Question: Please answer all parts to the question with explainations An electric utility company plans to build a new power plant, and their management wants to

Please answer all parts to the question with explainations

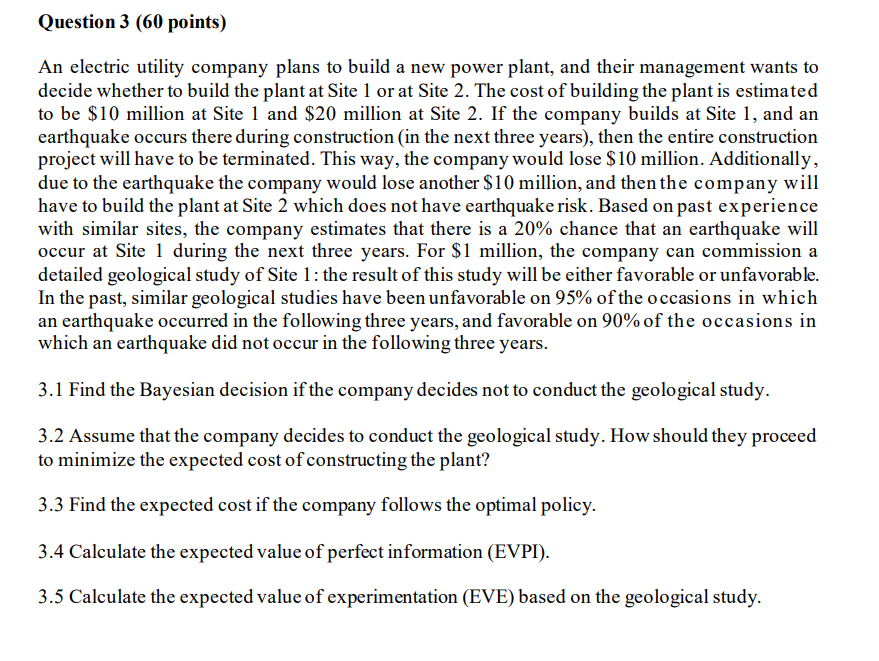

An electric utility company plans to build a new power plant, and their management wants to decide whether to build the plant at Site 1 or at Site 2 . The cost of building the plant is estimated to be $10 million at Site 1 and $20 million at Site 2. If the company builds at Site 1 , and an earthquake occurs there during construction (in the next three years), then the entire construction project will have to be terminated. This way, the company would lose $10 million. Additionally, due to the earthquake the company would lose another $10 million, and then the company will have to build the plant at Site 2 which does not have earthquake risk. Based on past experience with similar sites, the company estimates that there is a 20% chance that an earthquake will occur at Site 1 during the next three years. For $1 million, the company can commission a detailed geological study of Site 1 : the result of this study will be either favorable or unfavorable. In the past, similar geological studies have been unfavorable on 95% of the occasions in which an earthquake occurred in the following three years, and favorable on 90% of the occasions in which an earthquake did not occur in the following three years. 3.1 Find the Bayesian decision if the company decides not to conduct the geological study. 3.2 Assume that the company decides to conduct the geological study. How should they proceed to minimize the expected cost of constructing the plant? 3.3 Find the expected cost if the company follows the optimal policy. 3.4 Calculate the expected value of perfect information (EVPI). 3.5 Calculate the expected value of experimentation (EVE) based on the geological study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts