Question: Please answer all PLEASE Required information Exercise 7-16A Record amortization expense (LO7-5) [The following information applies to the questions displayed below.) On January 1, 2021,

Please answer all PLEASE

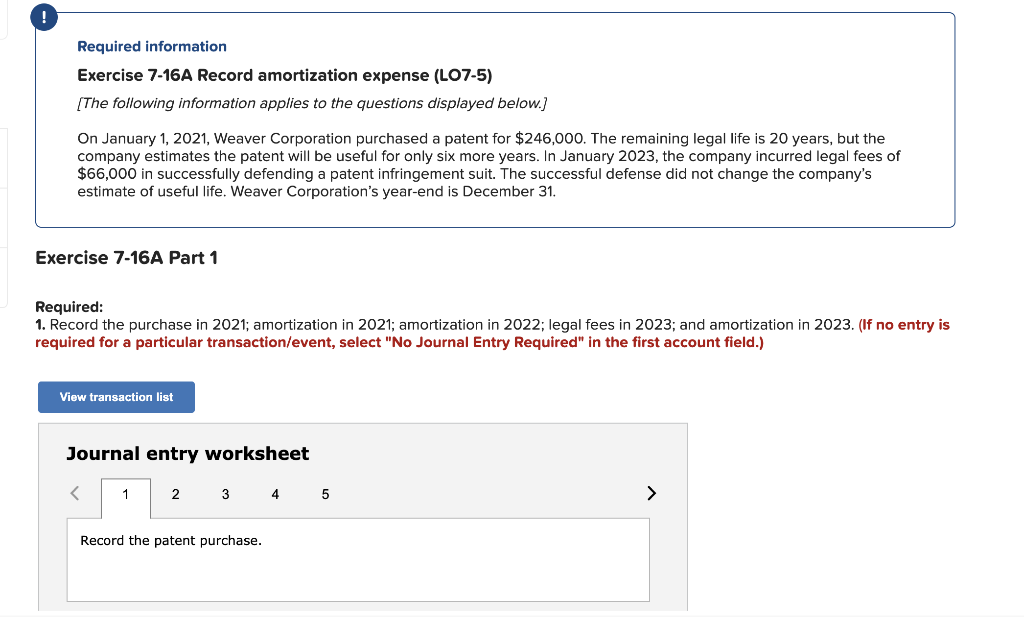

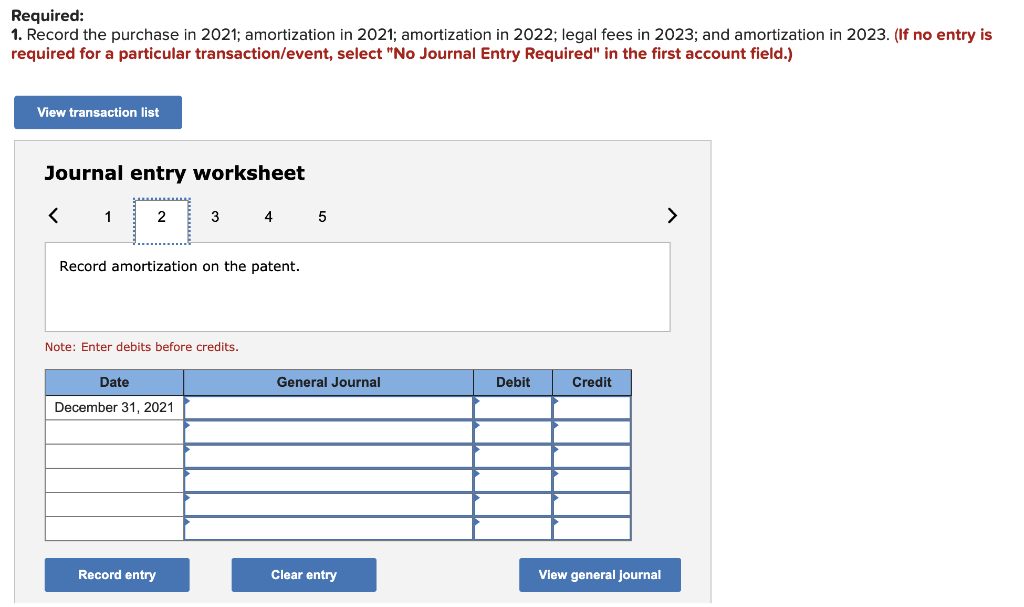

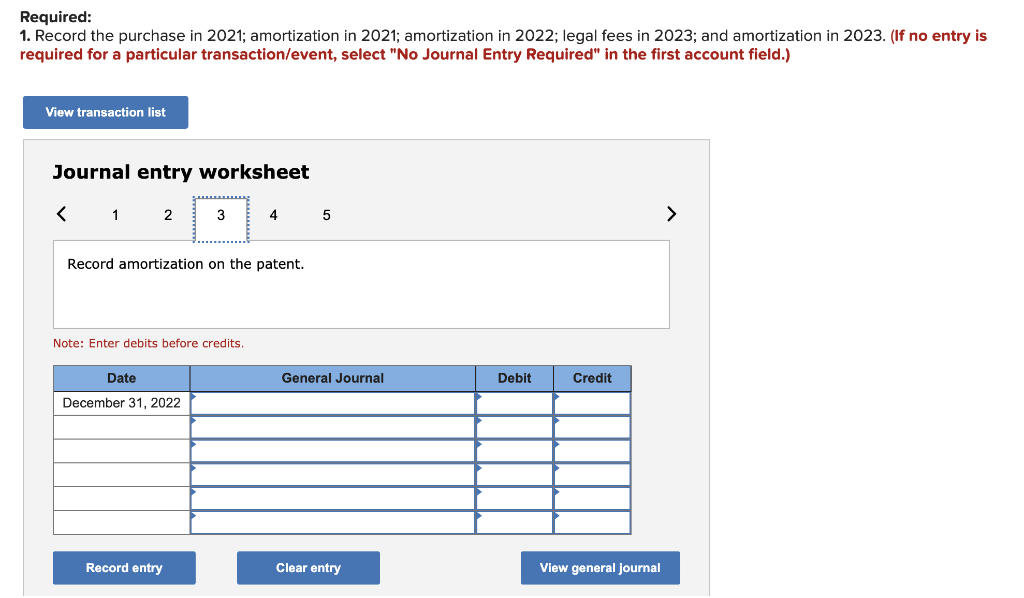

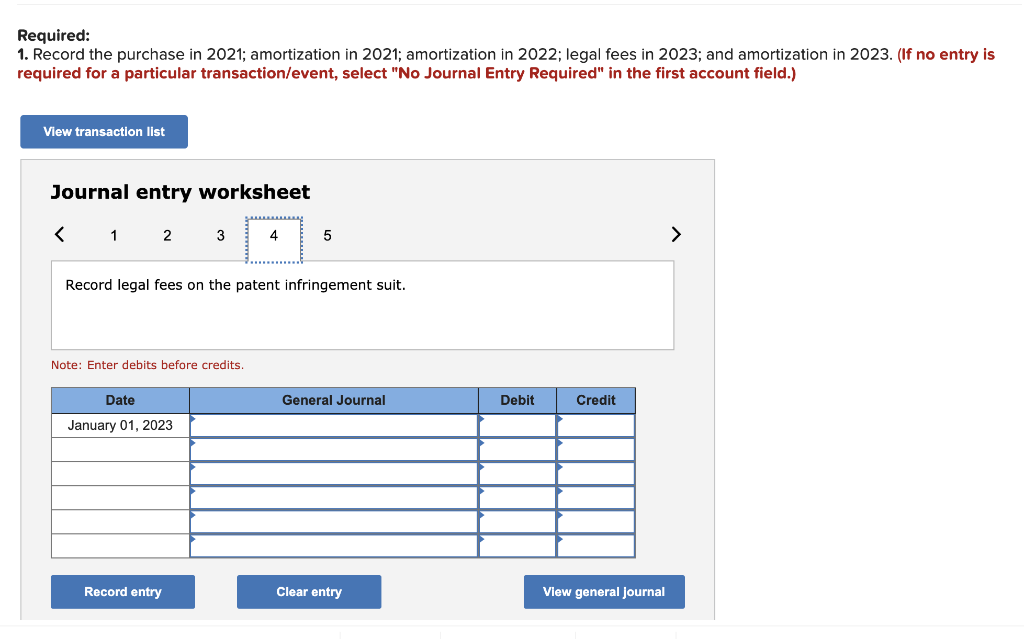

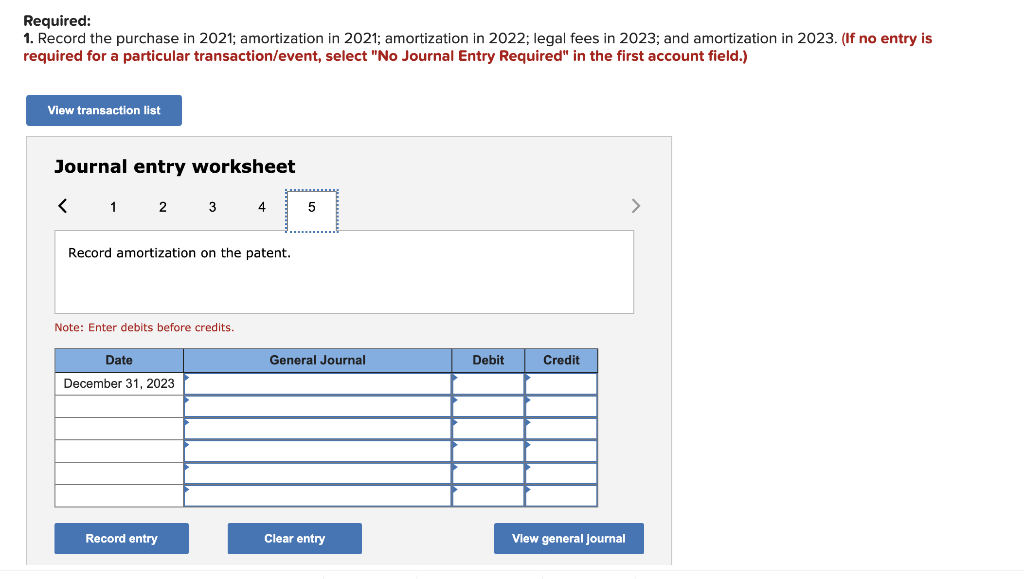

Required information Exercise 7-16A Record amortization expense (LO7-5) [The following information applies to the questions displayed below.) On January 1, 2021, Weaver Corporation purchased a patent for $246,000. The remaining legal life is 20 years, but the company estimates the patent will be useful for only six more years. In January 2023, the company incurred legal fees of $66,000 in successfully defending a patent infringement suit. The successful defense did not change the company's estimate of useful life. Weaver Corporation's year-end is December 31. Exercise 7-16A Part 1 Required: 1. Record the purchase in 2021; amortization in 2021; amortization in 2022; legal fees in 2023; and amortization in 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the patent purchase. Required: 1. Record the purchase in 2021; amortization in 2021; amortization in 2022; legal fees in 2023; and amortization in 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record amortization on the patent. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general Journal Required: 1. Record the purchase in 2021; amortization in 2021; amortization in 2022; legal fees in 2023; and amortization in 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record amortization on the patent. Note: Enter debits before credits Date General Journal Debit Credit December 31, 2022 Record entry Clear entry View general journal Required: 1. Record the purchase in 2021; amortization in 2021; amortization in 2022; legal fees in 2023; and amortization in 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record legal fees on the patent infringement suit. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2023 Record entry Clear entry View general journal Required: 1. Record the purchase in 2021; amortization in 2021; amortization in 2022; legal fees in 2023; and amortization in 2023. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record amortization on the patent. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2023 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts