Question: Please answer all parts with working. If using excel please show how cells were calculated. Thank you Q1: FUTURES: As a sophisticated energy trader, you

Please answer all parts with working. If using excel please show how cells were calculated. Thank you

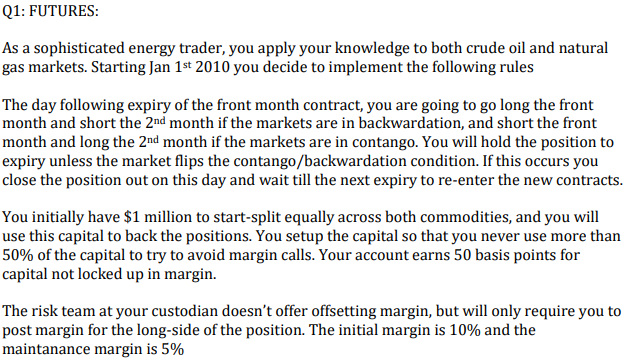

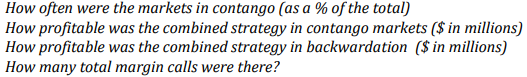

Q1: FUTURES: As a sophisticated energy trader, you apply your knowledge to both crude oil and natural gas markets. Starting Jan 1st 2010 you decide to implement the following rules The day following expiry of the front month contract, you are going to go long the front month and short the 2nd month if the markets are in backwardation, and short the front month and long the 2nd month if the markets are in contango. You will hold the position to expiry unless the market flips the contango/backwardation condition. If this occurs you close the position out on this day and wait till the next expiry to re-enter the new contracts. You initially have $1 million to start-split equally across both commodities, and you will use this capital to back the positions. You setup the capital so that you never use more than 50% of the capital to try to avoid margin calls. Your account earns 50 basis points for capital not locked up in margin. The risk team at your custodian doesn't offer offsetting margin, but will only require you to post margin for the long-side of the position. The initial margin is 10% and the maintanance margin is 5% How often were the markets in contango (as a % of the total) How profitable was the combined strategy in contango markets ($ in millions) How profitable was the combined strategy in backwardation ($ in millions) How many total margin calls were there? Q1: FUTURES: As a sophisticated energy trader, you apply your knowledge to both crude oil and natural gas markets. Starting Jan 1st 2010 you decide to implement the following rules The day following expiry of the front month contract, you are going to go long the front month and short the 2nd month if the markets are in backwardation, and short the front month and long the 2nd month if the markets are in contango. You will hold the position to expiry unless the market flips the contango/backwardation condition. If this occurs you close the position out on this day and wait till the next expiry to re-enter the new contracts. You initially have $1 million to start-split equally across both commodities, and you will use this capital to back the positions. You setup the capital so that you never use more than 50% of the capital to try to avoid margin calls. Your account earns 50 basis points for capital not locked up in margin. The risk team at your custodian doesn't offer offsetting margin, but will only require you to post margin for the long-side of the position. The initial margin is 10% and the maintanance margin is 5% How often were the markets in contango (as a % of the total) How profitable was the combined strategy in contango markets ($ in millions) How profitable was the combined strategy in backwardation ($ in millions) How many total margin calls were there

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts