Question: please answer all qs 3. PofCo Inc is a publicly traded firm with levered firm's value of 900,000. The firm has a DIE ratio of

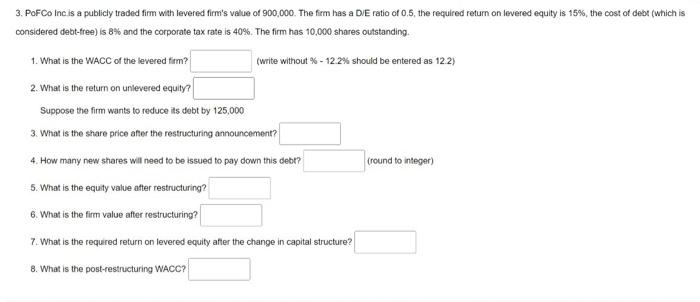

3. PofCo Inc is a publicly traded firm with levered firm's value of 900,000. The firm has a DIE ratio of 0.5, the required return on levered equity is 15%, the cost of debt (which is considered debt-free) is 8% and the corporate tax rate is 40%. The firm has 10,000 shares outstanding 1. What is the WACC of the levered firm? (write without % - 12.2% should be entered as 122) 2. What is the return on unlevered equity? Suppose the firm wants to reduce its debt by 125,000 3. What is the share price after the restructuring announcement? 4. How many new shares will need to be issued to pay down this debt? cround to integer) 5. What is the equity value atter restructuring? 6. What is the firm value after restructuring? 7. What is the required return on levered equity after the change in capital structure? 8. What is the post-restructuring WACC? 3. PofCo Inc is a publicly traded firm with levered firm's value of 900,000. The firm has a DIE ratio of 0.5, the required return on levered equity is 15%, the cost of debt (which is considered debt-free) is 8% and the corporate tax rate is 40%. The firm has 10,000 shares outstanding 1. What is the WACC of the levered firm? (write without % - 12.2% should be entered as 122) 2. What is the return on unlevered equity? Suppose the firm wants to reduce its debt by 125,000 3. What is the share price after the restructuring announcement? 4. How many new shares will need to be issued to pay down this debt? cround to integer) 5. What is the equity value atter restructuring? 6. What is the firm value after restructuring? 7. What is the required return on levered equity after the change in capital structure? 8. What is the post-restructuring WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts