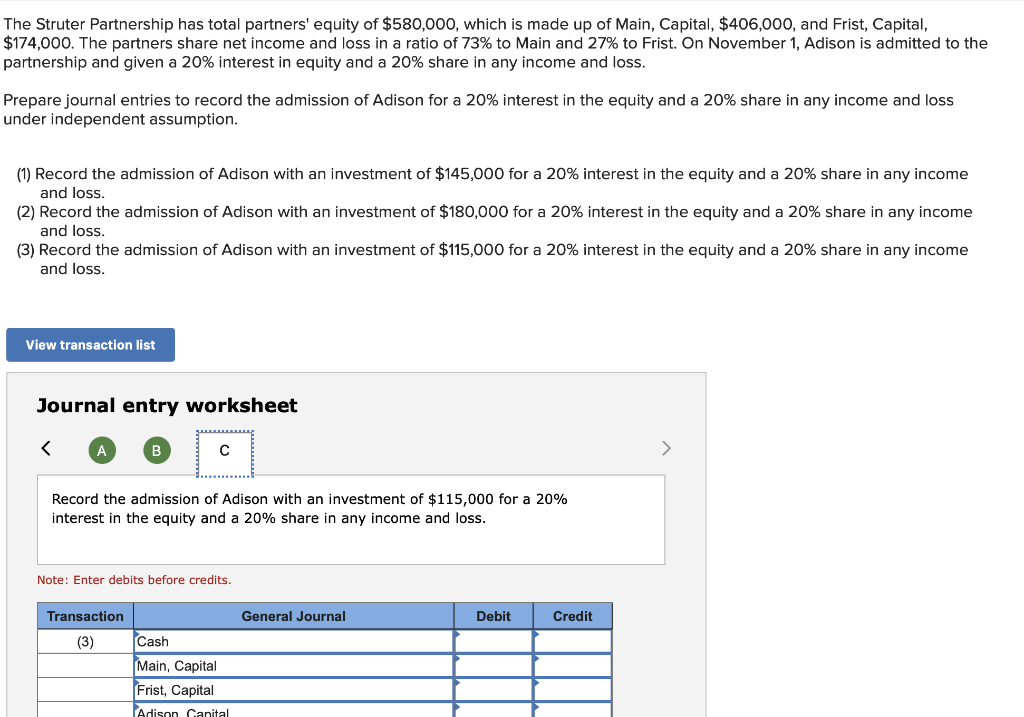

Exercise 12-11 (Algo) Admission of new partner LO P3 The Struter Partnership has total partners' equity of $580,000, which is made up of Main, Capital, $406,000, and Frist, Capital, $174,000. The partners share net income and loss in a ratio of 73% to Main and 27% to Frist. On November 1, Adison is admitted to the partnership and given a 20% interest in equity and a 20% share in any income and loss. Prepare journal entries to record the admission of Adison for a 20% interest in the equity and a 20% share in any income and loss under independent assumption. (1) Record the admission of Adison with an investment of $145,000 for a 20% interest in the equity and a 20% share in any income and loss. (2) Record the admission of Adison with an investment of $180,000 for a 20% interest in the equity and a 20% share in any income and loss. (3) Record the admission of Adison with an investment of $115,000 for a 20% interest in the equity and a 20% share in any income and loss. View transaction list Journal entry worksheet Record the admission of Adison with an investment of $145,000 for a 20% interest in the equity and a 20% share in any income and loss. Note: Enter debits before credits. General Journal Debit Credit Transaction (1) Cash Adison, Capital The Struter Partnership has total partners' equity of $580,000, which is made up of Main, Capital, $406,000, and Frist, Capital, $174,000. The partners share net income and loss in a ratio of 73% to Main and 27% to Frist. On November 1, Adison is admitted to the partnership and given a 20% interest in equity and a 20% share in any income and loss. Prepare journal entries to record the admission of Adison for a 20% interest in the equity and a 20% share in any income and loss under independent assumption. (1) Record the admission of Adison with an investment of $145,000 for a 20% interest in the equity and a 20% share in any income and loss. (2) Record the admission of Adison with an investment of $180,000 for a 20% interest in the equity and a 20% share in any income and loss. (3) Record the admission of Adison with an investment of $115,000 for a 20% interest in the equity and a 20% share in any income and loss. View transaction list Journal entry worksheet Record the admission of Adison with an investment of $180,000 for a 20% interest in the equity and a 20% share in any income and loss. Note: Enter debits before credits. Transaction General Journal Debit Credit (2) Cash Adison, Capital Main, Capital Frist, Capital The Struter Partnership has total partners' equity of $580,000, which is made up of Main, Capital, $406,000, and Frist, Capital, $174,000. The partners share net income and loss in a ratio of 73% to Main and 27% to Frist. On November 1, Adison is admitted to the partnership and given a 20% interest in equity and a 20% share in any income and loss. Prepare journal entries to record the admission of Adison for a 20% interest in the equity and a 20% share in any income and loss under independent assumption. (1) Record the admission of Adison with an investment of $145,000 for a 20% interest in the equity and a 20% share in any income and loss. (2) Record the admission of Adison with an investment of $180,000 for a 20% interest in the equity and a 20% share in any income and loss. (3) Record the admission of Adison with an investment of $115,000 for a 20% interest in the equity and a 20% share in any income and loss. View transaction list Journal entry worksheet B > Record the admission of Adison with an investment of $115,000 for a 20% interest in the equity and a 20% share in any income and loss. Note: Enter debits before credits. Transaction General Journal Debit Credit (3) Cash Main, Capital Frist, Capital Adison Ganital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts