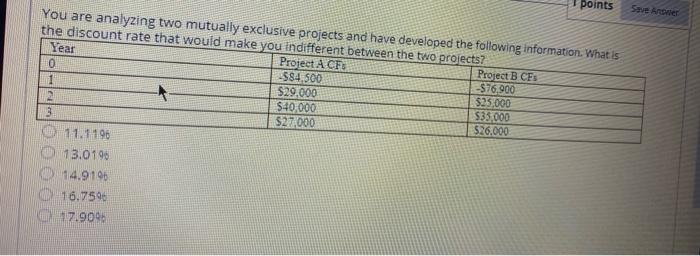

Question: please answer all points Save Anne You are analyzing two mutually exclusive projects and have developed the following information. What is the discount rate that

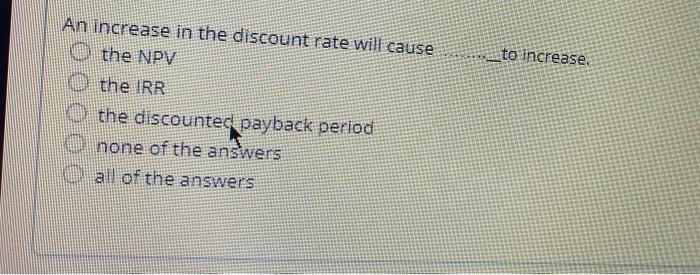

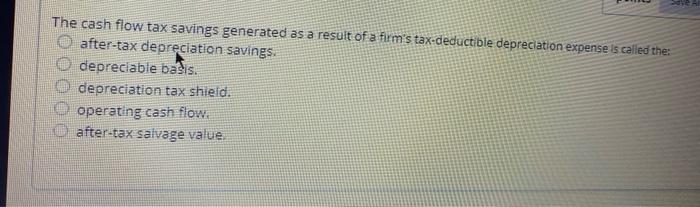

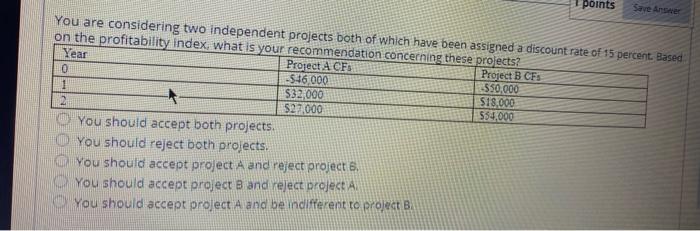

points Save Anne You are analyzing two mutually exclusive projects and have developed the following information. What is the discount rate that would make you indifferent between the two projects Year Project A CFS 0 Project B CES -$84,500 $76.900 1 - $29.000 $25,000 $40,000 $35.000 3 $27.000 $26.000 11. 1196 13.0190 14.9196 16.7596 17.9095 to increase, An increase in the discount rate will cause o the NPV the IRR the discounted payback period none of the answers all of the answers The cash flow tax savings generated as a resuit of a firm's tax-deductible depreciation expense is called the: after-tax depreciation savings. depreciable basis. depreciation tax shield. operating cash flow, after-tax salvage value points Sare Ansee You are considering two independent projects both of which have been assigned a discount rate of 15 percentBased on the profitability index, what is your recommendation concerning these projects? Year Project A CFS Project B CES 0 -$ 46,000 550.000 1 $32,000 $18.000 $27.000 554.000 You should accept both projects, O You should reject both projects. You should accept project A and reject project 6 You should accept project B and reject project A You should accept project A and be indifferent to project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts