Question: Please answer all parts for positive feedback :) Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,100 of raw

Please answer all parts for positive feedback :)

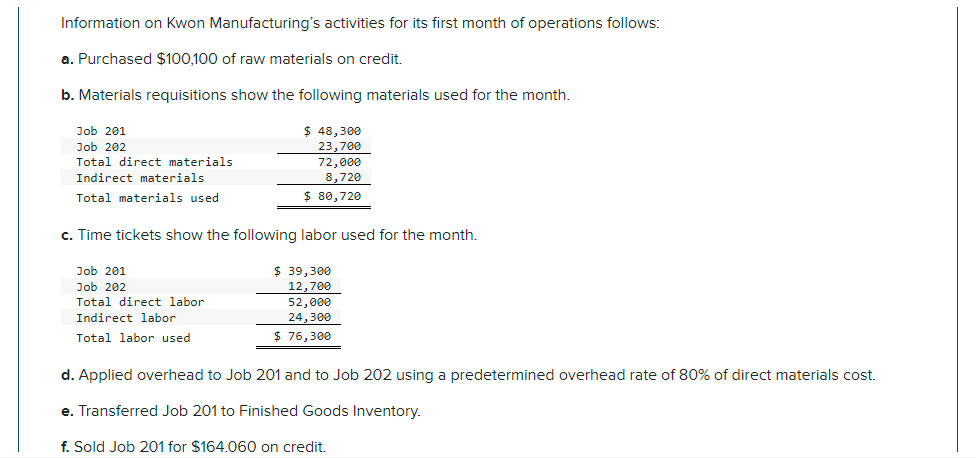

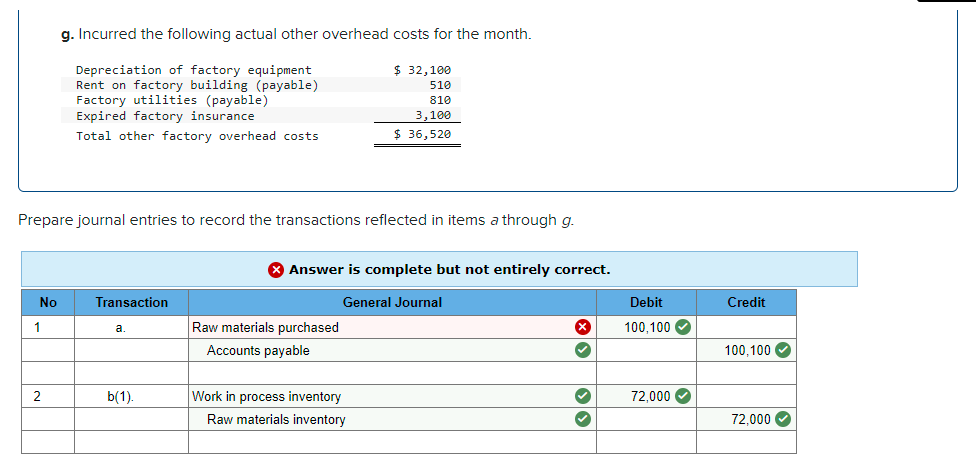

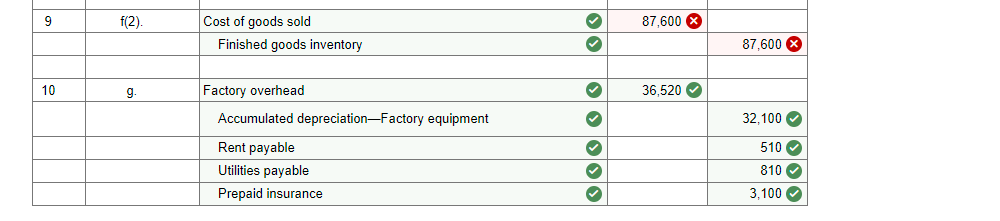

Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,100 of raw materials on credit. b. Materials requisitions show the following materials used for the month. Job 201 Job 202 Total direct materials Indirect materials Total materials used $ 48,300 23,700 72,000 8,720 $ 80,720 c. Time tickets show the following labor used for the month. Job 201 Job 202 Total direct labor Indirect labor Total labor used $ 39,300 12,700 52,000 24,300 $ 76,300 d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. Sold Job 201 for $164.060 on credit. g. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment Rent on factory building (payable) Factory utilities (payable) Expired factory insurance Total other factory overhead costs $ 32,100 510 810 3,100 $ 36,520 Prepare journal entries to record the transactions reflected in items a through g. Answer is complete but not entirely correct. No Transaction Debit Credit 1 a. General Journal Raw materials purchased Accounts payable X 100,100 100,100 2 b(1) 72,000 Work in process inventory Raw materials inventory olol 72,000 3 b(2) 8,720 Factory overhead Raw materials inventory 8,720 4 c(1). 52,000 Work in process inventory Direct labor used X 52,000 5 c(2). 24,300 Factory overhead Direct labor used X 24.300 6 d. 57,600 Work in process inventory Factory overhead 57,600 7 e 87,600 X Finished goods inventory Work in process inventory OO OOOO 87,600 X 8 f(1). 164,060 Accounts receivable Sales 164,060 9 f(2) 87,600 Cost of goods sold Finished goods inventory 87,600 X 10 g 36,520 32,100 Factory overhead Accumulated depreciationFactory equipment Rent payable Utilities payable Prepaid insurance OOOOO 510 810 3,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts