Question: Please answer all parts and please don't answer in excel format. Thanks! Simple bank's balance sheet is as below (in millions of dollars). Assets Liabilities

Please answer all parts and please don't answer in excel format. Thanks!

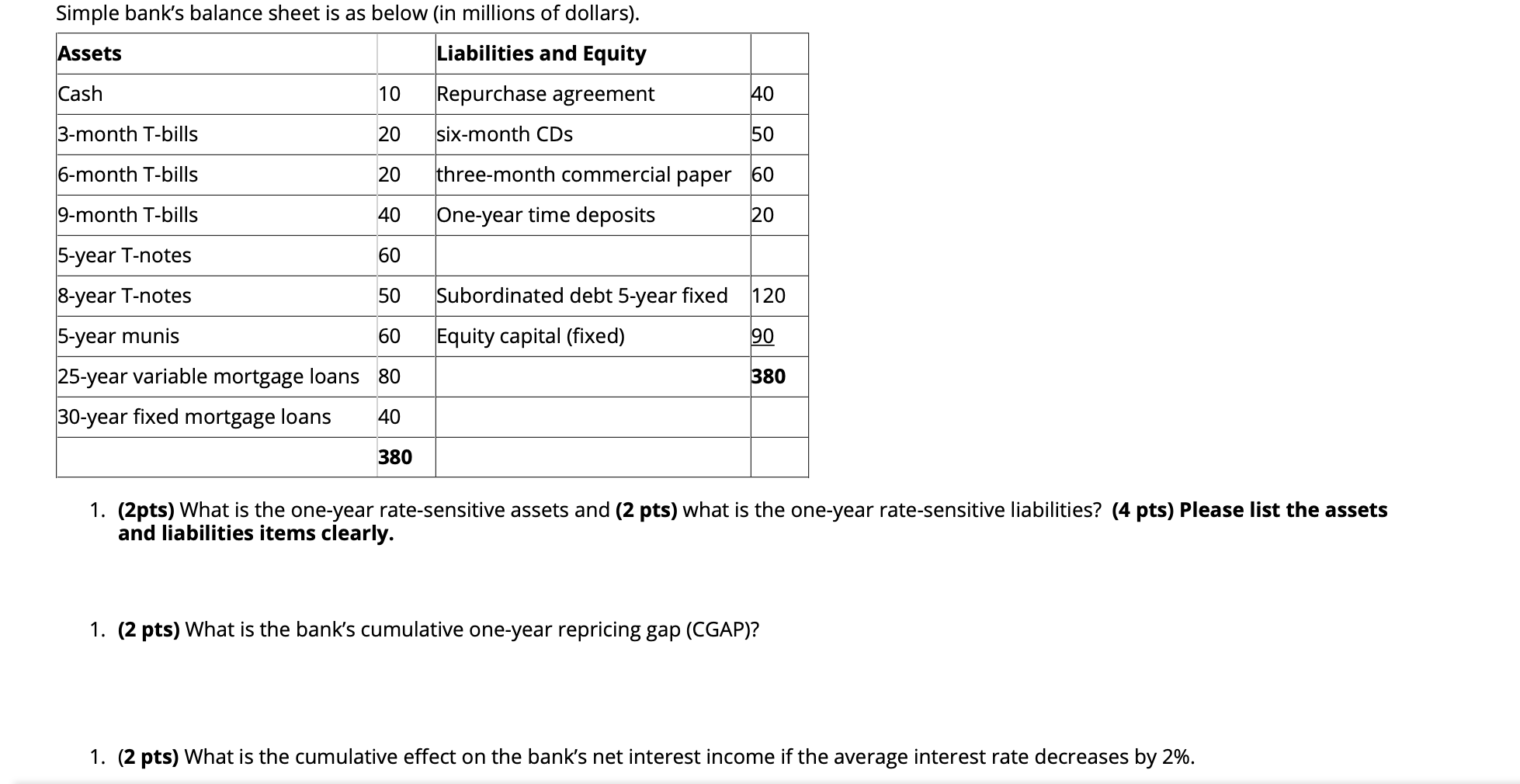

Simple bank's balance sheet is as below (in millions of dollars). Assets Liabilities and Equity Cash 10 Repurchase agreement 40 3-month T-bills 20 six-month CDs 50 6-month T-bills 20 three-month commercial paper 60 9-month T-bills 40 One-year time deposits 20 5-year T-notes 60 50 8-year T-notes 5-year munis Subordinated debt 5-year fixed 120 Equity capital (fixed) 90 60 380 25-year variable mortgage loans 80 30-year fixed mortgage loans 40 380 1. (2pts) What is the one-year rate-sensitive assets and (2 pts) what is the one-year rate-sensitive liabilities? (4 pts) Please list the assets and liabilities items clearly. 1. (2 pts) What is the bank's cumulative one-year repricing gap (CGAP)? 1. (2 pts) What is the cumulative effect on the bank's net interest income if the average interest rate decreases by 2%. Simple bank's balance sheet is as below (in millions of dollars). Assets Liabilities and Equity Cash 10 Repurchase agreement 40 3-month T-bills 20 six-month CDs 50 6-month T-bills 20 three-month commercial paper 60 9-month T-bills 40 One-year time deposits 20 5-year T-notes 60 50 8-year T-notes 5-year munis Subordinated debt 5-year fixed 120 Equity capital (fixed) 90 60 380 25-year variable mortgage loans 80 30-year fixed mortgage loans 40 380 1. (2pts) What is the one-year rate-sensitive assets and (2 pts) what is the one-year rate-sensitive liabilities? (4 pts) Please list the assets and liabilities items clearly. 1. (2 pts) What is the bank's cumulative one-year repricing gap (CGAP)? 1. (2 pts) What is the cumulative effect on the bank's net interest income if the average interest rate decreases by 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts