Question: PLEASE ANSWER ALL PARTS I WILL RATE HIGH!!! also look at the pictures of the questions please!! 1. Whirly Corporation's contribution format income statement for

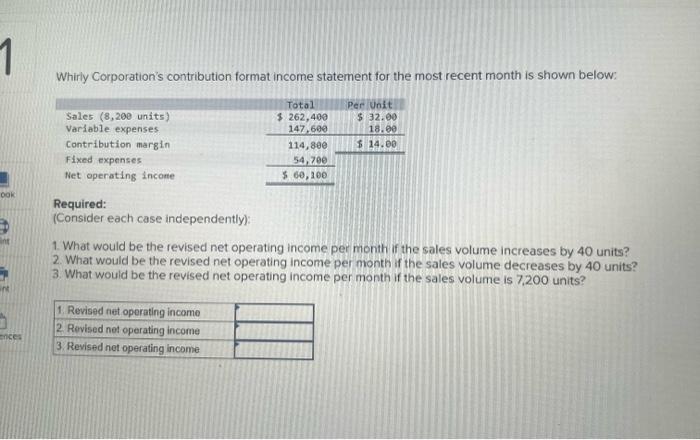

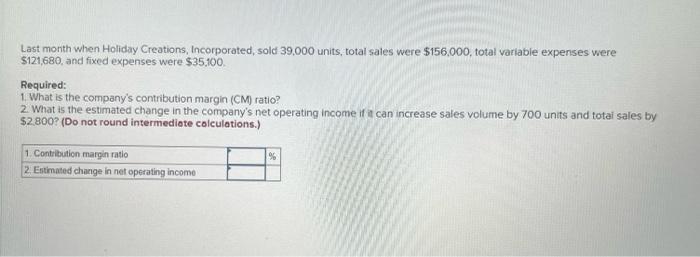

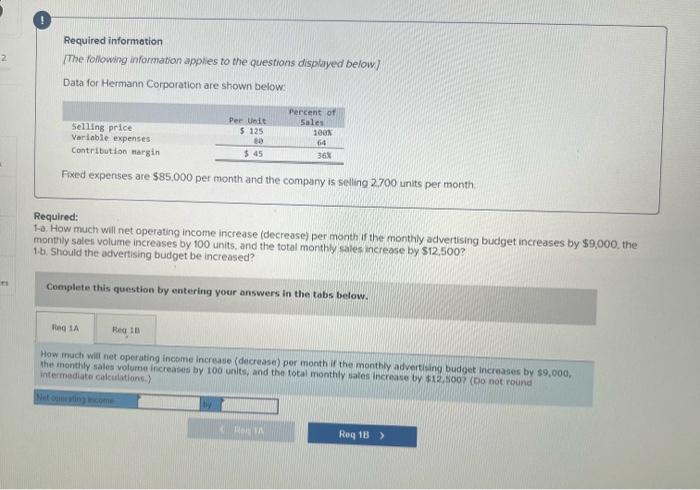

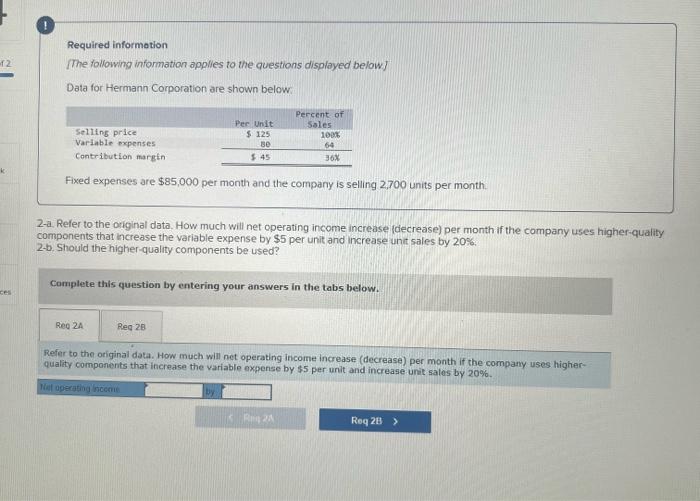

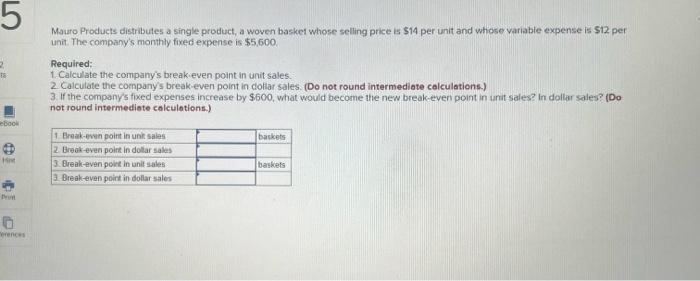

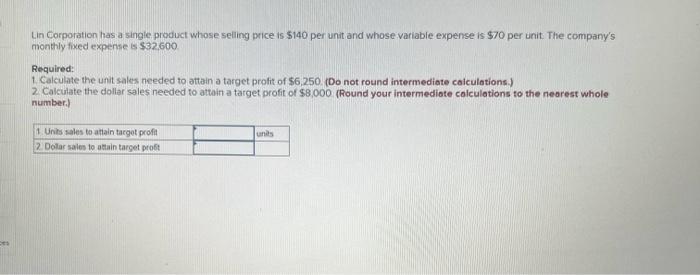

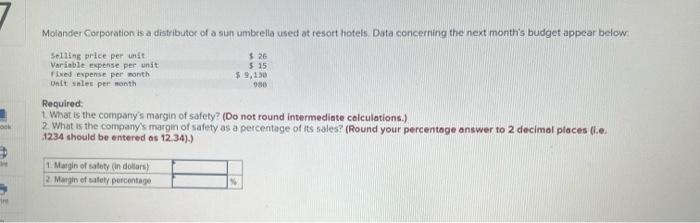

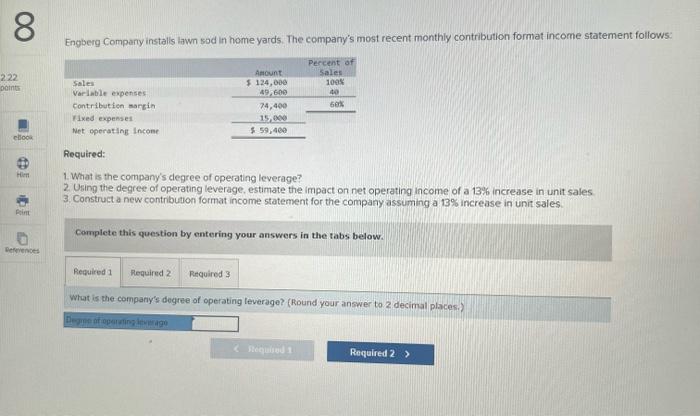

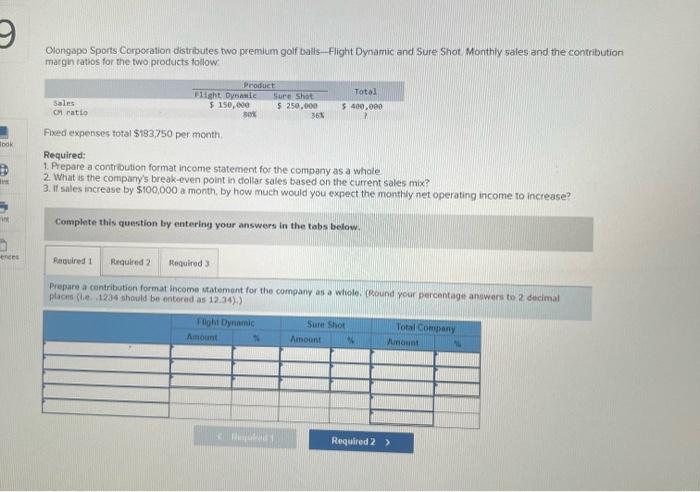

Whirly Corporation's contribution format income statement for the most recent month is shown below: Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 40 units? 2. What would be the revised net operating income per month if the sales volume decreases by 40 units? 3. What would be the revised net operating income per month if the sales volume is 7,200 units? Last month when Holiday Creations, Incorporated, sold 39,000 units, total sales were $156,000, total variable expenses were $121,680, and fixed expenses were $35.100. Required: 1. What is the company's contribution margin (CM) ratio? 2. What is the estimated change in the company's net operating income if it can increase saies volume by 700 units and totai sales by $2800? (Do not round intermediote colculations.) Required information The following information applies to the questrons displayed below] Data for Hermann Corporation are shown below: Fxed expenses are $85,000 per month and the company is selling 2700 units per month. Required: -a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000, the nonthly sales volume increases by 100 units, and the total monthly cales increase by $12,500 ? b. Should the advertising budget be increased? Complete this question by entering your answers in the tabs below. How much wal net operating income increase (decrease) per month if the monthly advertisina budget increases by $9,000, the monthly sales volume increases by 100 units, and the total monthly tates increase by $12 is 5007 (b0 not round intermediate cilculatione. Required information The following information applies to the questions displayed belowJ Data for Hermann Corporation are shown below: Fixed expenses are $85,000 per month and the company is selling 2,700 units per month. 2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality components that increase the variable expense by $5 per unit and increase unit sales by 20%. 2-b. Should the higher-quality components be used? Camplete this question by entering your answers in the tabs below. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higherquality components that increase the variable expense by $5 per unit and increase. unit sates by 20%. Mauro Products distributes a single product, a woven basket whose selling price is 514 per unit and whose variable expense is S12 pet unit. The company's monthly fived expense is $5,500. Required; 1. Calculate the company's breakieven point in unitsales. 2. Calculate the company's break-even point in cioliar sales. (Do not round intermediate calculations.) 3. If the company's fixed experses increase by $600, what would become the new breakeven point in ant sales? In dollar sales? (Do not round intermediate calculotions.) Lin Corporation has a single product whose seling price is $140 per unit and whose variable expense is $70 per unit The company's monthly fixed expense is $32,600 Required: 1. Calculate the unit sales needed to attain a target profit of $6,250 (Do not round intermediate caiculations) 2 Calculate the dollar sales needed to attain a target profit of $8,000 (Round your intermediote colculations to the nearest whole number.) Molander Corporation is a distributoe of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below. Reculred 1. What is the compary's margin of safety? (Do not round intermediate colculations.) 2. What is the company's margin of safety as a percentage of Its sales? (Round your percentage answer to 2 decimal places (i.e. 1234 should be entered as 12.34).) Engberg Compary instals lawn sod in home yards. The company's most recent monthly contribution format income statement follows. Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 13\% increase in unit sales 3. Construct a new contribution format income statement for the company assuming a 13% increase in unit sales. Complete this question by entering your answers in the tabs below. What is the company's degiee of operating leverage? (Round your answer to 2 decimal places.) Olongapo Sports Corporation distributes two premium golf balls. Flight Dynamic and Sure Shot. Monthily sales and the contribution matgin tatios for the two products follow Fixed expenses total $183,750 per month. Required: 1. Prepare a contrbution format income statement for the company as a whole 2. What is the company's break-even point in doltar sales based on the current sales mix? 3. If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? Complete this question by entering your answers in the tobs below. Prepare a centribution format income statement for the company an a whole. (Round your percentag anewers to 2 decimal placis (1.e. 1234 should be entered as 12.34). )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts