Question: Please answer all parts, if that's not possible please answer part D 2. Analysts expect Target Corporation to have earnings per share of $9.10 for

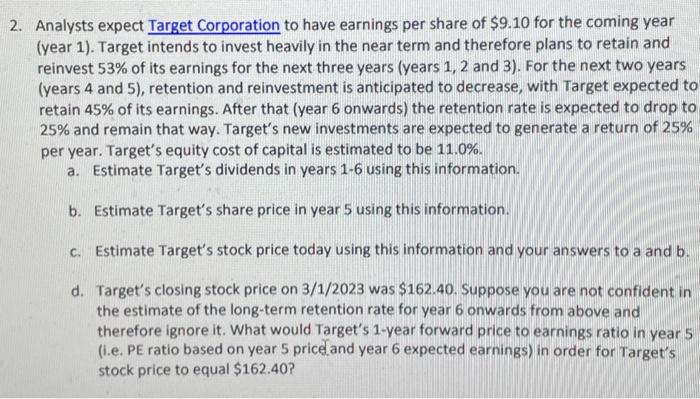

2. Analysts expect Target Corporation to have earnings per share of $9.10 for the coming year (year 1). Target intends to invest heavily in the near term and therefore plans to retain and reinvest 53% of its earnings for the next three years (years 1,2 and 3). For the next two years (years 4 and 5), retention and reinvestment is anticipated to decrease, with Target expected to retain 45% of its earnings. After that (year 6 onwards) the retention rate is expected to drop to 25% and remain that way. Target's new investments are expected to generate a return of 25% per year. Target's equity cost of capital is estimated to be 11.0%. a. Estimate Target's dividends in years 16 using this information. b. Estimate Target's share price in year 5 using this information. c. Estimate Target's stock price today using this information and your answers to a and b. d. Target's closing stock price on 3/1/2023 was $162.40. Suppose you are not confident in the estimate of the long-term retention rate for year 6 onwards from above and therefore ignore it. What would Target's 1-year forward price to earnings ratio in year 5 (i.e. PE ratio based on year 5 priceland year 6 expected earnings) in order for Target's stock price to equal $162.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts