Question: please answer all parts ! (: Jayleen Ibarra & | 04/24/20 1:42 PM Save Business Finance CRN 27051 Homework: Chapter 12 Homework Score: 0 of

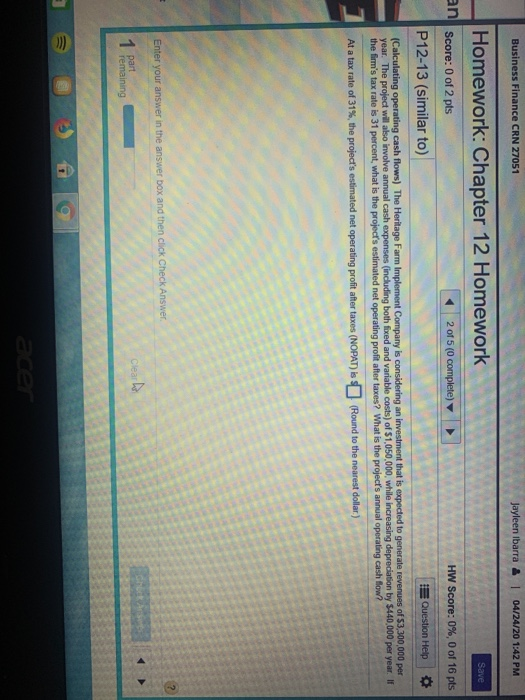

Jayleen Ibarra & | 04/24/20 1:42 PM Save Business Finance CRN 27051 Homework: Chapter 12 Homework Score: 0 of 2 pts 2 of 5 (0 complete) P12-13 (similar to) HW Score: 0%, 0 of 16 pts Question Help (Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment that is expected to generate revenues of $3,300,000 per year. The project will also involve annual cash expenses (including both fixed and variable costs) of $1,050,000, while increasing depreciation by S440,000 per year. If the firm's tax rate is 31 percent, what is the project's estimated net operating profit after taxes? What is the project's annual operating cash flow? At a tax rate of 31%, the project's estimated net operating profit after taxes (NOPAT) is (Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer 7 I remaining part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts