Question: please answer all parts, will upvote upon completion Problem 7. Rockey Centerw. Inc. (RC]) is a small investment company. The company is considering beilding a

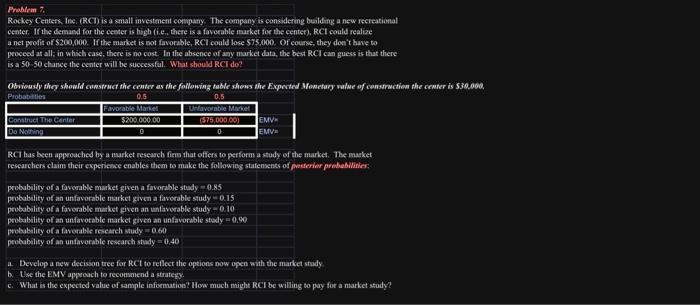

Problem 7. Rockey Centerw. Inc. (RC]) is a small investment company. The company is considering beilding a new recreational eenter. If the demand for the ceater is high (1.e. there is a favorable masket foe the centet), RCI could realise a net peofit of $200,000. If the market is not favorable. RCI could lose $75,000. Of course, they doa't have to proceed at all: in which case, there is no cost. In the absence of ayy market data, the bect RCI can guess is that there is a 5050 chance the center will be successful. What should RCI do? Obviousdy they showld canstruct the center as the following table shows dhe Expected Monefary value of canstrwction th Probatritite 0.6 0.5 RCT has been appeoached by a makket research fiems that offers to perform a study of the market. Tbe masket. reseafchers claim their cepericace enables them to make the followibg statemsents of pesterime prabubiaines: probubility of a favorable mialuet given a favorable study =0.85 probability of an unfavorable market givera a favorable sudy =0.15 probabilify of a favorable manket given an unfavorable study on 0.10 probability of an unfavorable market grven an unfavorable stady = 0.90 peobubality of a lavcoable tcoearch wudy =0.60 peobabilisy of an unfavorable research stady =0,40 a. Develop a new decision tree for RCl to reflect the options now open with the market stady b. Wse the EMV appeoach to recommend a strategy. c. What is the expected value of sample infocmation? How much might RCI be willing to pay fot a market study

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts