Question: PLEASE ANSWER ALL PARTS AND SHOW ANSWER CLEARLY Consider the following two scenarios for the economy and the expected returns in each scenario for the

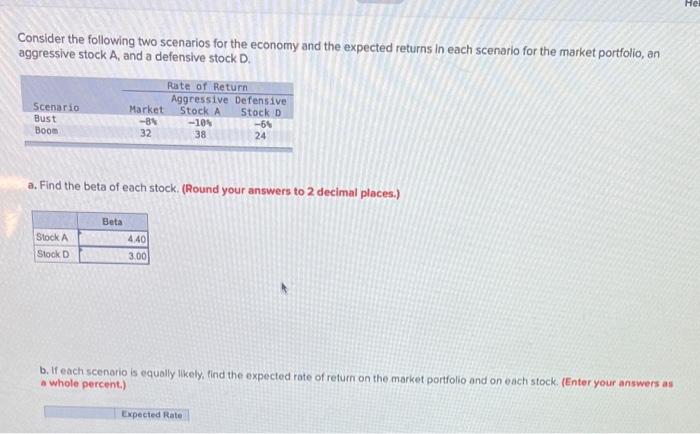

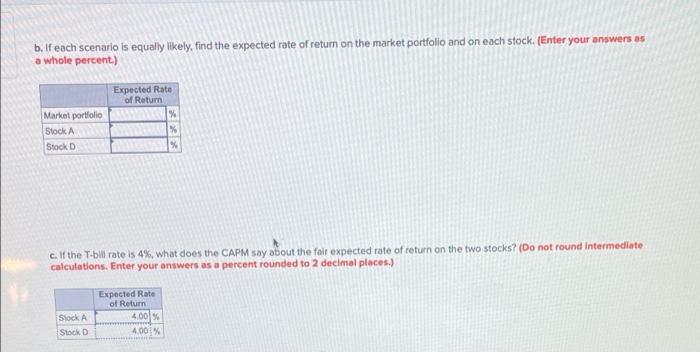

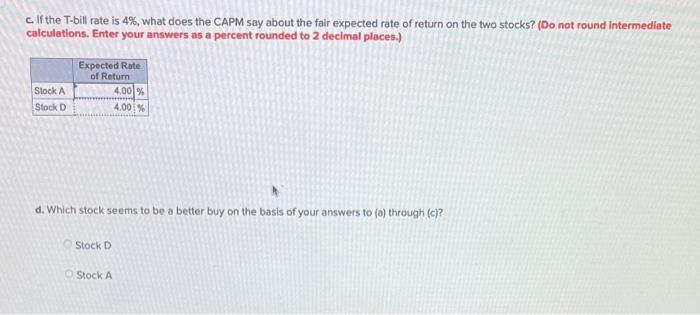

Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Aggressive Defensive Scenario Market Stock A Stock D Bust -88 -109 -64 Boom 32 38 24 a. Find the beta of each stock. (Round your answers to 2 decimal places.) Beta 440 Stock A Stock 3.00 b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. (Enter your answers as a whole percent.) Expected Rate b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. (Enter your answers as a whole percent) Expected Rate of Return % Market portfolio Stock Stock c. If the T-bill rate is 4%, what does the CAPM say about the fair expected rate of return on the two stocks? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Stock A Stock Expected Rate of Return 4.00% 4.001% c. If the T-bill rate is 4%, what does the CAPM say about the fair expected rate of return on the two stocks? (Do not round Intermediate calculations, Enter your answers as a percent rounded to 2 decimal places.) Slock A Stock D Expected Rate of Return 4.001% 4.00% d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Stock D Stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts