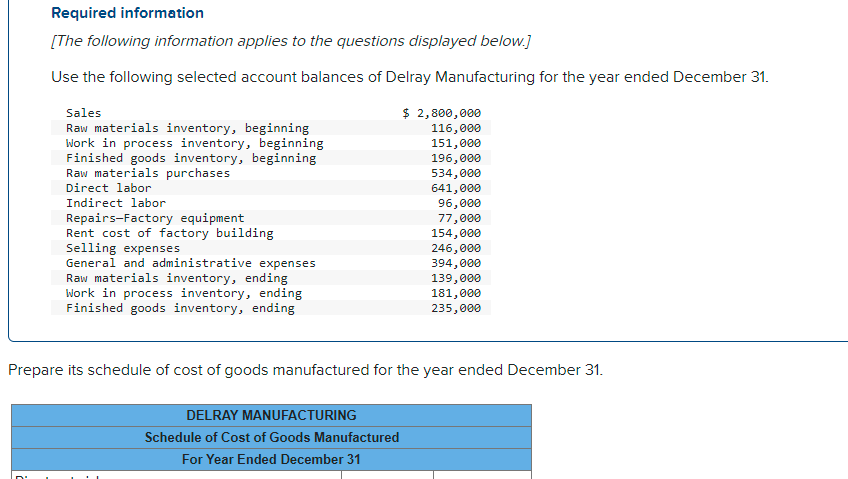

Question: Please answer all parts for positive feedback :) Required information [The following information applies to the questions displayed below.] Use the following selected account balances

![following information applies to the questions displayed below.] Use the following selected](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79f492fd1f_20066f79f48d75a8.jpg)

Please answer all parts for positive feedback :)

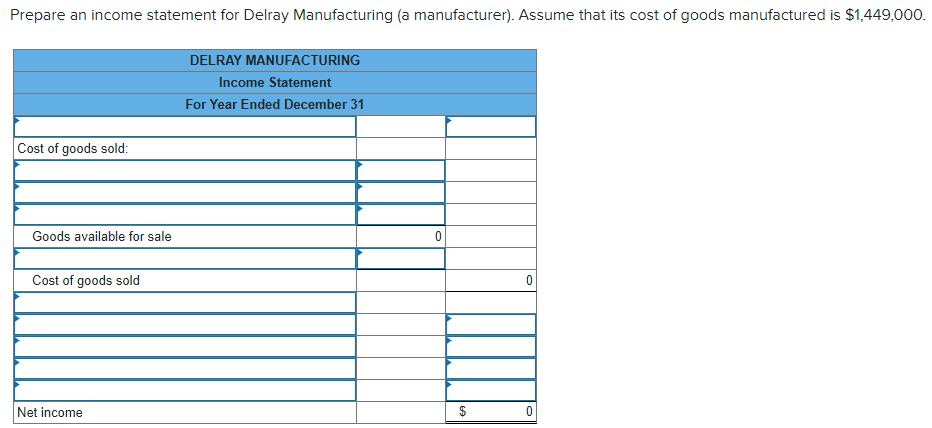

Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 2,800,000 116,000 151,000 196,000 534,000 641,000 96,000 77,000 154,000 246,000 394,000 139,000 181,000 235,000 Prepare its schedule of cost of goods manufactured for the year ended December 31. DELRAY MANUFACTURING Schedule of Cost of Goods Manufac For Year Ended December 31 red Direct materials: Raw materials available for use $ 0 Direct materials used $ 0 Factory overhead: $ 0 Total factory overhead Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured $ 0 Prepare an income statement for Delray Manufacturing (a manufacturer). Assume that its cost of goods manufactured is $1,449,000. DELRAY MANUFACTURING Income Statement For Year Ended December 31 Cost of goods sold: Goods available for sale 0 Cost of goods sold 0 Net income $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts