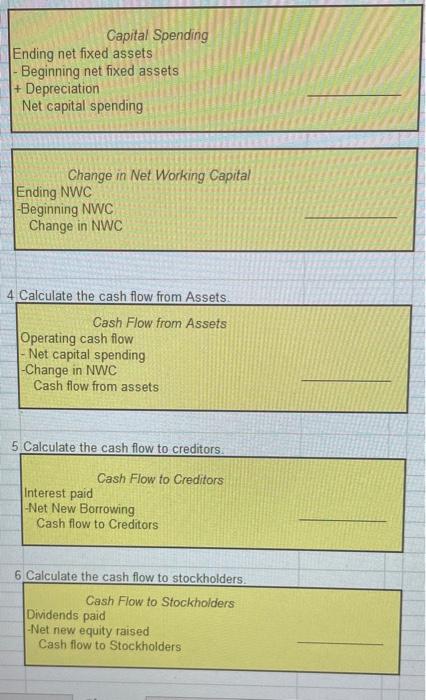

Question: please answer all parts (yellow boxes) Capital Spending Ending net fixed assets Beginning net fixed assets + Depreciation Net capital spending Change in Net Working

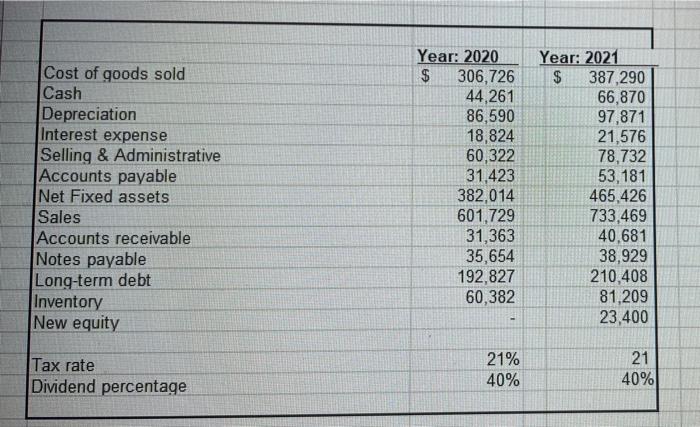

Capital Spending Ending net fixed assets Beginning net fixed assets + Depreciation Net capital spending Change in Net Working Capital Ending NWC - Beginning NWC Change in NWC 4 Calculate the cash flow from Assets Cash Flow from Assets Operating cash flow Net capital spending -Change in NWC Cash flow from assets 5 Calculate the cash flow to creditors. Cash Flow to Creditors Interest paid -Net New Borrowing Cash flow to Creditors 6 Calculate the cash flow to stockholders Cash Flow to Stockholders Dividends paid -Net new equity raised Cash flow to Stockholders Cost of goods sold Cash Depreciation Interest expense Selling & Administrative Accounts payable Net Fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity Year: 2020 $ 306,726 44,261 86,590 18,824 60,322 31,423 382,014 601,729 31,363 35,654 192,827 60,382 Year: 2021 $ 387,290 66,870 97,871 21,576 78,732 53,181 465,426 733,469 40,681 38,929 210,408 81,209 23,400 Tax rate Dividend percentage 21% 40% 21 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts