Question: Please answer all parts correctly (as best as possible). Required: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $13.20, and each clock

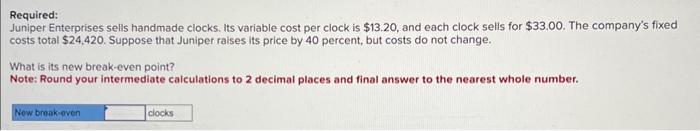

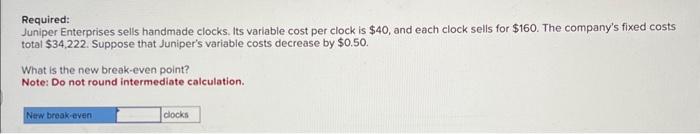

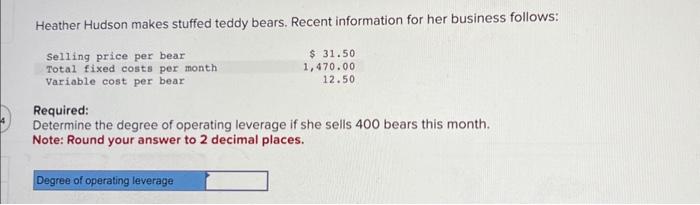

Required: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $13.20, and each clock selis for $33.00. The company's fixed costs total $24,420. Suppose that Juniper raises its price by 40 percent, but costs do not change. What is its new break-oven point? Note: Round your intermediate calculations to 2 decimal places and final answer to the nearest whole number. Required: Juniper Enterprises sells handmade clocks. Its variable cost per clock is $40, and each clock sells for $160. The company's fixed costs total $34,222. Suppose that Juniper's variable costs decrease by $0.50. What is the new break-even point? Note: Do not round intermediate calculation. Heather Hudson makes stuffed teddy bears. Recent information for her business follows: Required: Determine the degree of operating leverage if she sells 400 bears this month. Note: Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts