Question: please answer all parts Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its

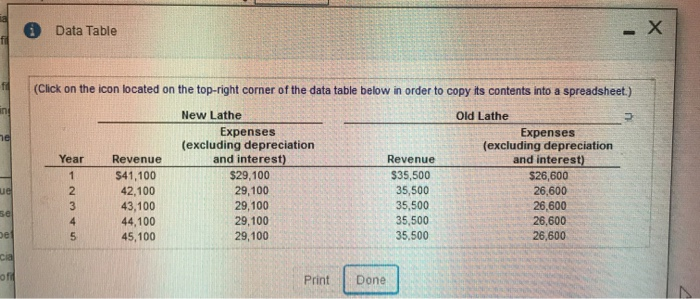

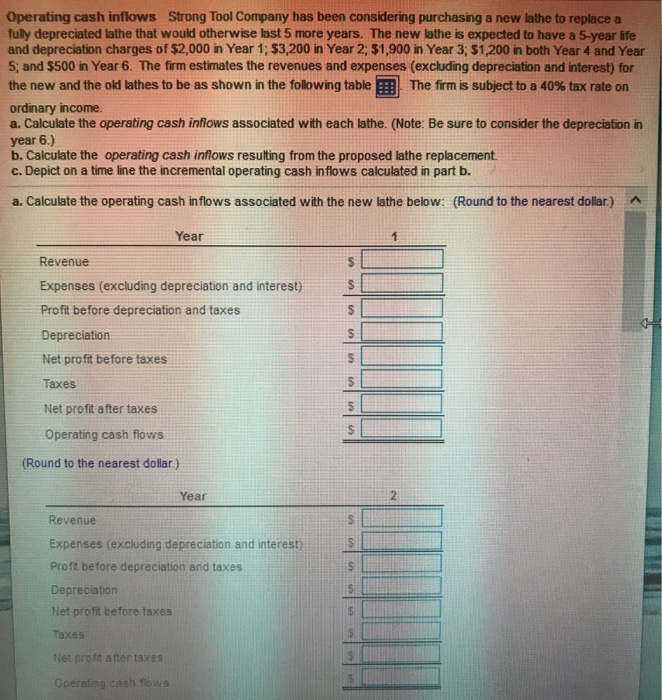

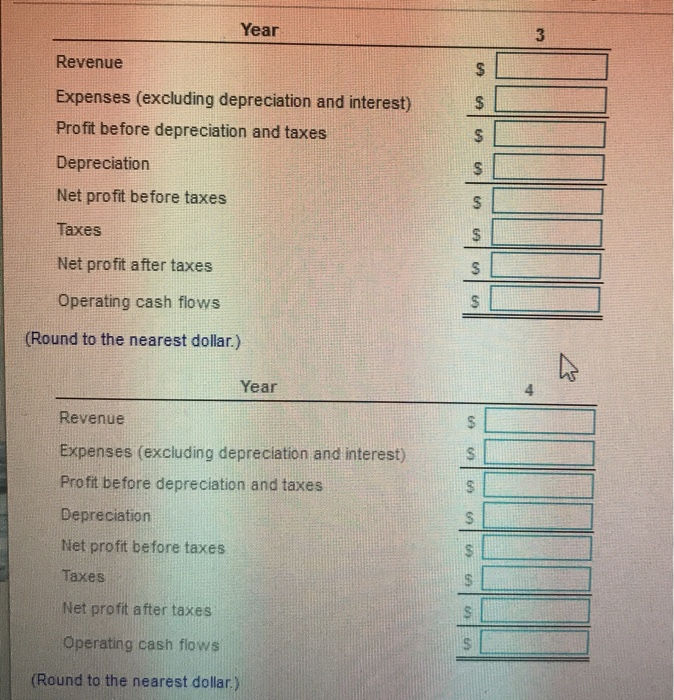

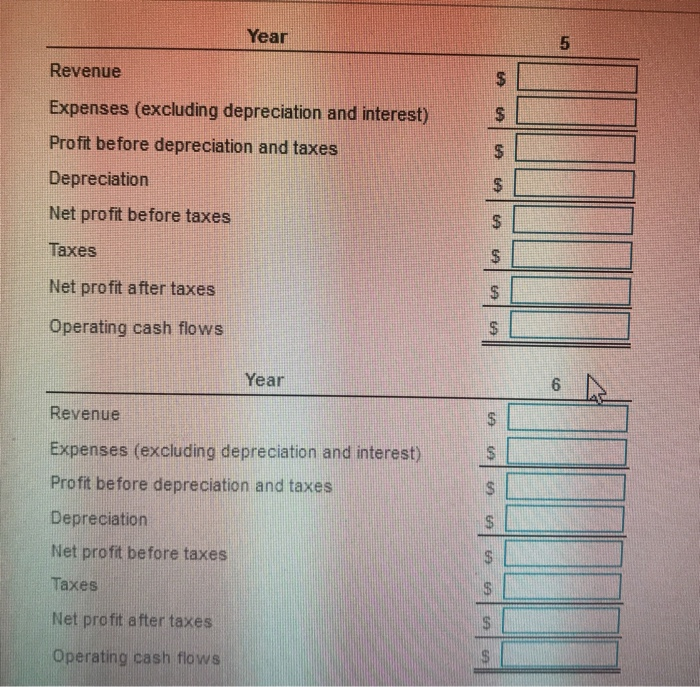

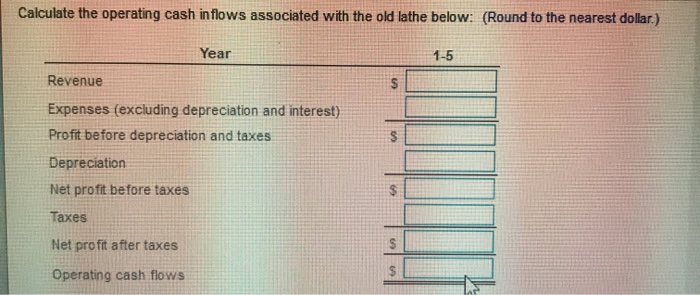

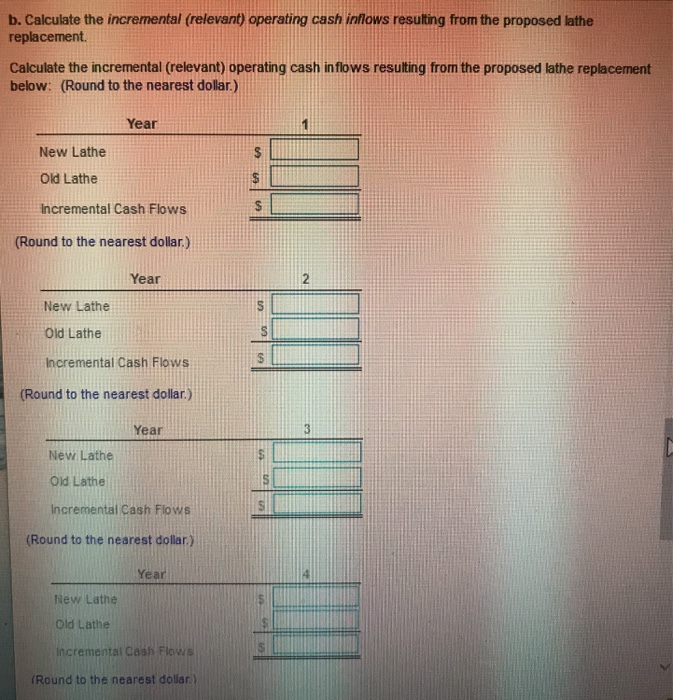

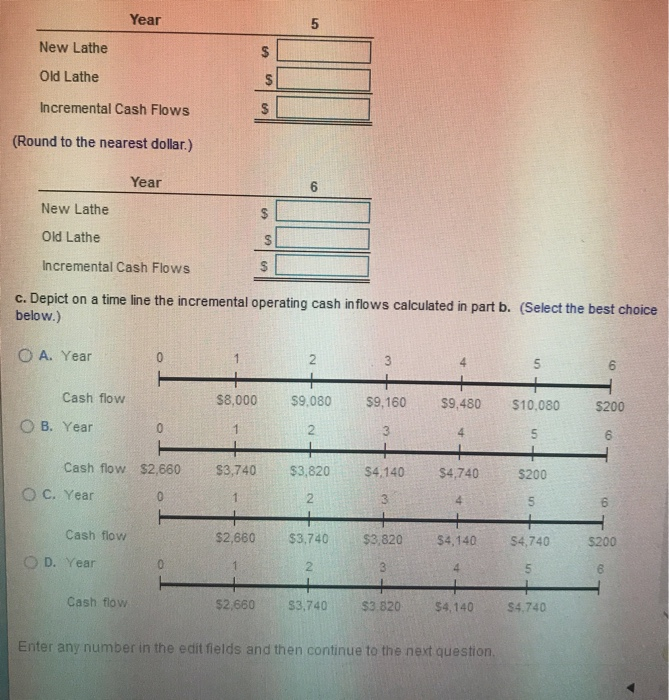

Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) New Lathe Old Lathe Expenses Expenses (excluding depreciation (excluding depreciation Year Revenue and interest) Revenue and interest) $41,100 $29,100 $35,500 $26,600 42,100 29,100 35,500 26,600 43,100 29,100 35,500 26,600 44,100 29,100 35,500 26,600 45,100 29,100 35,500 26,600 Print Done | Year Revenue Expenses (excluding depreciation and interest) Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash flows (Round to the nearest dollar.) Year Revenue Expenses (excluding depreciation and interest) Profit before depreciation and taxes Depreciation Net profit before taxes 69 9969 Taxes Net profit after taxes Operating cash flows (Round to the nearest dollar) Year Revenue Expenses (excluding depreciation and interest) Profit before depreciation and taxes Depreciation Net profit before taxes Taxes | Net profit after taxes | Operating cash flows Year Revenue Expenses (excluding depreciation and interest) Profit before depreciation and taxes Depreciation Net profit before taxes Taxes Net profit after taxes Operating cash flows b. Calculate the incremental (relevant) operating cash inflows resulting from the proposed lathe replacement Calculate the incremental (relevant) operating cash in flows resulting from the proposed lathe replacement below: (Round to the nearest dollar.) Year New Lathe Old Lathe Incremental Cash Flows (Round to the nearest dollar.) Year New Lathe Old Lathe Incremental Cash Flows (Round to the nearest dollar.) Year New Lathe Old Lathe Incremental Cash Flows (Round to the nearest dollar.) New Lathe Old Lathe Incremental Cash Flows (Round to the nearest dollar) Year New Lathe Old Lathe Incremental Cash Flows 165 (Round to the nearest dollar.) Year New Lathe Old Lathe Incremental Cash Flows c. Depict on a time line the incremental operating cash in flows calculated in part b. (Select the best choice below.) O A. Year $8,000 $9.080 $9,160 59,480 $10,080 $200 Cash flow O B. Year $2,660 $3,740 $3,820 94.140 Cash flow O c. Year $4,740 $200 0 $2,660 $3,740 $3,820 $4,140 54,740 Cash flow OD. Year $200 5 Cash flow $2,660 $3,740 $3.820 $4.140 $4,740 Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts