Question: Please answer all parts correctly and clearly! Labeling each part how you see it! Please double check all work! Will thumbs up if ALL parts

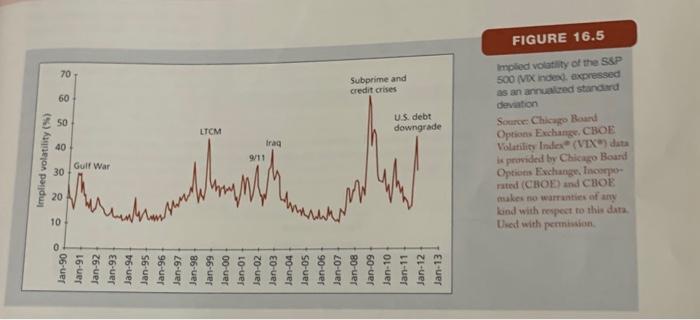

6. Reconsider the determination of the hedge ratio in the two-state model (Section 16.2), where we showed that one-third share of stock would hedge one option. What would be the hedge ratio for each of the following exercise prices: $120,$110,$100,$90 ? What do you conclude about the hedge ratio as the option becomes progressively more in the money? (LO 16-5) FIGURE 16.5 Implied volatilly of the SSP 500 (VoX noed expressed as an annualred standerd devation Source: Chicapo Round Options Exchangs, CBOE Wolatifitic Indes " (VIX") dats is provided by Chicago Bourd Options Exchunges hoopporated (CBOE) and CBOE asukes no warranties of awy knd with respect to this datz. Died with perminsion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts