Question: Please answer all parts to this problem. Please use excel and explain what steps you are using. Five projects for a small private cosmetic company

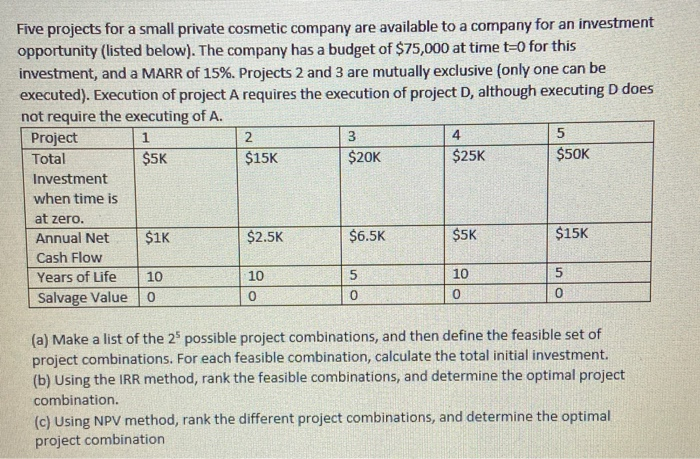

Five projects for a small private cosmetic company are available to a company for an investment opportunity (listed below). The company has a budget of $75,000 at time to for this investment, and a MARR of 15%. Projects 2 and 3 are mutually exclusive (only one can be executed). Execution of project A requires the execution of project D, although executing D does not require the executing of A. Project Total $5K $15K $20K $25K Investment when time is at zero. Annual Net $1K $2.5K $6.5K $5K $15K Cash Flow Years of Life 10 10 5 10 Salvage Value 0 0 $50K (a) Make a list of the 2 possible project combinations, and then define the feasible set of project combinations. For each feasible combination, calculate the total initial investment. (b) Using the IRR method, rank the feasible combinations, and determine the optimal project combination. (c) Using NPV method, rank the different project combinations, and determine the optimal project combination Five projects for a small private cosmetic company are available to a company for an investment opportunity (listed below). The company has a budget of $75,000 at time to for this investment, and a MARR of 15%. Projects 2 and 3 are mutually exclusive (only one can be executed). Execution of project A requires the execution of project D, although executing D does not require the executing of A. Project Total $5K $15K $20K $25K Investment when time is at zero. Annual Net $1K $2.5K $6.5K $5K $15K Cash Flow Years of Life 10 10 5 10 Salvage Value 0 0 $50K (a) Make a list of the 2 possible project combinations, and then define the feasible set of project combinations. For each feasible combination, calculate the total initial investment. (b) Using the IRR method, rank the feasible combinations, and determine the optimal project combination. (c) Using NPV method, rank the different project combinations, and determine the optimal project combination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts