Question: please answer all Prior, Inc., is expected to grow at a constant 53 39 and its current price is $42.67, what rate of 5.52 percent.

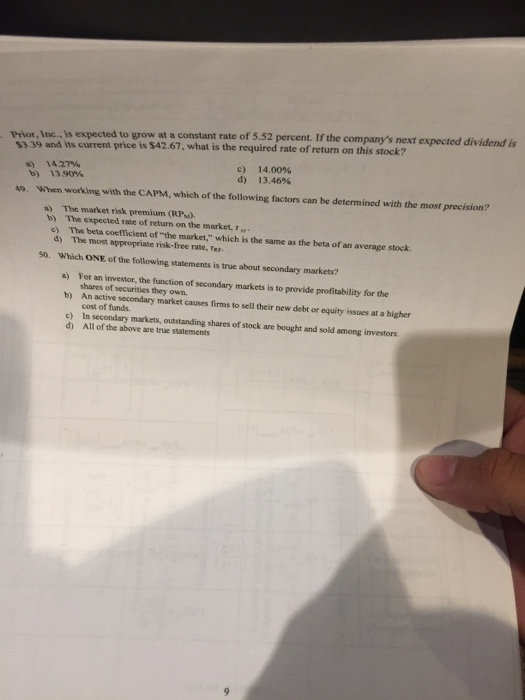

Prior, Inc., is expected to grow at a constant 53 39 and its current price is $42.67, what rate of 5.52 percent. If the company's next expected dividend is is the required rate of return on this stock? c) d) 14.00% 13.46% 14.27% b) 13.90% 49. When working with the CAPM, which of the following factors can be determined with the most precision? a) The market risk premium (RP). b) The expected rate of return on the market, c) The beta coefficlent of "the market" which is the same as the beta of an average stock. dy The most appropriate risk-free rate, rwx s0. Which ONE of the following statements is true about secondary markets? TRy. a) For an irnvestot, the function of secondary markets is to provide profitability for the b) An active secondary marketr causes firms to sell their new debt or equity issues at a higher shares of securities they own. c) d) cost of funds In secondary markets, outstanding shares of stock are bought and sold among investors All of the above are true statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts