Question: Please answer all parts ILL THUMBS UP ! ! ! ! FSA 6 : times interest earned and price earnings ratios: Ratio: times interest earned

Please answer all parts ILL THUMBS UP

FSA : times interest earned and price earnings ratios:

Ratio: times interest earned

You will use the NIKE financial statements in appendix C for this ratio. Round the ratio to the nearest tenth.

The formula for Times interest earned

income before taxes interest expense

interest expense

ratio

ratio

This ratio computes the number of times interest payments could be paid out of current period earnings. Because interest payments reduce income tax expense, the ratio is computed using income before tax. High values of this ratio are considered favorable. In contrast, low values are considered unfavorable. Values of this ratio less than suggest that the firm is unable to cover interest payments from current period income before tax.

Calculate both ratios and comment on NIKEs profitability between the two years

Ratio: priceearnings ratio

The formula for priceearnings ratio is:

Market price per share of common stock

Earnings per share on common stock

This ratio measures the companys future earnings prospects. The market price per share was for and for Use the basic earnings per share from the consolidated statements of income for the denominator. Round the ratio to the nearest hundredth.

ratio

ratio

Calculate both ratios and comment on NIKEs profitability between the two years have served as the Company's auditor since

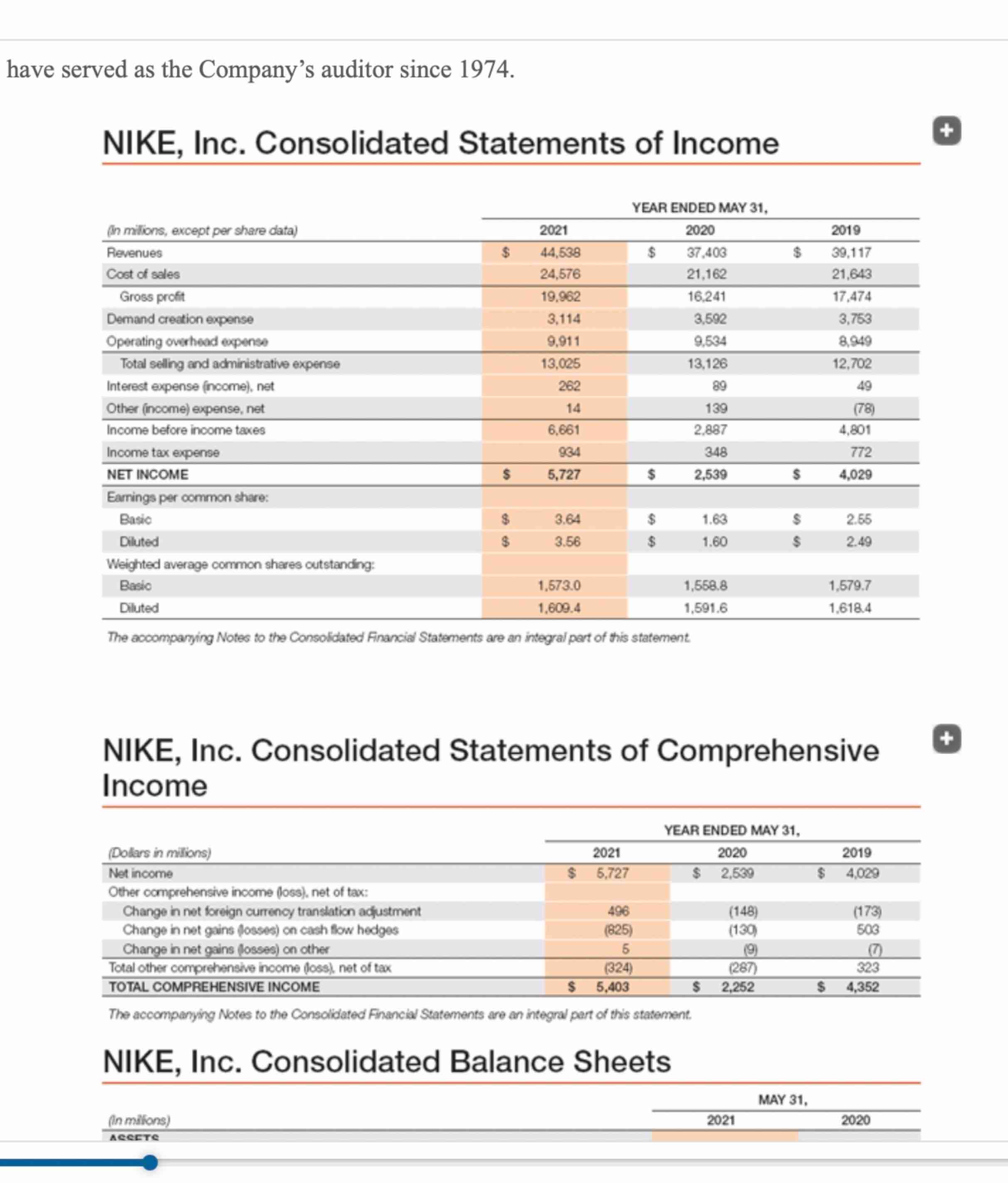

NIKE, Inc. Consolidated Statements of Income

YEAR ENDED MAY

The accompanying Notes to the Consoldated Financial Statements are an integral part of this statement.

NIKE, Inc. Consolidated Statements of Comprehensive Income

The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

NIKE, Inc. Consolidated Balance Sheets The accompanying Notes to the Consolidated Financial Statements are an integral pert of this statement.

NIKE, Inc. Consolidated Balance Sheets

begintabularccccc

hline multirowbin milions & multicolumncMAY

hline & multicolumnr & multicolumnr

hline multicolumnlASSETS

hline multicolumnlCurrent assets:

hline Cash and equivalents & $ & & $ &

hline Shortterm investments & & & &

hline Accounts receivable, net & & & &

hline Inventories & & & &

hline Prepaid expenses and other current assets & & & &

hline Total current assets & & & &

hline Property, plant and equipment, net & & & &

hline Operating lease rightofuse assets, net & & & &

hline Idertifiable intangible assets, net & & & &

hline Goodwill & & & &

hline Deferred income taxes and other assets & & & &

hline TOTAL ASSETS & $ & & $ &

hline multicolumnlLIABILITIES AND SHAREHOLDERS' EQUITY

hline multicolumnlCurrent liabilities:

hline Current portion of longterm debt & $ & & $ &

hline Notes payable & & & &

hline Accounts payable & & & &

hline Current portion of operating lease liablities & & & &

hline Accrued liablities & & & &

hline hocme taxes payable & & & &

hline Total current liabiaties & & & &

hline Longterm debt & & & &

hline Operating lease labilities & & & &

hline Deferred income taxes and other liabilities & & & &

hline multicolumnlCommitments and contingencies Note

hline Pedeemable preferred stock & & & &

hline multicolumnlShareholders equity:

hline multicolumnlCommon stock at stated value:

hline Class A convertible and shares outstanding & & & &

hline Class B and shares outstanding & & & &

hline Capital in excess of stated value & & & &

hline Accumulated ther comprehensive income loss & & & &

hline Retained earnings deficit & & & &

hline Total shareholders' equity & & & &

hline TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY & $ & & $ &

hline

endtabular

The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

NIKE, Inc. Consolidated Statements of Cash Flows

YEAR ENDED MAY

begintabularcccccc

hline multirowbDolars in milions & multicolumnrmultirowb & multicolumnrmultirowb &

hline & & & & &

hline multicolumnlCash provided used by operations:

hline Net income & $ & & $ & & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock